Flat Income Tax Rate in India – Need, Pros, Cons and Measures

This topic of “Flat Income Tax Rate in India – Need, Pros, Cons and Measures” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Why in News?

- In November 2017, the central government had formed a task force to create a new Direct Tax law which seeks to replace the present Income Tax Act, 1961. The Task Force will submit its report to the government on how to fix the more-than-50-year-old Income Tax Act, 1961.

What is the flat income tax rate?

- Flat income tax rate refers to a taxation system in which a constant marginal rate generally applied to individual or corporate income.

- In simple terms, it is an income tax system in which everyone pays the same tax rate irrespective of income level. Hence it is also known as proportional taxation system.

- A true flat tax would be a proportional tax, but the execution of this system are mostly progressive and rarely regressive based on deductions and exemptions in the tax base.

What is the need for flat income tax?

- India’s current tax system is progressive in nature, with tax rates increases when the income level goes up. To meet the changing economic needs of the country, and to fix the more than 50-year-old Income Tax Act, 1961 which is not consistent with current times, a flat tax rate system is essential.

What are the arguments in favour?

- While simplification and better administration of the law are major reforms that India requires, some economists even suggest going for a flat tax system or lower tax system.

- A flat tax rate of 12% would be appealing even for the low-income people and the compliance rate will increase by eight percentage points to 33%.

- Best examples of the flat tax system are of Hong Kong, Russia, and New Zealand.

- Hong Kong was one of the poorest country during the World War II. However, it adopted a flat tax in 1947 which resulted in higher compliance rate and drastic economic growth.

- Russia adopted a 13% flat tax rate in 2001 and its economy expanded by about 10 percent since then. Russia’s income tax revenue has grown by more than 50% since people found it fair and easier to pay.

- New Zealand is called BBLR (broader bases and lower rates) country. In New Zealand, the tax law experts focus on taxing a lot of actions at a low rate, or flat rate and most importantly at the simpler tax code. New Zealand in 1980 did away with deductions and write-offs and instead applied the lowest rates on average workers. With higher compliance, New Zealand is one of the countries with the best income tax practices.

Also read – Precision farming in India – Features, Merits, Demerits and Challenges

What are the arguments against?

- India’s current tax system is progressive in nature, with tax rates going up when the income level goes up. It is because India is a democratic country and is expected to invest in social welfare and infrastructure. Hence progressive tax rate is essential.

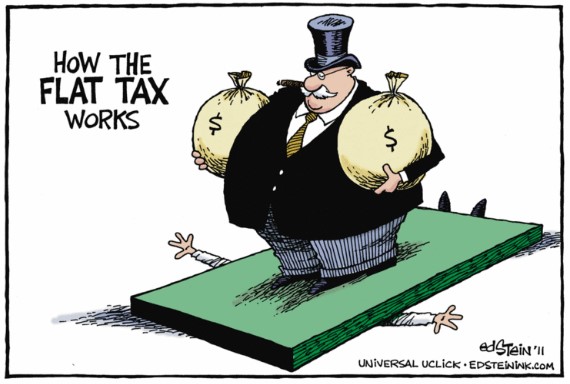

- For a developing country like India, which is in lower middle income bracket, a flat tax structure may not be an equitable one since Income inequality in India is one of the highest, with 22 percent of the national income going to top 1 percent.

- Only with a progressive tax system, such wide income inequalities can be addressed. Hence a flat tax system will be regressive, considering India’s current situation.

- A system prescribing a higher rate of income tax for a higher income group helps garner revenue without being burdensome to low-income taxpayers.

- The success of Russia is not just through the implementation of a flat tax rate but also through several changes in both the structure and the taxation administration. The reforms widened the tax base by eliminating many exemptions and deductions as well as increasing taxes on several capital income.

Initiatives taken by India

- An attempt to redraft the Income Tax Act made by the ex-finance minister P. Chidambaram in 2009 through the Direct Taxes Code (DTC). It proposed a simpler tax code and did away with unnecessary exemptions and created space for lower tax rates. But the bill lapsed due to the dissolution of the 15th Lok Sabha in 2014.

- The current government implemented general anti-avoidance rules (GAAR) since coming to power in 2014.

- In 2016, Finance Minister promised to lower corporate tax rate to 25% in 5 years.

- Currently, income up to Rs 2.5 lakh per annum is exempted from tax for individuals.

Also read – European Monsoon – The mysterious phenomenon

Way forward

Many countries have reported success from the implementation of the flat income tax rate system. It is high time that India also adopts it. But the government should implement it as a pilot project for monitoring various impacts and come up with the effective solution to prevent various challenges in the actual implementation. And the government should also ensure that the poor are not affected from this reform.