Economic Survey 2022-23 Summary: Notes, Mindmap & Key Economic Terms

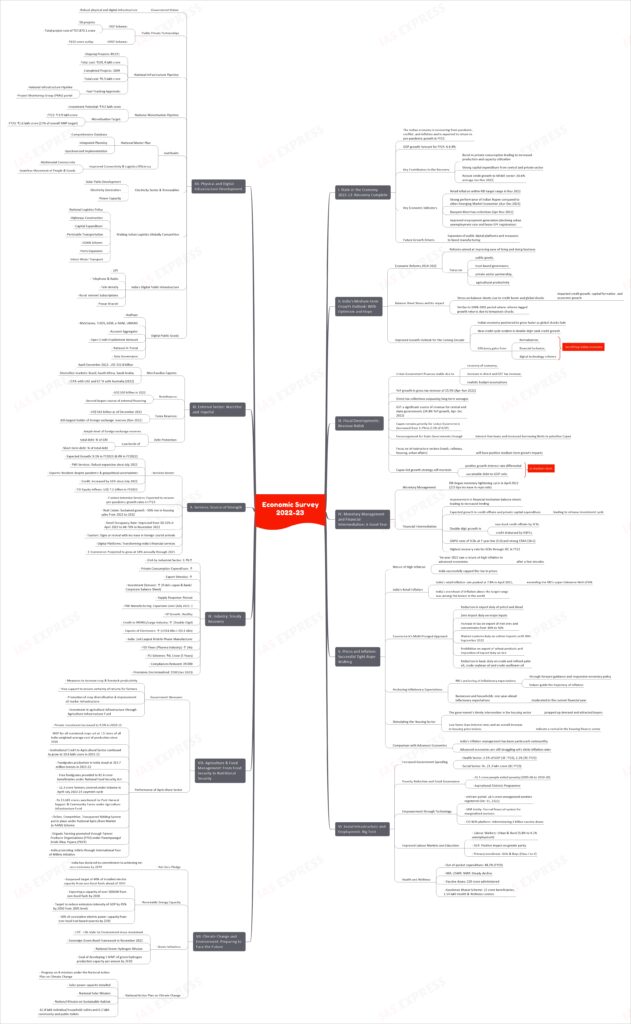

The Union Finance Minister presented the Economic Survey for the Financial Year 2022-23 following the President’s address. The survey showed that India has fully recovered from the pandemic and its economy is predicted to grow between 6% to 6.8% in the upcoming financial year 2023-24.

About Economic Survey

- The Economic Survey of India is a yearly publication released by the Ministry of Finance and is usually unveiled in Parliament before the Union Budget.

- It is crafted by the Economics Division of the Department of Economic Affairs under the Chief Economic Advisor’s direction.

- The document reviews the previous year’s developments in the Indian economy and provides an economic outlook for the current fiscal year.

- It also details the present state of the Indian economy, including data on GDP, inflation, employment, and trade.

- The first Economic Survey in India was presented in 1950-51 and until 1964, it was presented alongside the Union Budget. Since 1964, it has been separate from the budget.

I. State of the Economy 2022-23: Recovery Complete

- The Indian economy is recovering from the pandemic-induced contraction, Russian-Ukraine conflict, and inflation and is expected to return to the pre-pandemic growth path in FY23.

- GDP growth is expected to remain robust in FY24, with a forecast of 6-6.8%.

Key Contributors to the Recovery

- Boost in private consumption, which is at its highest since FY15, leading to an increase in production activity and capacity utilization across sectors.

- Strong capital expenditure from the central government and private sector, driven by the improvement of corporate balance sheets.

- Robust credit growth to the MSME sector, averaging 30.6% during Jan-Nov 2022.

Key Economic Indicators

- Retail inflation within RBI’s target range in November 2022.

- Strong performance of the Indian Rupee compared to other Emerging Market Economies in Apr-Dec 2022.

- Buoyant direct tax collections during April-November 2022.

- Improved employment generation, reflected in the declining urban unemployment rate and faster net registration in Employee Provident Fund.

Future Growth Drivers

- Expansion of public digital platforms and measures to boost manufacturing output.

Key Takeaway:- chapter 1 highlights a broad-based recovery of the Indian economy, positioning it for sustained growth in the coming years.

II. India’s Medium-term Growth Outlook: With Optimism and Hope

Economic Reforms 2014-2022

- The Indian economy underwent extensive reforms aimed at improving the ease of living and doing business.

- Reforms focused on creating public goods, trust-based governance, partnership with the private sector, and improving agricultural productivity.

Balance Sheet Stress and its Impact

- The period of 2014-2022 witnessed stress on the balance sheets due to the credit boom in previous years and one-off global shocks.

- This impacted credit growth, capital formation, and economic growth.

Comparison to the 1998-2002 Period

- The situation is similar to the period of 1998-2002, when structural reforms lagged growth returns due to temporary shocks in the economy.

- The reforms paid growth dividends from 2003 once the shocks faded away.

Improved Growth Outlook for the Coming Decade

- The Indian economy is well positioned to grow faster in the coming decade as the global shocks from the pandemic and commodity price spikes fade away.

- With improved balance sheets in the banking, non-banking, and corporate sectors, a new credit cycle has already begun, evident in double-digit growth in bank credit over the past months.

- Efficiency gains from greater formalization, higher financial inclusion, and economic opportunities created by digital technology-based reforms are already benefiting the Indian economy.

Key Takeaway:- India’s growth outlook is better than in pre-pandemic years and the economy is prepared to grow at its potential in the medium term.

III. Fiscal Developments: Revenue Relish

- The Union Government’s finances have demonstrated stability in the fiscal year 2022-2023, due to the recovery of the economy, increase in direct tax and Goods and Services Tax (GST) revenues, and realistic budget assumptions.

- Gross Tax Revenue showed a YoY growth of 15.5% from April to November 2022, attributed to strong growth in both direct taxes and GST.

- Direct tax collections showed impressive growth during the first eight months of the year, surpassing their long-term averages.

- GST has established itself as a significant source of revenue for both central and state governments, with gross GST collections increasing by 24.8% YoY from April to December 2022.

- Capital expenditure (Capex) remains a priority for the Union Government, despite higher expenditure requirements. The Centre’s Capex has steadily increased from an average of 1.7% of GDP (2009-2020) to 2.5% of GDP in the fiscal year 2022 (provisional).

- The Centre has also encouraged the State Governments through interest-free loans and increased borrowing limits to prioritize their Capex spending.

- The focus on infrastructure-heavy sectors like roads and highways, railways, and housing and urban affairs will have positive medium-term growth impacts, as a result of the increase in Capex.

- The government’s Capex-led growth strategy will maintain a positive growth-interest rate differential, leading to a sustainable debt-to-GDP ratio in the medium-term.

Key Takeaway:- The Union Government’s finances in fiscal year 2022-2023 have shown stability due to the recovering economy, increase in direct taxes, GST revenues, and realistic budget assumptions. The government’s focus on infrastructure-heavy sectors and the increase in Capex will result in positive medium-term growth impacts, leading to a sustainable debt-to-GDP ratio in the medium-term.

IV. Monetary Management and Financial Intermediation: A Good Year

Monetary Management

- RBI Initiates Monetary Tightening Cycle: The Reserve Bank of India (RBI) began its monetary tightening cycle in April 2022, raising the repo rate by 225 bps to curb surplus liquidity conditions.

Financial Intermediation

- Enhanced Lending by Financial Institutions: The improvement in balance sheets of financial institutions has led to an increase in lending activities.

- Growth in Credit Offtake: The growth in credit offtake is expected to be sustained, and combined with a boost in private capital expenditure, will lead to a virtuous investment cycle.

- Positive Credit Trends: Non-food credit offtake by Scheduled Commercial Banks (SCBs) has been growing in double digits since April 2022, while credit disbursed by Non-Banking Financial Companies (NBFCs) has also been on the rise.

- Healthy Bank Metrics: The Gross Non-Performing Assets (GNPA) ratio of SCBs has fallen to a seven-year low of 5.0, while the Capital-to-Risk Weighted Assets Ratio (CRAR) remains strong at 16.0.

- Successful Recovery Rates: The recovery rate for SCBs through Insolvency and Bankruptcy (IBC) was the highest in FY22 compared to other channels.

Key Takeaway:- The Reserve Bank of India (RBI) initiated its monetary tightening cycle in April 2022 and raised the repo rate, leading to improved financial intermediation and lending activities by financial institutions. The growth in credit offtake and healthy bank metrics, including a fall in Gross Non-Performing Assets and strong Capital-to-Risk Weighted Assets Ratio, indicate a positive trend in monetary management.

V. Prices and Inflation: Successful Tight-Rope Walking

Return of High Inflation

- The year 2022 saw a return of high inflation in advanced economies after a few decades

- India successfully capped the rise in prices

India’s Retail Inflation

- India’s retail inflation rate peaked at 7.8% in April 2022, exceeding the RBI’s upper tolerance limit of 6%

- India’s overshoot of inflation above the target range was among the lowest in the world

Government’s Multi-Pronged Approach

- The government adopted a multi-pronged approach to control the increase in prices

- The following measures were implemented:

- Reduction in export duty of petrol and diesel

- Zero import duty on major inputs

- Increase in tax on export of iron ores and concentrates from 30% to 50%

- Waived customs duty on cotton imports until 30th September 2022

- Prohibition on export of wheat products and imposition of export duty on rice

- Reduction in basic duty on crude and refined palm oil, crude soybean oil and crude sunflower oil

Anchoring Inflationary Expectations

- The RBI’s anchoring of inflationary expectations through forward guidance and responsive monetary policy helped guide the trajectory of inflation

- Businesses and households’ one-year-ahead inflationary expectations have moderated in the current financial year

Stimulating the Housing Sector

- The government’s timely intervention in the housing sector propped up demand and attracted buyers

- Low home loan interest rates and an overall increase in housing price indices indicate a revival in the housing finance sector

Comparison with Advanced Economies

- India’s inflation management has been particularly noteworthy

- Advanced economies are still struggling with sticky inflation rates

Key Takeaway:- India has successfully managed to balance prices and inflation, even as advanced economies struggle with sticky inflation rates. The government’s multi-pronged approach and the RBI’s anchoring of inflationary expectations helped guide the trajectory of inflation in India. The revival of the housing finance sector, with a stable to moderate increase in housing price indices, offers confidence to homeowners and home loan financiers.

VI. Social Infrastructure and Employment: Big Tent

Increased Government Spending on Social Sector

- The government’s budgeted expenditure on the health sector reached 2.1% of GDP in FY23 (BE) and 2.2% in FY22 (RE), up from 1.6% in FY21.

- The social sector expenditure increased to Rs. 21.3 lakh crore in FY23 (BE) from Rs. 9.1 lakh crore in FY16.

Poverty Reduction and Good Governance

- 41.5 crore people have exited poverty in India between 2005-06 and 2019-20, according to the 2022 report of the UNDP on Multidimensional Poverty Index.

- The Aspirational Districts Programme has become a model for good governance, particularly in remote and challenging areas.

Empowerment through Technology

- The eShram portal was developed to create a national database of unorganized workers, verified with Aadhaar. As of December 31, 2022, over 28.5 crore unorganized workers were registered on the eShram portal.

- The JAM trinity (Jan-Dhan, Aadhaar, and Mobile) combined with DBT has brought marginalized sections of society into the formal financial system and revolutionized transparent and accountable governance.

- Aadhaar played a crucial role in developing the Co-WIN platform and in administering over 2 billion vaccine doses transparently.

Improved Labour Markets and Education

- Labour markets have recovered beyond pre-Covid levels, in both urban and rural areas, with unemployment rates falling from 5.8% in 2018-19 to 4.2% in 2020-21.

- The Gross Enrolment Ratios (GER) in schools improved in FY22, with a positive impact on gender parity.

- The primary-enrolment in class I to V as a percentage of the population in age 6 to 10 years for girls and boys has improved in FY22.

Health and Wellness

- Due to the government’s efforts, out-of-pocket expenditure as a percentage of total health expenditure declined from 64.2% in FY14 to 48.2% in FY19.

- The Infant Mortality Rate (IMR), Under Five mortality rate (U5MR), and neonatal Mortality Rate (NMR) have steadily declined.

- Over 220 crore COVID vaccine doses have been administered as of January 6, 2023.

- Nearly 22 crore beneficiaries have been verified under the Ayushman Bharat Scheme as of January 4, 2023. Over 1.54 lakh Health and Wellness Centres have been established across the country under Ayushman Bharat.

Key Takeaway:- The Indian government has increased its budgeted expenditure on social sector initiatives, particularly in the areas of health, poverty reduction and good governance, labor markets and education, health and wellness. Through initiatives such as the Aspirational Districts Program, eShram portal and Ayushman Bharat Scheme, the government has made significant progress in empowering marginalized sections of society and improving social indicators like GER and IMR.

VII. Climate Change and Environment: Preparing to Face the Future

Net Zero Pledge:

- India has declared its commitment to achieving net zero emissions by 2070 through the Net Zero Pledge.

Renewable Energy Capacity:

- The country has surpassed its target of 40% of installed electric capacity from non-fossil fuels ahead of 2030.

- India is expecting a capacity of over 500 GW from non-fossil fuels by 2030, which will result in a 29% decline in average emissions by 2029-30 compared to 2014-15.

- The target is to reduce emissions intensity of GDP by 45% by 2030 from 2005 levels, with 50% of cumulative electric power capacity coming from non-fossil fuel-based sources by 2030.

Green Initiatives:

- The “LIFE – Life style for Environment” mass movement has been launched to create awareness about environmental conservation.

- India has issued the Sovereign Green Bond Framework in November 2022 and auctioned two tranches of ₹4,000 crore of Sovereign Green Bonds.

- The National Green Hydrogen Mission aims to make India energy independent by 2047 and has set a goal of developing 5 MMT of green hydrogen production capacity per annum by 2030.

- The mission is expected to lead to a reduction in fossil fuel imports worth over ₹1 lakh crore and creation of over 6 lakh jobs by 2030.

National Action Plan on Climate Change:

- The Survey highlights the progress made on eight missions under the National Action Plan on Climate Change to address environmental concerns and promote sustainable development.

- Solar power capacity installed, a key metric under the National Solar Mission, stood at 61.6 GW as of October 2022, making India a favored destination for renewables with investments worth USD 78.1 billion in the past seven years.

- Under the National Mission on Sustainable Habitat, 62.8 lakh individual household toilets and 6.2 lakh community and public toilets have been constructed by August 2022.

Key Takeaway:– India is making significant efforts to mitigate the impact of climate change and move towards a more sustainable future. The country has pledged to achieve net zero emissions by 2070 and has surpassed its target of 40% of installed electric capacity from non-fossil fuels ahead of 2030. India has also launched various green initiatives, including the “LIFE – Life style for Environment” mass movement, issued the Sovereign Green Bond Framework and is working towards becoming energy independent through the National Green Hydrogen Mission.

VIII. Agriculture & Food Management: From Food Security to Nutritional Security

- Government Measures:

- Measures taken to increase crop and livestock productivity

- Price support to ensure certainty of returns for farmers

- Promotion of crop diversification and improvement of market infrastructure

- Investment in agriculture infrastructure through the Agriculture Infrastructure Fund

- Performance of the Agriculture Sector:

- Private investment in agriculture increased to 9.3% in 2020-21

- MSP for all mandated crops fixed at 1.5 times of all India weighted average cost of production since 2018

- Institutional Credit to the Agricultural Sector continued to grow to 18.6 lakh crore in 2021-22

- Foodgrains production in India stood at 315.7 million tonnes in 2021-22

- Free foodgrains provided to 81.4 crore beneficiaries under the National Food Security Act for one year from January 1, 2023

- 11.3 crore farmers covered under the Scheme in April-July 2022-23 payment cycle

- Rs 13,681 crores sanctioned for Post-Harvest Support and Community Farms under the Agriculture Infrastructure Fund

- Online, Competitive, Transparent Bidding System put in place under the National Agriculture Market (e-NAM) Scheme

- Organic Farming promoted through Farmer Producer Organisations (FPO) under the Paramparagat Krishi Vikas Yojana (PKVY)

- India promoting millets through the International Year of Millets initiative

Key Takeaway:– India has taken several measures to increase crop and livestock productivity, diversify crops and improve market infrastructure through initiatives such as price support, investment in agriculture infrastructure, and the Agriculture Infrastructure Fund. The result of these efforts has been a growth in private investment, higher foodgrains production, wider coverage under the National Food Security Act, and promotion of organic farming through initiatives like the Paramparagat Krishi Vikas Yojana (PKVY) and the International Year of Millets.

IX. Industry: Steady Recovery

- Gross Value Added (GVA) by the Industrial Sector rose 3.7% in the first half of FY 22-23

- Robust growth in Private Final Consumption Expenditure and export stimulus

- Increase in investment demand triggered by enhanced public capex and strengthened bank and corporate balance sheets

- Robust supply response of the industry to demand stimulus

- PMI manufacturing remained in the expansion zone for 18 months since July 2021

- Index of Industrial Production (IIP) grew at a healthy pace

- Credit to Micro, Small and Medium Enterprises (MSMEs) and large industry showed double-digit growth

- Exports of electronics rose nearly threefold from US $4.4 billion in FY19 to US $11.6 Billion in FY22

- India became the second-largest mobile phone manufacturer globally

- Foreign Direct Investment (FDI) flows into the Pharma Industry rose four times

- Production Linked Incentive (PLI) schemes introduced with an estimated capex of ₹4 lakh crore over five years

- Over 39,000 compliances reduced and more than 3500 provisions decriminalized as of January 2023

Key Takeaway:– The Indian industry showed steady recovery with growth in Gross Value Added (GVA) by the industrial sector of 3.7% in H1 of FY22-23, due to robust growth in private final consumption expenditure and export stimulus. The industry responded positively to the demand stimulus, resulting in an increase in investment demand and double-digit growth in credit to MSMEs and large industries.

X. Services: Source of Strength

- The services sector is expected to grow at 9.1% in the fiscal year 2023, a significant improvement from 8.4% growth in the fiscal year 2022.

- Evidence of robust expansion in PMI services, a key indicator of service sector activity, has been observed since July 2022.

- India’s services exports have remained resilient despite the Covid-19 pandemic and geopolitical uncertainties, driven by increasing demand for digital support, cloud services, and infrastructure modernization. India is now among the top ten services exporting countries in the world, with its share in global commercial services exports increasing from 3% in 2015 to 4% in 2021.

- The credit to the services sector has increased by over 16% since July 2022, with US$ 7.1 billion FDI equity inflows in the fiscal year 2022.

- The contact-intensive services are expected to recover their pre-pandemic growth rates in FY23.

- The real estate sector is showing sustained growth, with a 50% rise in housing sales from 2021 to 2022, taking the sector back to its pre-pandemic levels.

- The hotel occupancy rate has improved from 30-32% in April 2021 to 68-70% in November 2022, while the tourism sector is showing signs of revival with an increase in foreign tourist arrivals.

- Digital platforms are transforming India’s financial services, while the e-commerce market is projected to grow at 18% annually through 2025.

Key Takeaway:– The services sector in India is showing signs of steady growth, with an expected growth rate of 9.1% in FY2023. The sector has remained resilient during the Covid-19 pandemic, driven by increased demand for digital services and infrastructure modernization. India is now among the top ten services exporting countries in the world and has seen an increase in FDI equity inflows and credit to the services sector.

XI. External Sector: Watchful and Hopeful

- Merchandise exports for the period April-December 2022 were recorded at US$ 332.8 billion.

- India has diversified its markets, with increased exports to countries such as Brazil, South Africa, and Saudi Arabia.

- To further increase market size and improve market penetration, India has entered into the Comprehensive Economic Partnership Agreement (CEPA) with UAE and the Economic Cooperation Treaty Agreement (ECTA) with Australia in 2022.

- India remains the largest recipient of remittances in the world, receiving US$ 100 billion in 2022. Remittances serve as the second largest source of external financing, following service exports.

- As of December 2022, India’s Forex Reserves stand at US$ 563 billion, covering 9.3 months of imports.

- India is also the sixth largest holder of foreign exchange reserves in the world as of November 2022.

- The current stock of external debt is well-protected by the ample level of foreign exchange reserves.

- India boasts relatively low levels of total debt as a percentage of Gross National Income and short-term debt as a percentage of total debt.

Key Takeaway:- India has strengthened its economic ties by entering into comprehensive trade agreements with UAE and Australia and continues to be the largest recipient of remittances in the world, receiving $100 billion in 2022. With ample forex reserves of $563 billion, India is well-protected from external debt and has relatively low levels of debt as a percentage of GNI and short-term debt as a percentage of total debt.

XII. Physical and Digital Infrastructure Development

Government Vision: The government has a vision to develop robust physical and digital infrastructure to support the growth of the economy.

Public Private Partnerships:

- VGF Scheme: 56 projects have been granted In-Principal Approval under the VGF Scheme, with a total project cost of ₹57,870.1 crore from 2014-15 to 2022-23.

- IIPDF Scheme: The government notified the IIPDF Scheme with ₹150 crore outlay from FY 23-25 on November 3, 2022.

National Infrastructure Pipeline:

- Ongoing Projects: There are 89,151 projects costing ₹141.4 lakh crore under different stages of implementation.

- Completed Projects: 1009 projects worth ₹5.5 lakh crore have been completed.

- Fast-Tracking Approvals: The National Infrastructure Pipeline and Project Monitoring Group (PMG) portal have been linked to fast-track approvals and clearances for projects.

National Monetisation Pipeline:

- Investment Potential: The estimated cumulative investment potential is ₹ 9.0 lakh crore.

- Monetisation Target: The monetisation target of ₹ 0.9 lakh crore was achieved against the expected ₹0.8 lakh crore in FY22. The target for FY23 is envisaged to be ₹1.6 lakh crore (27% of overall NMP target).

GatiShakti:

- National Master Plan: PM GatiShakti National Master Plan creates a comprehensive database for integrated planning and synchronized implementation across Ministries/Departments.

- Improved Connectivity and Logistics Efficiency: The plan aims to improve multimodal connectivity and logistics efficiency while addressing critical gaps for the seamless movement of people and goods.

Electricity Sector and Renewables

- -Solar Parks Development: The government has sanctioned the target capacity of 40 GW for the development of 59 Solar Parks in 16 states as of 30 September 2022.

- -Electricity Generation: In FY22, 17.2 lakh GWh electricity was generated compared to 15.9 lakh GWh in FY21.

- -Power Capacity: The total installed power capacity increased from 460.7 GW on 31 March 2021 to 482.2 GW on 31 March 2022.

Making Indian Logistics Globally Competitive

- -National Logistics Policy: The government envisions a technologically advanced, integrated, cost-effective, sustainable, and trustworthy logistics ecosystem in the country for accelerated and inclusive growth.

- -Highways Construction: The construction of National Highways has rapidly increased with 10457 km constructed in FY22 compared to 6061 km in FY16.

- -Capital Expenditure: The budget expenditure has increased from ₹1.4 lakh crore in FY20 to ₹2.4 lakh crore in FY23, giving a renewed push to capital expenditure.

- -Perishable Transportation: Kisan rails transported approximately 7.91 lakh tonnes of perishables as of October 2022.

- -UDAN Scheme: Over one crore air passengers have availed the benefit of the UDAN scheme since its inception in 2016.

- -Ports Expansion: The capacity of major ports has near doubled in 8 years.

- -Inland Water Transport: The Inland Vessels Act 2021 replaced the 100-year-old act to ensure hassle-free movement of vessels and promote Inland Water Transport.

India’s Digital Public Infrastructure

- -UPI: UPI-based transactions grew in value (121%) and volume (115%) between 2019-22, paving the way for international adoption.

- -Telephone and Radio: The total telephone subscriber base in India stands at 117.8 crore (as of Sept,22), with 44.3% of subscribers in rural India and over 98% of the subscribers connected wirelessly.

- -Tele-density: The overall tele-density in India stood at 84.8% in March 22.

- -Rural Internet Subscriptions: There was a 200% increase in rural internet subscriptions between 2015 and 2021.

- -Prasar Bharati: Prasar Bharati broadcasts in 23 languages and 179 dialects from 479 stations and reaches 92% of the area and 99.1% of the total population.

Digital Public Goods

- -Aadhaar: The government has achieved low-cost accessibility since the launch of Aadhaar in 2009.

- -MyScheme, TrEDS, GEM, e-NAM, UMANG: These government schemes have transformed the marketplace and enabled citizens to access services across sectors.

- -Account Aggregator: The consent-based data sharing framework is currently live across over 110 crore bank accounts.

- -Open Credit Enablement Network: The network aims to democratize lending operations and allow end-to-end digital loan applications.

- -National AI Portal: The National AI Portal has published 1520 articles, 262 videos, and 120 government initiatives and is viewed as a tool for overcoming the language barrier, for example, Bhashini.

- -Data Governance: The government is introducing legislation for enhanced user privacy and creating an ecosystem for standard, open, and interoperable protocols underlining robust data governance.

Key Takeaway:- The Indian government has a vision to develop robust physical and digital infrastructure to support the growth of the economy, achieved through various initiatives including the VGF Scheme, IIPDF Scheme, National Infrastructure Pipeline, National Monetisation Pipeline, and PM GatiShakti National Master Plan. Additionally, the government has made significant efforts to make India’s logistics globally competitive and expand its digital public infrastructure, including Aadhaar, various e-governance schemes, and a focus on data governance.

Key Economic terms

- GDP: Gross Domestic Product, the total market value of goods and services produced within a country’s borders in a given period of time.

- GDP growth: The rate at which a country’s economy is growing.

- CAD: Current Account Deficit, the difference between a country’s imports and exports, excluding capital flows.

- Private consumption: The spending of individuals on goods and services.

- Capital expenditure (Capex): the money spent by the government on assets such as the development of machinery, equipment, building, health facilities, education, etc.

- Retail inflation: The increase in prices of goods and services bought by individuals for consumption.

- Headline Inflation: A measure of the overall change in the price level of goods and services in an economy, including food and energy prices.

- Direct tax: Taxes paid directly to the government, such as income tax.

- Balance sheets: Financial statements that summarize a company’s assets, liabilities, and equity at a specific point in time

- Urban unemployment rate: The percentage of the urban workforce that is unemployed.

- Employee Provident Fund: A retirement savings scheme in India.

- Gross Tax Revenue: Total tax revenue collected by the government.

- YoY: Year over Year, the percentage change in a value from the same period in the previous year.

- Capex: Capital expenditure.

- Debt-to-GDP ratio: The ratio of a country’s total debt to its Gross Domestic Product.

- Repo rate: The rate at which banks can borrow money from the central bank.

- Gross Non-Performing Assets (GNPA) ratio: The percentage of a bank’s loan portfolio that is considered to be uncollectible.

- Capital-to-Risk Weighted Assets Ratio (CRAR): The ratio of a bank’s capital to its risk-weighted assets.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.