Atmanirbhar Bharat Abhiyan (Self-reliant India Mission): program, significance, issues

As India continues to fight the pandemic of COVID-19, The PM recently made a clarion call for a post-pandemic economic redemption. The Atmanirbhar Bharat i.e. Self-reliant India is a policy that aims to convert the crisis into opportunity and boost the Make in India program. The Finance Minister explained the nitty-gritty of the policy in a press conference.

This topic of “Atmanirbhar Bharat Abhiyan (Self-reliant India Mission): program, significance, issues” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is Atmanirbhar Bharat Abhiyan or Self-reliant Mission?

- Atmanirbhar Bharat Abhiyan is an economic stimulus program that aims to cut down import dependence by focusing on substitution while improving the quality and safety standards of made in India products to enter the global value chain.

- The PM declared an economic package of total Rs. 20 lakh crore which is about 20% of India’s Gross Domestic Product in 2019-20.

- This self-reliance doesn’t mean the tariff escalation, MRTP days of pre-liberalization days. It is a program to project India into the global market and gain a significant position.

- It focuses on the importance of “local product” promotion.

- The latest announcement is the 5th and last tranche of big economic stimulus packages announced in the fight against the economic impacts of the lockdown.

- It not only contains financial packages for different sectors but also pushes the reform measures in agriculture, PSUs, etc.

What are the five pillars of the Atmanirbhar Bharat Mission?

The PM outlined the five pillars of the mission. They are:

- Economy- The quantum jump and not incremental changes;

- Infrastructure- Representing India

- System- Driven by the new age technologies

- Demography- The force behind self-reliant India

- Demand- to utilize the strength of our demand-supply chain

The prologue to the Mission

Before the PM announced the mission there were a series of actions to revive the economic stress after the lockdown. They are discussed below.

- The PM Garib Kalyan Yojana

The size of the package was Rs. 1.7 lakh crores (0.85% of the GDP) which consisted

- Front-loading of PM Kisan funds: Rs 17,380 crore

- Building and Other Construction Workers Welfare Cess Fund: Rs 31,000 crore

- District Mineral Foundation Funds: Rs 35,925 crore

- Additional fiscal cost to the central government: Rs. 85,695 crores.

- Liquidity Injection by the Reserve Bank of India

The two-step liquidity injection by the RBI consisted of actions given below

- Targeted Long-Term Repo Operations (TLTRO): Rs 1,00,000 crore after which additional TLTRO of Rs. 50,000 crores were declared

- Cash Reserve Ratio (CRR) cut of 100 basis points to 3% of net demand and time liabilities: Rs 1,37,000 crore

- Accommodation under Marginal Standing Facility hiked from 2% of Statutory Liquidity Ration to 3%: Rs 1,37,000 crore

- Refinance of SIDBI, NABARD and NHB: Rs 50,000 crore

- Special Liquidity Facility for Mutual Funds: 50,000 crores

The Atmanirbhar Bharat mission: A Detailed breakup

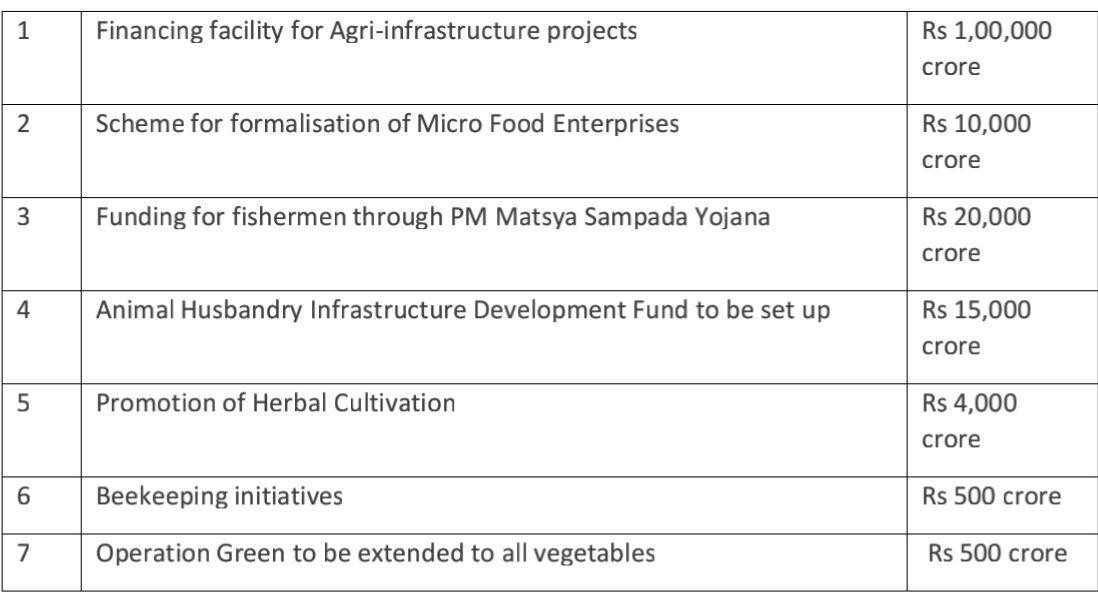

In order to give shape to the mission, the FM announced that land, labour, liquidity, and laws have all been emphasized. The package was declared in total of five tranches. They are enumerated below.

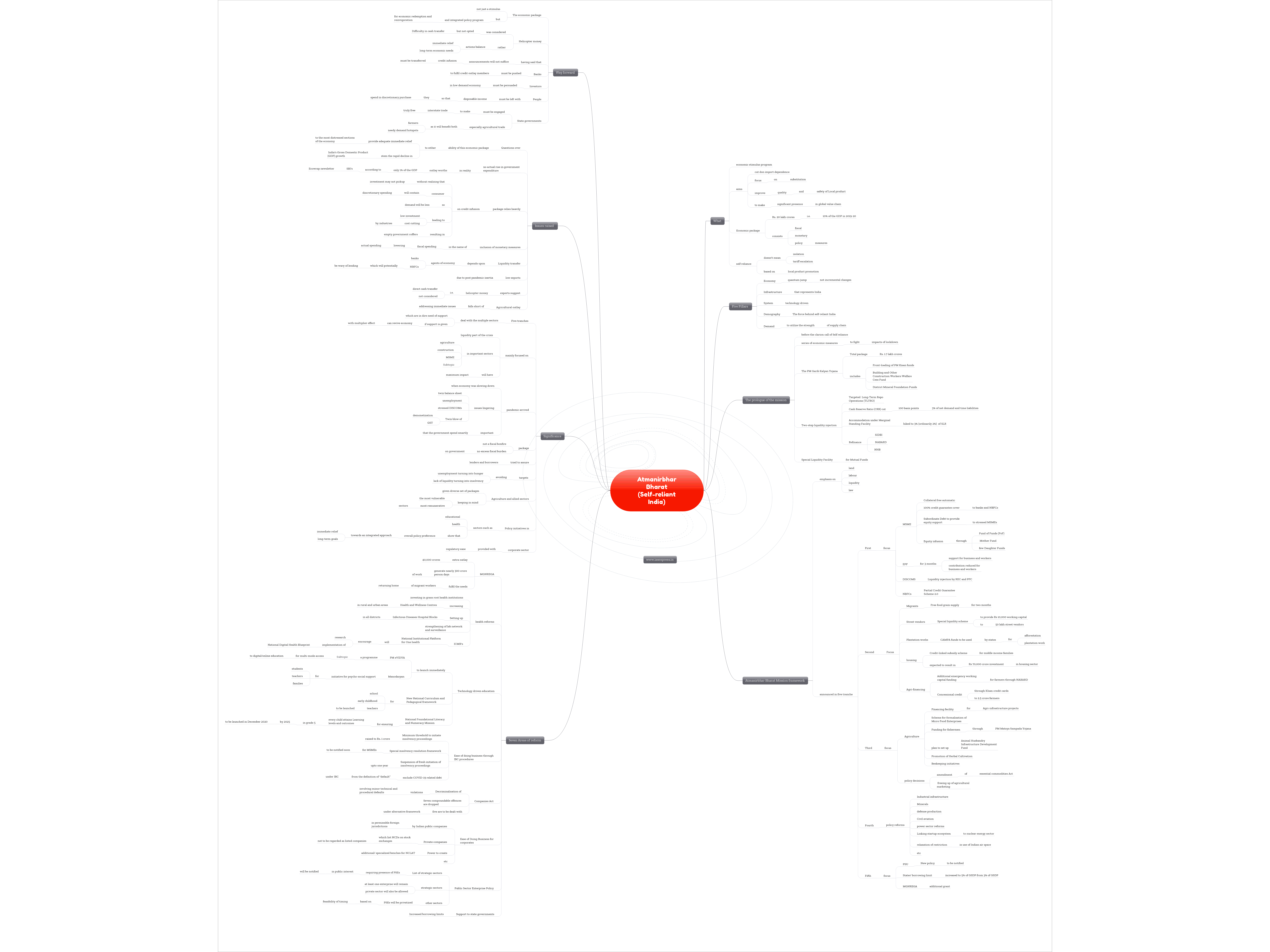

- The first Tranche: The Rs. 5.94 lakh crores outlay focuses on the MSME sector, EPF contributions, and DISCOMS.

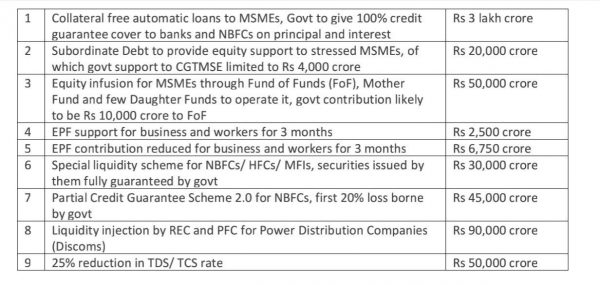

- The Second Tranche: Rs. 3 Lakh crores focuses on the Migrants, Street vendors, plantation workers, and the housing sector

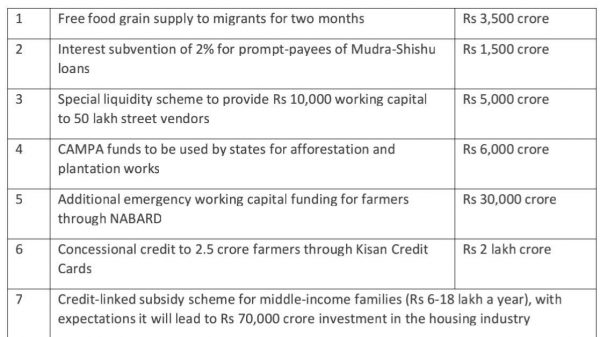

- The Third Tranche: It deals with the agricultural and allied sectors with an outlay of Rs 1.5 lakh crores

Apart from these layouts, the policy reforms such as the amendment of essential commodities Act and freeing up of agricultural marketing were also announced.

- The Fourth Tranche: policy reforms with total outlay Rs. 8100 crores

- Privatization of DISCOMS in Union territories

- Boosting investment in social infrastructure

- Relaxation of restriction f use of Indian airspace

- Private participation space sector

- Self-reliance in defense manufacturing

- Linking the robust startup ecosystem to the nuclear sector

- The Fifth Tranche: It focuses on the PSUs, state borrowings, and MGNREGA

- New policy for public sector enterprises and strategic sectors will be notified in which there will be at least one (but not more than four) PSEs in addition to private players.

- Limit of state borrowings increased to 5% of GSDP from 3% of GSDP; but only 0.5% of it (Rs 1.07 lakh crore) can be raised conditionally

- MGNREGA gets an additional Rs 40,000 crore

As can be seen from the above detailed breakup of the mission package, the mission includes the multisectoral financial and administrative-policy measures.

The FM announced that the measures work on seven areas of reforms. They are elaborated below.

- The MGNREGA outlay

- It will help generate nearly 300 crore person-days in total addressing the need for more work including returning migrant workers in Monsoon season as well.

- The Creation of a larger number of durable and livelihood assets including water conservation assets will boost the rural economy through higher production.

- Health reforms and initiatives

- The sector will be helped by investing in grassroot health institutions and ramping up Health and Wellness Centres in rural and urban areas.

- Setting up of Infectious Diseases Hospital Blocks in all districts and strengthening of lab network and surveillance by Integrated Public Health Labs in all districts & block level Labs & Public Health Unit to manage pandemics.

- ICMR’s National Institutional Platform for One health will encourage research andimplementation of the National Digital Health Blueprint under the National Digital Health Mission.

- Technology Driven Education with Equity post-COVID

- PM eVIDYA, a program for multi-mode access to digital/online education to be launched immediately

- Manodarpan, an initiative for psycho-social support for students, teachers, and families for mental health and emotional well-being to be launched immediately as well

- New National Curriculum and Pedagogical frameworkfor school, early childhood, and teachers will also be launched.

- National Foundational Literacy and Numeracy Missionfor ensuring that every child attains Learning levels and outcomes in grade 5 by 2025 will be launched by December 2020.

- Ease of Doing Business through solvency measures

- The Minimum threshold to initiate insolvency proceedings has been raised to Rs. 1 crore (from Rs. 1 lakh, which largely insulates MSMEs).

- For MSMEs, a Special insolvency resolution framework will be notified soon.

- Suspension of fresh initiation of insolvency proceedings up to one year, depending upon the pandemic situation.

- Empowering the Government to exclude COVID 19 related debt from the definition of “default” under the Code will be considered.

- Decriminalization of Companies Act defaults

- Decriminalization of Companies Act violations involving minor technical and procedural defaults.

- Seven compoundable offenses are dropped and five are to be dealt with under an alternative framework.

- Ease of Doing Business for Corporates

- Direct listing of securities by Indian public companies in permissible foreign jurisdictions.

- Private companies that list NCDs on stock exchanges not to be regarded as listed companies.

- Including the provisions of Part IXA (Producer Companies) of Companies Act, 1956 in Companies Act, 2013.

- Power to create additional/ specialized benches for NCLAT

- Lower penalties for all defaults for Small Companies, One-person Companies, Producer Companies & Startups.

- Public Sector Enterprise Policy

- List of strategic sectors requiring the presence of PSEs in the public interest will be notified

- In strategic sectors, at least one enterprise will remain in the public sector but the private sector will also be allowed

- In other sectors, PSEs will be privatized (timing to be based on feasibility etc.)

- In order to minimize the wasteful administrative expenditures, the number of enterprises in strategic sectors will ordinarily be kept only one to four; others will be privatized/ merged/ brought under holding companies.

- Support to State Governments

- Centre has decided to increase the borrowing limits of States from 3% to 5% for 2020-21 only.

- This will give States extra resources of Rs. 4.28 lakh crore. It will be seen that part of the borrowing is linked to specific reforms, including recommendations of the Finance Commission.

- Reform linkage will be in four areas:

- universalization of ‘One Nation One Ration card’,

- Ease of Doing Business,

- Power distribution

- Urban Local Body revenues.

How will the announced measures will help the economy?

- The Five tranches of economic measures deal with the multiple sectors of the economy which are in dire need of support and provided they are given adequate support can revive the economy with spillover effects as well.

- The announcements are mainly focused on the liquidity part of the crisis. By injecting liquidity in the sectors such as agriculture, housing, MSMEs the government strikes where the impact will be the most.

- It must be noted that, the pandemic arrived in an economy that was already showing the signs of slowing down. The twin balance sheet issue was not resolved, unemployment was becoming a major issue, the DISCOMs were not performing well, the MSME sector was still coming to terms with the twin blow of Demonetization and GST. In this scenario it was important that the government spend smartly.

- In acknowledgment of that, care is taken that the package is not a fiscal bonfire. For now, it does not substantially add fiscal burden on the government.

- While doing that, it has tried to assure borrowers and lenders alike.

- The mission targets avoiding unemployment turning into hunger and lack of liquidity turning into insolvency.

- The agricultural and allied sectors have been given diverse sets of packages keeping in mind the most vulnerable and the most remunerative sectors.

- The vulnerable sectors like migrants, construction sector, street vendors are provided with special packages to deal with the economic lockdown that has stagnated the activities. The vulnerable are provided with food grains under Garib Kalyan Yojana.

- The policy initiatives in the educational sector, health sector show that the overall policy preference is towards an integrated approach that includes immediate and long-term needs. As such, it is a truly a mission that aims for self-reliance.

- The Corporate sector has been provided with regulatory ease.

What are the issues raised regarding the mission?

- Many have openly questioned the ability of this economic package to either provide adequate immediate relief to the most distressed sections of the economy, or indeed stem the rapid decline in India’s Gross Domestic Product (GDP) growth.

- The government is not raising its total expenditure. The total expenditure-as shown by many calculations- is only 1% of the GDP under Atmanirbhar Bharat, far from its promise of 10%. The State Bank of India has in its Ecowrap newsletter pegged the actual size of the fiscal package at ₹2 lakh crore or 1 per cent of the GDP.

- It is contended that the package relies heavily on credit infusion without realizing that the investment may not pick up in the near future. As the consumer will try to contain discretionary expenditure like cars, tourism, the overall demand will be lower. This will lead to cost-cutting by the industry in turn leaving government coffers empty.

- The government has included monetary actions within its fiscal stimulus announcement. It will lead to lowering actual spending by the government.

- The Banks will tend to lend only to creditworthy customers. Hence, the monetary stimulus which has been included in the package shall not reach the real needy people: small and marginal farmers, the unorganized sector, the daily wage workers.

- The experts have been suggesting the direct transfer of money to the people i.e. helicopter money. It is said to be more equitable as it can target the most vulnerable sections and negate the transfer of benefits to the well-to-do and relatively unharmed middle class.

- The stimulus package in the agricultural sector does not clearly address the immediate problem of the farmers such as opening up of the markets, purchase of the harvest at an appropriate price, etc.

Way forward

- Though the program is being criticized for its inflated numbers and heavy dependency on agents of redistribution like banks, it must be noted that it is not just a stimulus package.

- The government has tried to respond to the aggregate issues that are plaguing the economy through an ambitious economic reinvigoration and reform mission.

- The Helicopter money, as the FM said, was considered but not opted because it is difficult to determine how many to be given cash grants. Rather than helicopter money, the government opted for a multiplier effect to stimulate the agents of the economy and meanwhile provide for immediate needs of the neediest by providing food grains, fuel, front-loading PM-KISAN amount, etc.

- Having said that, only announcements will not suffice. It is true that most of the money is in the form of credit infusion. Given the possible market sentiments, it is important to see that the investment potential is realized.

- The banks must be pushed to fulfill the credit outlay numbers. The industry must be persuaded to invest in a low demand economy.

- The people must be left with disposable income so that they go for discretionary expenditure.

- The state governments must be brought around to make the interstate trade truly free and especially, interstate agricultural trade must be encouraged. It will have a double benefit of realization of good price for farmers and supply of Agri-product to the demand hotspots

Conclusion

The Atmanirbhar Bharat Abhiyan is an important mission for the economic revival and progress of the Indian economy under lockdown. The Atmanirbhar Bharat has been praised for reintroducing the idea of Swaraj as a redemptive tool for the post-pandemic Indian economy. If implemented effectively, it can help achieve the dream of India being economically stable, technologically superior, self-reliant in its needs. The integrated approach can help the much-discussed India-Bharat gap and fulfill the aspiration of an equitable society.

Practice Question for Mains

What is Atmanirbhar Bharat Abhiyan? Critically analyze its efficacy in bringing economy to normalcy and propelling its growth. (250 words)

It was nice information

Atmanirbhar bharat abhiyan

How to get PDF file of this