Inheritance Tax in India: A Nightmare for the Wealthy or a Dream for Equality?

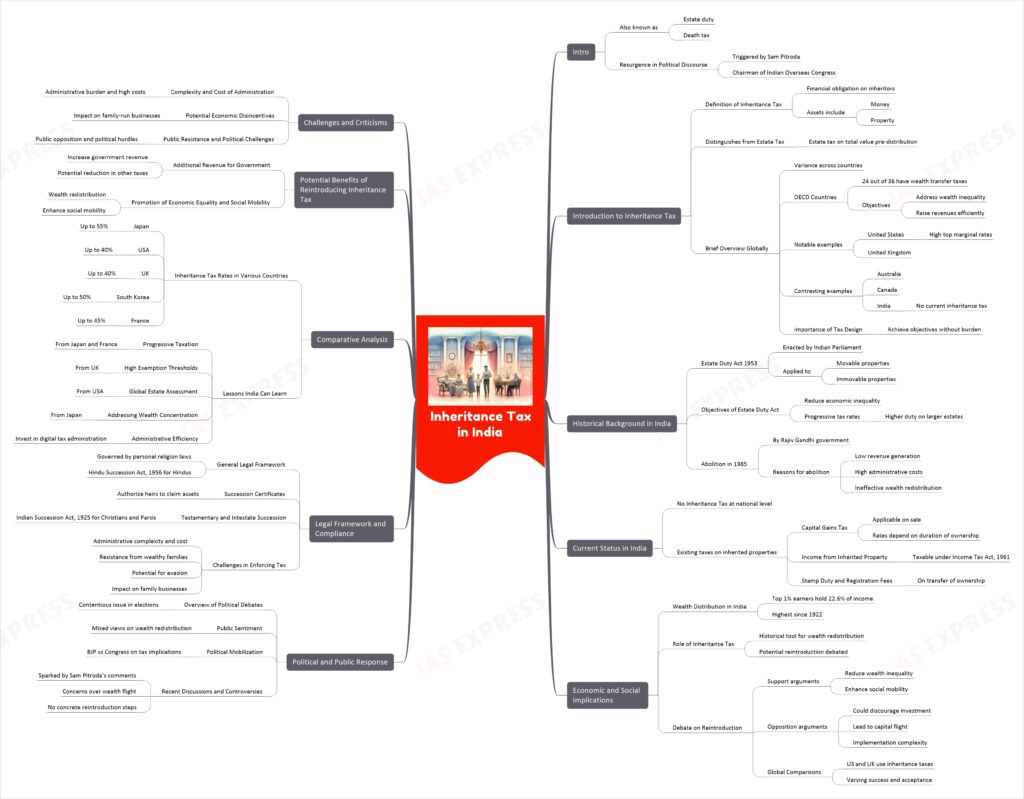

Inheritance tax, often termed “estate duty” or “death tax,” has resurfaced in Indian political discourse following comments by Sam Pitroda, chairman of the Indian Overseas Congress. Historically, India implemented this tax from 1953 to 1985 to address wealth disparities but abolished it due to its ineffectiveness and administrative burdens. Recent debates have reignited discussions on its potential reintroduction, reflecting ongoing concerns about wealth inequality and fiscal policy in the country.

This topic of “Inheritance Tax in India: A Nightmare for the Wealthy or a Dream for Equality?” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Introduction to Inheritance Tax

- Definition of Inheritance Tax

- Inheritance tax is a financial obligation that falls upon individuals who inherit assets, such as money or property, from a deceased person.

- This tax is distinct from an estate tax, which is levied on the total value of a deceased person’s estate before distribution to heirs.

- Brief Overview of Inheritance Tax Globally

- Globally, inheritance tax varies significantly across countries, with some imposing high rates and others having no such tax at all.

- OECD countries show a diverse approach to inheritance taxation, with 24 out of 36 member countries levying wealth transfer taxes to address issues like wealth inequality and to raise revenues efficiently.

- The United States and the United Kingdom are notable examples where inheritance or estate taxes are imposed, with the US having one of the highest top marginal rates among OECD countries.

- In contrast, countries like Australia, Canada, and India do not currently impose an inheritance tax, reflecting a trend where several nations have moved away from this form of taxation.

- The design and implementation of inheritance, estate, and gift taxes are crucial for achieving their objectives without imposing undue administrative burdens or disincentivizing economic growth.

Historical Background of Inheritance Tax in India

- Introduction of the Estate Duty Act in 1953

- The Estate Duty Act was enacted by the Indian Parliament to impose a tax on the estate of deceased persons.

- This tax was applicable to both movable and immovable properties that were transferred to heirs upon the death of an individual.

- Objectives of the Estate Duty Act: addressing economic disparity

- The primary aim of the Estate Duty Act was to reduce economic inequality by taxing the transfer of wealth at death.

- The tax rates were progressive, with the duty increasing for larger estates, which was intended to redistribute wealth more equitably.

- Abolition of the inheritance tax in 1985 by the Rajiv Gandhi government

- The Estate Duty Act was abolished in 1985 during the tenure of Prime Minister Rajiv Gandhi.

- The abolition was motivated by the tax’s low revenue generation compared to its high administrative costs and its failure to significantly alter wealth distribution.

Current Status of Inheritance Tax in India

- No Inheritance Tax in India

- As of now, India does not impose an inheritance tax at the national level, following its abolition in 1985.

- This status places India alongside other countries that have also chosen not to levy inheritance tax, distinguishing it from nations that continue to enforce such taxes.

- Taxes Applicable to Inherited Properties

- Despite the absence of a specific inheritance tax, inherited properties in India are subject to other forms of taxation depending on various circumstances.

- Capital Gains Tax: When inherited property is sold, capital gains tax is applicable. The tax rate and liability depend on whether the gain is classified as long-term or short-term, based on the duration of ownership which includes the period the property was held by the deceased.

- Income from Inherited Property: Any income generated from inherited property, such as rent, is taxable under the Income Tax Act, 1961. The new owner must declare this income and fulfill their tax obligations accordingly.

- Stamp Duty and Registration Fees: The transfer of ownership of inherited property may attract stamp duty and registration fees, although these are not considered direct forms of inheritance tax.

Economic and Social Implications

- Analysis of Wealth Distribution in India and the Role of Inheritance Tax in Addressing Inequality

- Wealth Distribution: Recent data highlights a significant concentration of wealth in India, with the top 1% of earners receiving 22.6% of the national income, the highest since 1922.

- Role of Inheritance Tax: Historically, inheritance taxes have been viewed as tools to mitigate wealth disparities by redistributing accumulated wealth. The potential reintroduction of such taxes is seen as a way to address the growing economic divide, especially when wealth is increasingly concentrated among the elite.

- The Debate on Reintroducing Inheritance Tax to Curb Wealth Concentration

- Support for Reintroduction: Proponents argue that reintroducing inheritance tax could reduce wealth inequality and enhance social mobility by redistributing wealth. They suggest that this could lead to a fairer society where economic opportunities are not solely determined by family wealth.

- Opposition and Challenges: Critics contend that an inheritance tax could discourage investment and lead to capital flight, potentially harming the economy. Concerns about the complexity of implementing such a tax effectively and the potential for increased tax evasion are also significant.

- Global Comparisons: Looking at other countries, some with robust inheritance taxes like the United States and the United Kingdom have managed to use these taxes as part of broader strategies to manage wealth concentration, though with varying degrees of success and public acceptance.

Political and Public Response

- Overview of Political Debates and Public Sentiment Towards Inheritance Tax

- The topic of inheritance tax has become a contentious issue in Indian politics, particularly highlighted during the national election campaigns.

- Public sentiment is mixed, with some viewing it as a necessary tool for wealth redistribution, while others see it as a punitive measure that could discourage wealth generation and investment.

- Political leaders have used the issue to mobilize support, with the BJP criticizing the Congress for potentially reintroducing the tax, which they argue could harm economic growth and violate the rights of individuals to pass on property to their heirs.

- Recent Discussions and Controversies Surrounding the Potential Reintroduction of Inheritance Tax

- The debate was reignited by Sam Pitroda’s comments suggesting a U.S.-style inheritance tax, which led to a political slugfest with significant media coverage and public discourse.

- Concerns about the flight of wealth from the country and the administrative challenges of implementing such a tax have been prominent in the discussions.

- Despite the controversy, there is a growing dialogue about the potential benefits of such a tax in terms of addressing income inequality and funding public services, though no concrete steps have been taken towards its reintroduction.

Legal Framework and Compliance

- Description of the Legal Processes Involved in Inheritance Under Current Indian Law

- General Legal Framework: Inheritance in India is primarily governed by personal laws specific to one’s religion, with the Hindu Succession Act, 1956 being a major legislative framework for Hindus, Buddhists, Jains, and Sikhs.

- Succession Certificates: These are crucial for the legal heirs to claim their inheritance, especially in the absence of a will. They authorize heirs to inherit debts, securities, and other assets of the deceased.

- Testamentary and Intestate Succession: The laws differentiate between testamentary (with a will) and intestate (without a will) succession. For instance, the Indian Succession Act, 1925 applies to Christians and Parsis, outlining the procedures for both types of succession.

- Challenges in Enforcing and Administering Inheritance Tax

- Administrative Complexity: Implementing an inheritance tax involves a complex administrative setup, which can be resource-intensive and costly. The enforcement and compliance mechanisms required are substantial.

- Resistance from Wealthy Families: There is significant opposition from affluent families who might see an inheritance tax as diminishing the wealth they can pass to their heirs. This resistance can manifest in both political and social spheres.

- Potential for Evasion: High net worth individuals may use various legal mechanisms such as trusts, offshore accounts, or lifetime gifts to minimize or evade inheritance taxes.

- Impact on Family Businesses: Inheritance taxes could force heirs to liquidate assets to cover tax liabilities, potentially harming family-owned businesses and leading to job losses.

Comparative Analysis

Below is a comparative analysis of inheritance tax rates in various countries and the lessons India can learn from their implementation.

| Country | Inheritance Tax Rate | Key Features |

|---|---|---|

| Japan | Up to 55% | – Highest inheritance tax rate among OECD countries. – Progressive rate structure, with slabs ranging from 10 million yen to over 600 million yen. |

| USA | Up to 40% | – Estate tax applicable to the worldwide estate of the assessee. – One of the highest top marginal rates among OECD countries. |

| UK | Up to 40% | – Inheritance tax based on the deceased’s domicile status. – High IHT exemption thresholds compared internationally. |

| South Korea | Up to 50% | – High inheritance tax rate, with discussions to potentially increase the upper limit to 60%. |

| France | Up to 45% | – Progressive rates ranging from 5% to 45%, depending on the relationship between the donor and the beneficiary. |

Lessons India Can Learn

- Progressive Taxation: Countries like Japan and France employ a progressive rate structure for inheritance taxes, which could serve as a model for India to ensure that the tax burden is equitably distributed, particularly among the wealthier sections of society.

- High Exemption Thresholds: The UK’s approach of having high exemption thresholds ensures that middle-class families are less likely to be affected by inheritance taxes, a strategy that could be beneficial for India to consider.

- Global Estate Assessment: The USA’s practice of taxing the worldwide estate of the assessee could be a lesson for India, especially in preventing tax evasion through offshore assets.

- Addressing Wealth Concentration: Japan’s high inheritance tax rate is a measure to curb wealth concentration. India, facing similar challenges of wealth inequality, could explore adopting a similar approach, albeit tailored to its economic context.

- Administrative Efficiency: Learning from the administrative challenges faced by countries with inheritance taxes, India could invest in digital and efficient tax administration to minimize compliance costs and enhance tax collection efficiency.

Potential Benefits of Reintroducing Inheritance Tax

- Additional Revenue for Government and Potential Reduction in Other Taxes

- Revenue Generation: Reintroducing inheritance tax could significantly increase government revenue by tapping into large, untaxed estates. This additional income could be substantial, helping to fund public services and reduce the need for other forms of taxation.

- Tax Burden Redistribution: With the increased revenue from inheritance taxes, there could be a potential for lowering other taxes, such as income or sales taxes, which generally have a broader impact on the general population.

- Promotion of Economic Equality and Social Mobility

- Wealth Redistribution: Inheritance tax can serve as a tool for reducing wealth inequality by redistributing wealth from the wealthiest estates to fund public services that benefit the broader society, thus promoting greater economic equality.

- Enhancing Social Mobility: By taxing large inheritances, resources can be reallocated to fund education, healthcare, and other social programs that enhance social mobility for individuals from less privileged backgrounds.

Challenges and Criticisms

- Complexity and Cost of Administration

- Administrative Burden: Implementing and managing an inheritance tax system involves significant administrative complexities. This includes the need for accurate valuation of estates, legal verification processes, and handling disputes, which can be resource-intensive.

- High Costs: The costs associated with administering an inheritance tax may outweigh the benefits, especially if the tax does not generate sufficient revenue relative to its operational expenses.

- Potential Economic Disincentives and Impact on Family-Run Businesses

- Economic Disincentives: There is a concern that inheritance tax could act as a disincentive for savings and investment. Wealthy individuals might divert their investments to countries with more favorable tax regimes.

- Impact on Family Businesses: Inheritance tax could force heirs of family-run businesses to sell parts of their business to pay the tax, potentially leading to job losses and business discontinuity.

- Public Resistance and Political Challenges

- Public Opposition: Inheritance tax often faces strong opposition from the public, particularly among those who view it as an unfair penalty on wealth accumulation and familial legacy.

- Political Hurdles: The reintroduction of inheritance tax can be a politically sensitive issue, with potential backlash affecting the political capital of the parties advocating for it. This makes it a challenging policy to implement, especially in a democratic setup where public opinion plays a crucial role.

Conclusion

The debate over reintroducing inheritance tax in India is multifaceted, balancing potential benefits such as increased government revenue and enhanced social equity against significant challenges like administrative complexity, economic disincentives, and public resistance. While it could play a role in addressing wealth inequality, the practical implications and political feasibility of implementing such a tax make it a contentious issue that requires careful consideration and strategic planning.

Practice Question

Evaluate the potential impacts of reintroducing inheritance tax in India on wealth distribution and economic growth. Discuss the administrative challenges associated with its implementation. (250 words)