[Update] Telecom Sector in India – Challenges & Way Forward

The Indian telecommunication sector is the 2nd largest in the world with a subscriber base of more than a billion. It is the backbone of the digital wave carrying the country ahead in the recent years. Its importance was made more evident by the recent waves of COVID-19 pandemic. An unfortunate issue that has been plaguing such a vital sector is that it is mostly perceived as nothing more than a cash cow. However, the recent reforms approved by the Cabinet in September have renewed hopes of the sector’s resurgence.

This topic of “[Update] Telecom Sector in India – Challenges & Way Forward” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

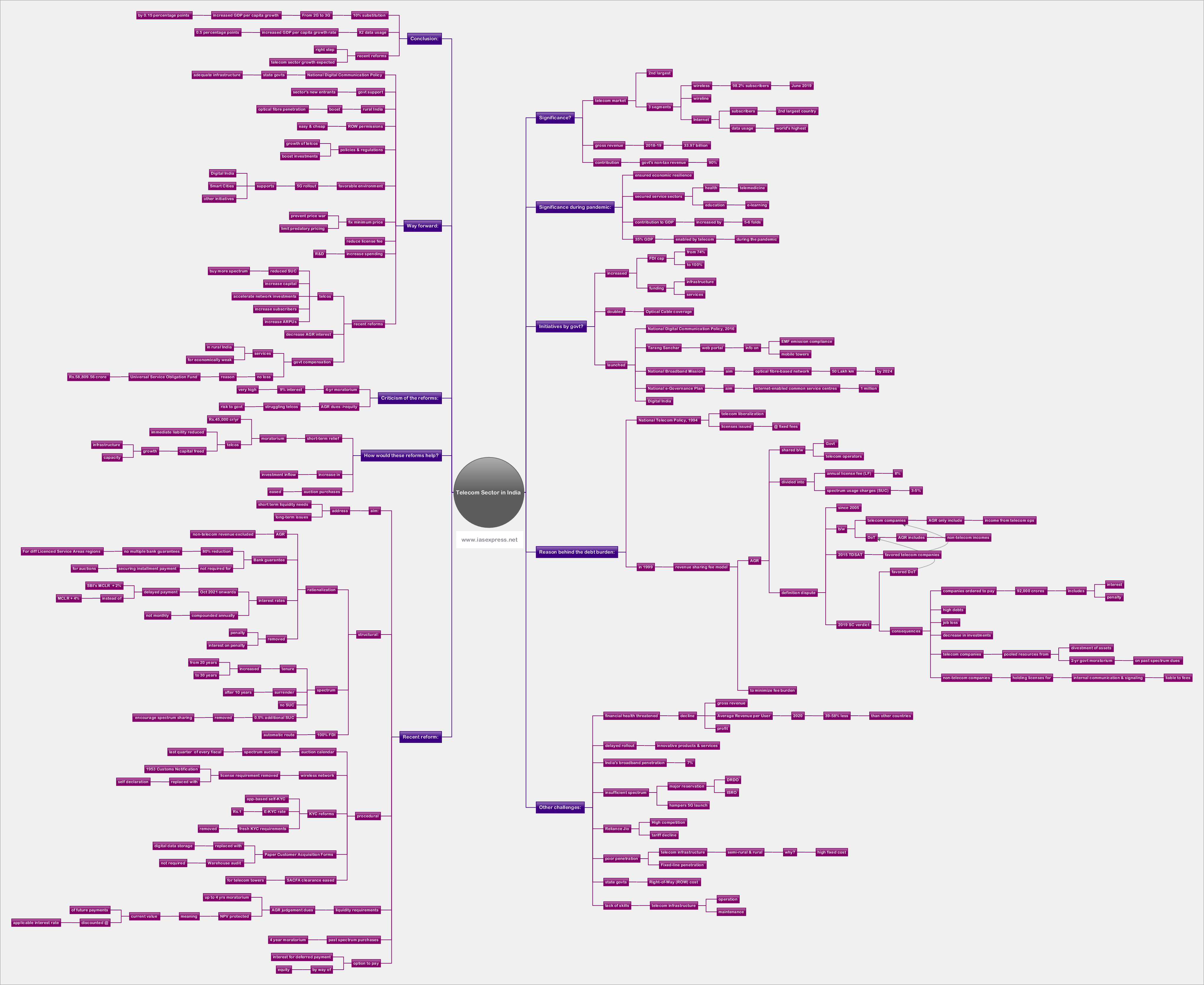

What is the sector’s significance?

- India is the 2nd-largest telecommunications market.

- The telecommunication market includes three segments – wireless, wireline and internet services.

- The wireless market comprises of 98.2% of the total subscriber base as of June 2019.

- India is also the 2nd-largest country in terms of internet subscribers and has the world’s highest data usage.

- The gross revenue of the telecom sector stood at USD 33.97 billion in 2018-19.

- Telecom sector is estimated to contribute about 90% of the government’s non-tax revenue.

- Therefore, securing the financial health of this sector is vital for safeguarding India’s revenue and the economy as a whole.

How significant has the sector been in light of the pandemic?

- The telecom sector has helped keep the economic engine running even during the lockdown period.

- The sector propped up not just the economy but also the vital social sectors such as health and education through telemedicine and online learning.

- More than 54% of India’s GDP is from the service sector. A huge part of it was hit by the lockdowns- especially the hospitality and travel sectors. Whatever survived of this sector did so mainly because of the telecom infrastructure in the country. According to estimates, some 35% of the GDP was enabled by the sector during the COVID period.

- In the post-pandemic period, especially during the lockdown, the contribution of telecom sector to the country’s GDP has increased 5-6 folds.

What are the initiatives taken by the government to promote this sector?

- Policy support from the government through an increase in the FDI cap to 100% from 74%, increasing expenditure on telecom infrastructure and services, and the launch of National Digital Communication Policy, 2018 has led to the growth of this sector.

- “Tarang Sanchar” launched by the DoT is a web portal that provides for information on mobile towers and EMF emission compliance.

- The nationwide Optical Cable (OFC) coverage doubled from 7 lakh km to 1.4 million km. The National Broadband Mission seeks to deploy optical fiber-based network spanning 50 lakh kilometres by 2024.

- The Department of Information Technology is going to establish over 1 million internet-enabled common service centres in accordance with the National e-Governance Plan.

- Digital India also played a role in the growth of this sector.

Why is the telecom sector currently facing huge debt?

- It all began in the 1990s when the Indian economy was liberalised.

- The telecom sector, during this time, was liberalised under the National Telecom Policy, 1994 after which the licences were issued to the companies in return for a fixed license fee.

- To provide relief from the high license fee, the government, in 1999, gave an option to the licensees to migrate to the revenue sharing fee model.

- Under this model, the mobile telephone operators are required to share a percentage of their adjusted gross revenue (AGR) with the government. AGR is divided into annual license fee (LF) and spectrum usage charges (SUC).

- The LF and SUC were set at 8% and 3-5% of AGR respectively, based on the agreement between the DoT and the telecom companies.

- However, the DoT and telecom companies have been disputing over the definition of AGR since 2005.

- The telecom companies argued that the AGR should include only the income from the telecom operations.

- The DoT disagreed and stated that the AGR should also include non-telecom incomes like the asset sales, interests on deposits, rents etc.

- In 2015, the Telecom Disputes Settlement and Appellate Tribunals (TDSAT) stayed the case in favour of the telecom companies and held that the AGR includes all receipts except capital receipts and revenue from non-core sources like rent, profit on the sale of fixed assets, dividend etc.

- However, on October 24, 2019, the Supreme Court ruled in favour of the DoT by accepting its definition, putting the telecom companies under tremendous financial pressure.

- These companies were ordered to pay Rs.92,000 crores to the government within three months (January 24, 2020).

- The telecom operators, based on the TDSAT’s 2015 judgment had paid only what they estimated due as the licence fees and spectrum charges.

- However, the original disputed amount (license fees) of Rs. 23,000 crore snowballed into a massive figure of nearly 93,000 crores, as the DoT contended that the entire dues accumulated over the last 15 years along with interest and penalty.

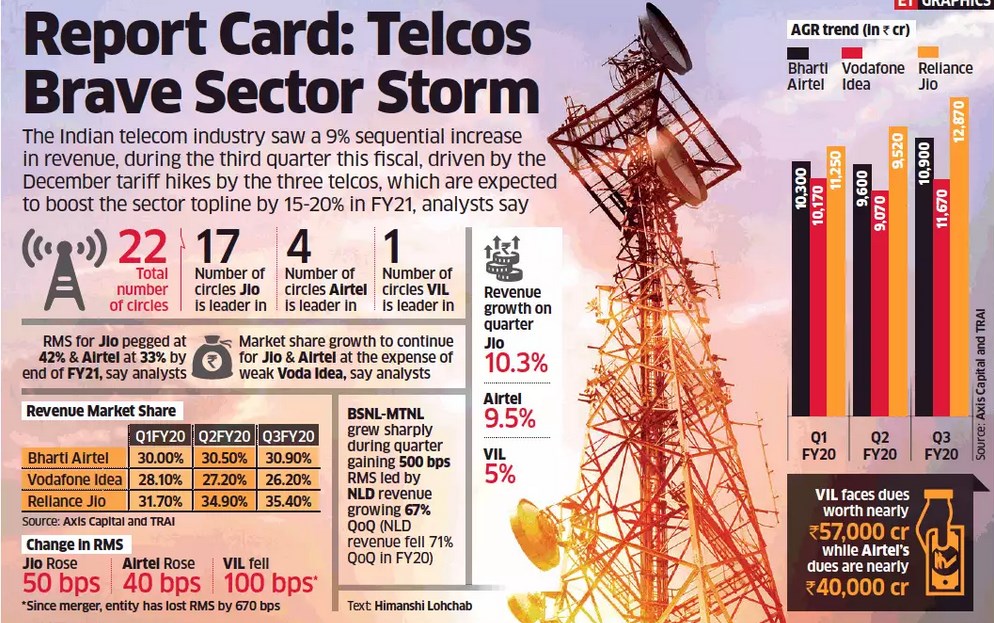

- This led to a huge loss for the already suffering telecom companies and two of the three remaining private sector telecos, Vodafone Idea and Bharati Airtel posted their highest-ever quarterly losses since the apex court’s ruling.

- Before the verdict, the telecom companies were already facing huge taxes from the government (18% GST and AGR of 3-5% for spectrum usage charges and 8% as licence fee).

- The high debt faced by the telecos giants would mean increasing job losses and decreasing investments.

- To settle their dues, companies looked to pool funds from the market, proceeds from the divestment of assets and relief provided by the government in the form of a two-year moratorium on past spectrum dues.

- Even non-telecom companies that hold licences for internal communication and signalling are liable to pay fees on their entire revenue even if they do not offer telecom services. This is because the SC’s ruling is an interpretation of the licence agreement and thus applies universally to all companies holding telecom licences.

What other challenges are faced by the sector?

- Financial health under threat: The gross revenue has come down from 20% to 15% for the year 2017-18 as the overall sector’s revenue dropped. The rapid decline of ARPU (Average Revenue per User), losses and falling profits are worsening the financial stability within this sector.

- In 2020, the ARPU realized by the Indian telcos was 39-58% lower than that realized by other countries’ telcos (such as in Indonesia and Philippines that are in a comparable stage of development).

- Delayed rollout of innovative products and services due to the unfavourable environment caused by government policies and regulations.

- According to the International Telecommunication Union, broadband penetration in India is only 7%.

- Inadequate availability of spectrum is a major concern for India. This situation is worsened as ISRO and India’s defence forces are demanding a major reservation. This could hamper the effective roll-out of the 5G services. The mobile phone operators may push back 5G network deployment due to insufficient spectrum and high base prices.

- High competition and dropping of tariff following the entry of the Reliance Jio.

- The telecom infrastructure has not penetrated the semi-rural and rural areas due to the initial liability of high fixed cost.

- Fixed-line penetration in India is also poor.

- Huge Right-of-Way (ROW) cost charged by the state governments for permitting the laying of fibres etc.

- Lack of trained personnel to maintain and operate telecom infrastructure.

What are the recent reforms brought in by the government?

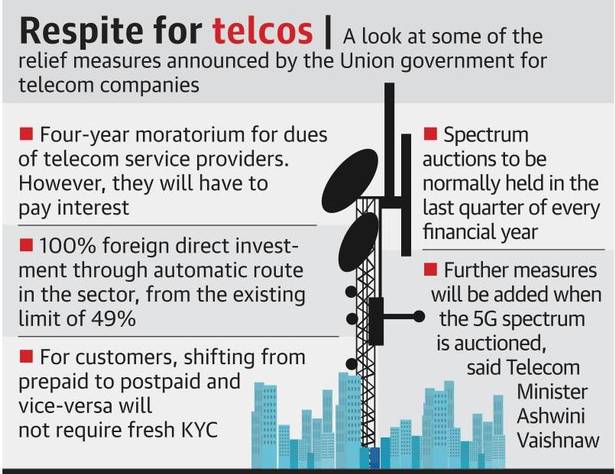

- In September 2021, the Cabinet approved a set of reforms- structural and procedural to address the issues faced by the telecom sector. These reforms seek to address not only the short term liquidity needs but also the long-term issues that have been bogging the sector down.

- The structural reforms are as follows:

- Rationalization of AGR: by exclusion of non-telecom revenue on prospective basis from its definition.

- Rationalization of Bank Guarantees: the bank guarantees requirement has been reduced by 80% i.e. the requirement for telecom operators is now just 20%. There is no longer a requirement for multiple bank guarantees in different Licenced Service Areas regions in the country. i.e. 1 bank guarantee will be enough.

- Rationalization of interest rates: from October onwards, delayed payments of License Fee /Spectrum Usage Charge attract interest rate of SBI’s MCLR (Marginal Cost of Funds based Lending Rate) plus 2% instead of MCLR plus 4%. In addition to this, the interest is to be compounded annually instead of monthly. Also, the penalty and interest on penalty has been removed.

- Bank guarantees aren’t required for securing installment payment for auctions held henceforth.

- Spectrum tenure has been increased to 30 years for future auctions (from 20 years).

- For spectrum acquired in future auctions, surrender of spectrum is to be allowed after 10 years.

- No SUC for spectrum acquired in future auctions.

- Additional SUC of 0.5% for spectrum sharing has been removed to encourage spectrum sharing.

- 100% FDI under automatic route has been permitted in the sector. All safeguards will apply.

- The procedural reforms are as follows:

- The centre has fixed the auction calendar. Spectrum auctions are to be held in the last quarter of every financial year.

- Removal of cumbersome requirement of licenses for wireless equipment under 1953 Customs Notification. This has been replaced with self-declaration.

- Know Your Customers reforms: app-based self-KYC has been permitted. E-KYC rate has been revised to only 1 INR. The reforms have done away with the requirement for fresh KYC when shifting from prepaid to post-paid and vice-versa.

- Paper Customer Acquisition Forms (CAF) has been replaced by digital data storage. Warehouse audit of CAF will not be required anymore.

- Easing of SACFA (Standing Advisory Committee on Frequency Allocation) clearance for telecom towers. The telecom department will accept data on a portal on self-declaration basis. Other agencies’ portals (such as Civil Aviation) are to be linked with DoT Portal.

- Steps have been taken to address the liquidity requirement of the telecom service providers:

- Up to 4 years moratorium/ deferment in annual payments of dues arising out of the AGR judgement. However, the Net Present Value of the due amounts are protected. Net Present Value/ NPV is the current value of a future stream of payments discounted at applicable interest rate.

- Up to 4 years moratorium/deferment on due payments of spectrum purchased in past auctions (excluding the 2021 auction). Again, the NPV is protected at the interest rate stipulated in the respective auctions.

- Option to pay the interest amount arising due to deferred payment by way of equity.

How would these reforms help the sector?

- The short-term relief in the form of moratorium is considered as very crucial and timely– given the debt situation faced by Vodafone Idea and Bharti Airtel. The move is expected to provide a breather of 45,000 crore INR per year for the next 4 years.

- If the telcos opt for the moratorium/ deferred payment, their immediate liability would be reduced- freeing up capital for strengthening their infrastructure and for capacity building– especially in view of the dawn of 5G era.

- The legacy pain point of telcos- inclusion of non-telecom revenues for AGR calculation– has been done away with. This is a welcome move for the telcos.

- The bank guarantee requirement revision is expected to result in increased cash flows for the cash-strapped telecom operators. It would also give more leeway for banks to lend more to these debt-ridden telcos.

- The permission for 100% FDI is expected to attract more global investments into the sector.

- The streamlining of the auction calendar and removal of SUC are expected to reduce the dues outgo. It will also help the telcos plan auction purchases.

Why are the reforms being criticized as insufficient?

- The reform package have been criticized as ‘kicking the can down the road’.

- The telcos will have to pay the MCLR+2% interest rate (currently 9%) on their AGR dues during the moratorium- meaning the government’s receipts are NPV protected. The 9% interest rate on the 4-year moratorium has been criticized as excessive, especially when the telecom levies in India are higher than most developing economies in Asia.

- While the option for the government to convert the AGR dues into equity may demonstrate the commitment to maintain the sector’s competitive landscape, there is a need to consider the fact that the government is already saddled with 2 loss making telecom units: BSNL and MTNL. Further acquisition of stakes in other struggling telcos would be imprudent.

What can be the way forward?

- The state governments should set up adequate telecom infrastructure to realise the National Digital Communication Policy (NDCP).

- The government should ensure a favourable environment for the entry of new players into the market.

- The government should increase the optical fibre penetration across the rural areas as these areas house 72% of the Indian population.

- It must provide for easy and cheap right-of-way permissions.

- Improving policies and regulations for ensuring the growth of the existing telecos and increasing the investments in the domestic market.

- Promoting favourable environment for 5G rollout as it will impact the government’s various flagship programs like Digital India, Smart Cities and all the other sectors within the Indian economy like healthcare, transport, finance etc.

- The government should limit predatory pricing by fixing the minimum price to prevent price war.

- The licence fee is one of the highest in the world. This should be reduced to support the companies’ growth.

- The government should increase its spending on research and development to make India capable of manufacturing and exporting hardware components like mobile handsets, touch screen monitors etc.

With regards to the recent reforms:

- The recent reforms have been a welcome move, but the telecom market’s survival depends on a substantive rise in tariff.

- For the telcos to benefit from the reduced SUC, they will have to buy more spectrum in the future auctions.

- According to Citi Research, the onus is now on the companies to successfully complete its long-delayed capital raise, accelerate network investments, stem its subscriber losses, and eventually increase ARPUs– all of which come with challenges and uncertainties.

- There have been calls for rolling back the interest on the AGR.

- The government should compensate telcos for catering to customers in rural India and the economically weaker section– rather than acquiring equity in the struggling telcos.

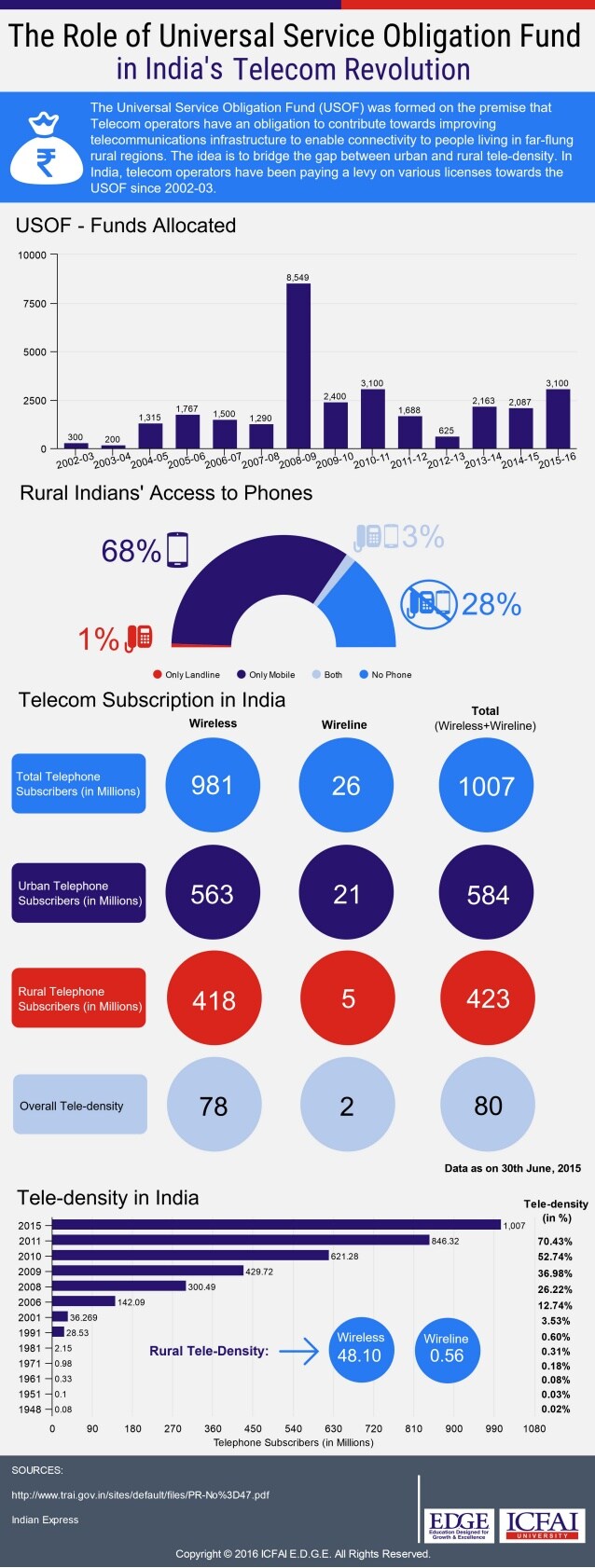

- This compensation would not be a problem, despite the financially strained times. This is because of the 58,809.56 crore INR available in the Universal Service Obligation Fund (August 31, 2021).

- The very objective of USOF is to provide non-discriminatory access to telecom services to people in rural and remote areas at affordable and reasonable rates and hence, bridging the digital divide.

Conclusion:

Telecom sector is an essential service and not merely a revenue generator. It is estimated that for a given level of mobile penetration, a 10% substitution from 2G to 3G increased GDP per capita growth by 0.15 percentage points. Likewise, the doubling of data use leads to an increase in the GDP per capita growth rate of 0.5 percentage points. The recent reforms are a step in the right direction- especially with regards to the rationalization of AGR. The sector is looking at a potential boom in the coming decade.

Test yourself:

Why is India’s telecom sector currently facing a huge debt? What can be done to address this issue? (250 words)

https://indianexpress.com/article/explained/telecom-reforms-vodafone-idea-mrket-dot-7516500/

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1755086

https://www.thehindubusinessline.com/opinion/telecom-reforms-not-sweeping-enough/article37309140.ece