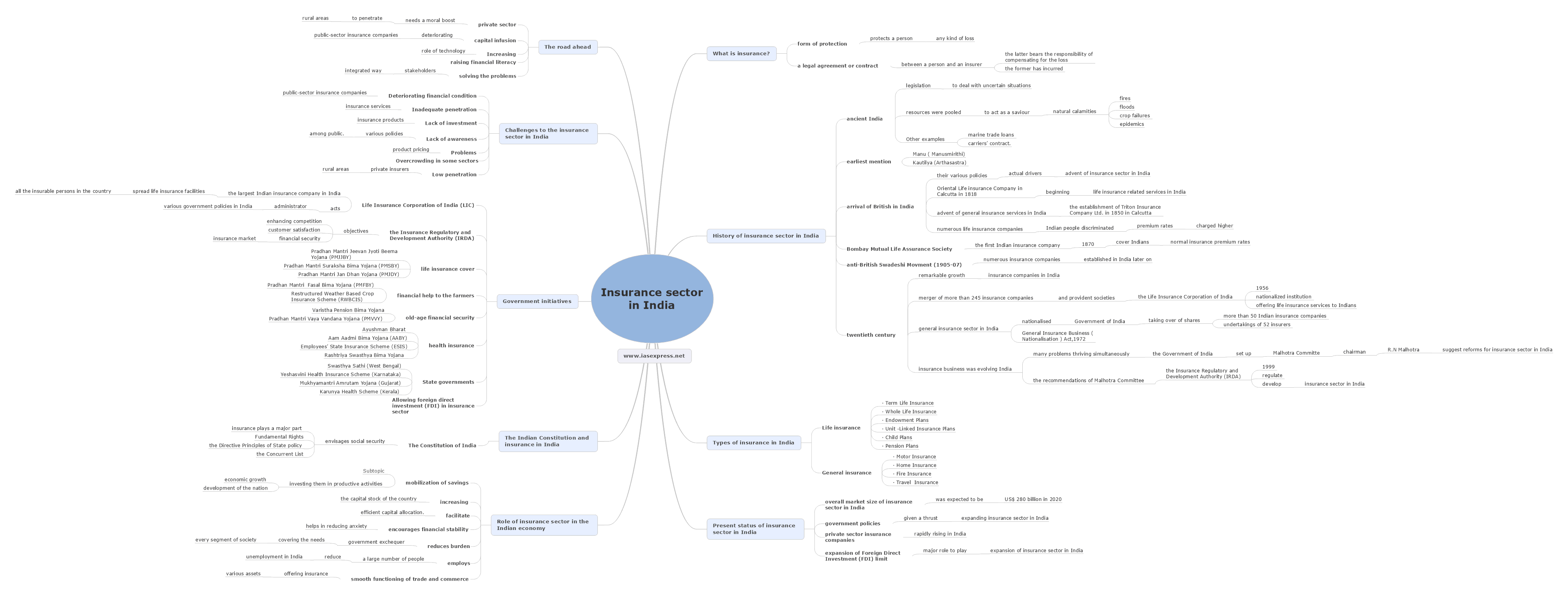

Insurance Sector in India – History, Types, Status, Govt Efforts

In the last few decades, the insurance industry in India has dynamically expanded. Governments from time to time have shown their commitment to providing insurance facilities to the citizens of India. The insurance market in India holds great potential to act as a booster for the Indian economy. With the rise of population and poverty in the country, there is a looming risk of uncertain financial losses. In such a situation, the insurance sector in India has a major role to play in the coming time.

What is insurance?

Insurance is a form of protection that protects a person from any kind of loss. Sometimes, it is in the form of a legal agreement or contract between a person and an insurer in which the latter bears the responsibility of compensating for the loss, the former has incurred in any adverse situation.

History of the insurance sector in India

- The history of insurance in India begins in the days of ancient India to deal with uncertain situations. In ancient India, resources were pooled to act as a saviour in the time of natural calamities like fires, floods, crop failures and epidemics. Insurance in India finds its earliest mention in the books of Manu ( Manusmirithi), Kautilya (Arthasastra) and others. Other examples of insurance in ancient India include marine trade loans and carriers’ contract.

- However, the arrival of the British in India and their various policies, act as the actual drivers in the advent of the insurance sector in India. The establishment of the Oriental Life insurance Company in Calcutta in 1818 marks the beginning of life insurance-related services in India. This company, however, failed later on and many other companies were established. Foreign insurance offices dominated the picture of the insurance sector in India at that time.

- The advent of general insurance services in India dates back to the establishment of Triton Insurance Company Ltd. in 1850 in Calcutta by the British.

- Although there were numerous life insurance companies offering services to people, the Indian people were discriminated in terms of premium rates and were charged higher. Bombay Mutual Life Assurance Society was the first Indian insurance company, established in 1870 to cover Indians at normal insurance premium rates. With the rise in patriotic motives and the anti-British Swadeshi Movement (1905-07), numerous insurance companies were established in India later on.

- The twentieth century saw a remarkable growth of insurance companies in India. However, it was much later on, when by the merger of more than 245 insurance companies and provident societies, the Life Insurance Corporation of India came into existence in 1956 as a nationalized institution offering life insurance services to Indians.

- The whole general insurance sector in India was nationalised by the Government of India by taking over of shares of more than 50 Indian insurance companies and undertakings of 52 insurers carrying general insurance business in India. This sector was nationalised by the General Insurance Business ( Nationalisation ) Act,1972.

- However, the insurance business was evolving India, many problems were thriving simultaneously which needed to be dealt with. Following this, the Government of India set up the Malhotra Committee under the chairmanship of R.N Malhotra to suggest reforms for the insurance sector in India. Following the recommendations of the Malhotra Committee, the Insurance Regulatory and Development Authority (IRDA) was established in1999 to regulate and develop the insurance sector in India.

Types of insurance in India

Life insurance

Life insurance policies deal with coverage against unfortunate events like death or disability of the policyholder.

Examples:-

- Term Life Insurance

- Whole Life Insurance

- Endowment Plans

- Unit –Linked Insurance Plans

- Child Plans

- Pension Plans

General insurance

General insurance plans comprise of other forms of insurances which offer coverage against other unfortunate events and loss except for the death of the policyholder.

Examples:-

- Motor Insurance

- Home Insurance

- Fire Insurance

- Travel Insurance

Present status of the insurance sector in India

The overall market size of the insurance sector in India was expected to be US$ 280 billion in 2020. The various types of government policies to insure the uninsured have given a thrust to the all-time expanding insurance sector in India. The size of contribution by private sector insurance companies has been rapidly rising in India. The expansion of Foreign Direct Investment (FDI) limit in the insurance sector has a major role to play in the expansion of the insurance sector in India.

Role of the insurance sector in the Indian economy

- Insurance companies help in mobilization of savings and investing them in productive activities thus helping in the economic growth and development of the nation.

- They help in increasing the capital stock of the country and facilitate efficient capital allocation.

- Insurance encourages financial stability and thus helps in reducing anxiety.

- The insurance sector reduces the burden on the government exchequer by covering the needs of every segment of society.

- The insurance sector in India employs a large number of people thus reducing the unemployment burden in India.

- The insurance sector helps in the smooth functioning of trade and commerce by offering insurance against various assets thus helping the Indian economy thrive.

The Indian Constitution and insurance in India

The Constitution of India in various ways envisages social security for its citizens and insurance plays a major part in providing social security to Indian citizens. The Constitution of India ensures the social security of its citizens through various provisions of Fundamental Rights, the Directive Principles of State policy, and the Concurrent List. Thus, insurance as a social security measure has gained momentum in recent decades. The government through its various initiatives tries to provide social security to its citizens through insurance in India.

Government initiatives

- The establishment of the Life Insurance Corporation of India (LIC) in 1956 can be seen as a major step ahead in guaranteeing social security to the citizens of India. It is the largest Indian insurance company in India. The primary objective of this organisation is to spread life insurance facilities to all the insurable persons in the country. It also acts as an administrator of various government policies in India.

- The establishment of the Insurance Regulatory and Development Authority (IRDA) in 1999 to regulate and promote the insurance business in India. Its objectives include enhancing competition, customer satisfaction and ensuring the financial security of the insurance market which is a major backbone of the Indian economy.

- Government schemes like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jan Dhan Yojana (PMJDY) provide life insurance cover to the policyholders thus ensuring the financial stability of socially and economically backward sections of the society.

- Pradhan Mantri Fasal Bima Yojana (PMFBY) and Restructured Weather Based Crop Insurance Scheme (RWBCIS) aim at providing financial help to the farmers in the event of crop loss thus stabilising farmers’ income in India.

- Government schemes like Varistha Pension Bima Yojana, Pradhan Mantri Vaya Vandana Yojana (PMVVY) and others aim at providing old-age financial security to the policyholders.

- Government schemes like Ayushman Bharat, Aam Aadmi Bima Yojana (AABY), Employees’ State Insurance Scheme (ESIS), Rashtriya Swasthya Bima Yojana etc provide health insurance to a large number of people in India thus protecting them in the time of health emergency and disability.

- Various State governments in India have also initiated various schemes at the state level to provide insurance cover to people like Swasthya Sathi (West Bengal), Yeshasvini Health Insurance Scheme (Karnataka), Mukhyamantri Amrutam Yojana (Gujarat), Karunya Health Scheme (Kerala) and others.

- Allowing foreign direct investment (FDI) in the insurance sector is one such initiative that has boosted the growth of the insurance sector in India.

Challenges to the insurance sector in India

- The deteriorating financial condition of public-sector insurance companies.

- Inadequate penetration of insurance services.

- Lack of investment in insurance products.

- Lack of awareness about various policies among the public.

- Problems in product pricing.

- Overcrowding in some sectors.

- Low penetration of private insurers in rural areas.

The road ahead

With increasing liberalisation in the insurance sector, there is a need that the problems plaguing are addressed immediately. The private sector needs a morale boost to penetrate the rural areas thus insuring the uninsured. There is a need for capital infusion in the deteriorating public-sector insurance companies as they play a vital part in maintaining the financial health of India. Increasing the role of technology, raising financial literacy and solving the problems of various stakeholders in an integrated way can make the insurance sector thrive in India.

- https://financialservices.gov.in/insurance-divisions/Government-Sponsored-Socially-Oriented-Insurance-Schemes/Pradhan-Mantri-Jeevan-Jyoti-Bima-Yojana(PMJJBY)

- https://www.ibef.org/industry/insurance-presentation

- https://www.irdai.gov.in/

- https://licindia.in/Top-Links/about-us/History

- https://www.statista.com/topics/6514/insurance-industry-in-india/

- https://www.ideasforindia.in/topics/money-finance/india-s-insurance-sector-challenges-and-opportunities.html

- https://financialservices.gov.in/insurance-divisions/Government-Sponsored-Socially-Oriented-Insurance-Schemes/Pradhan-Mantri-Suraksha-Bima-Yojana(PMSBY)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.