Universal Pension Scheme

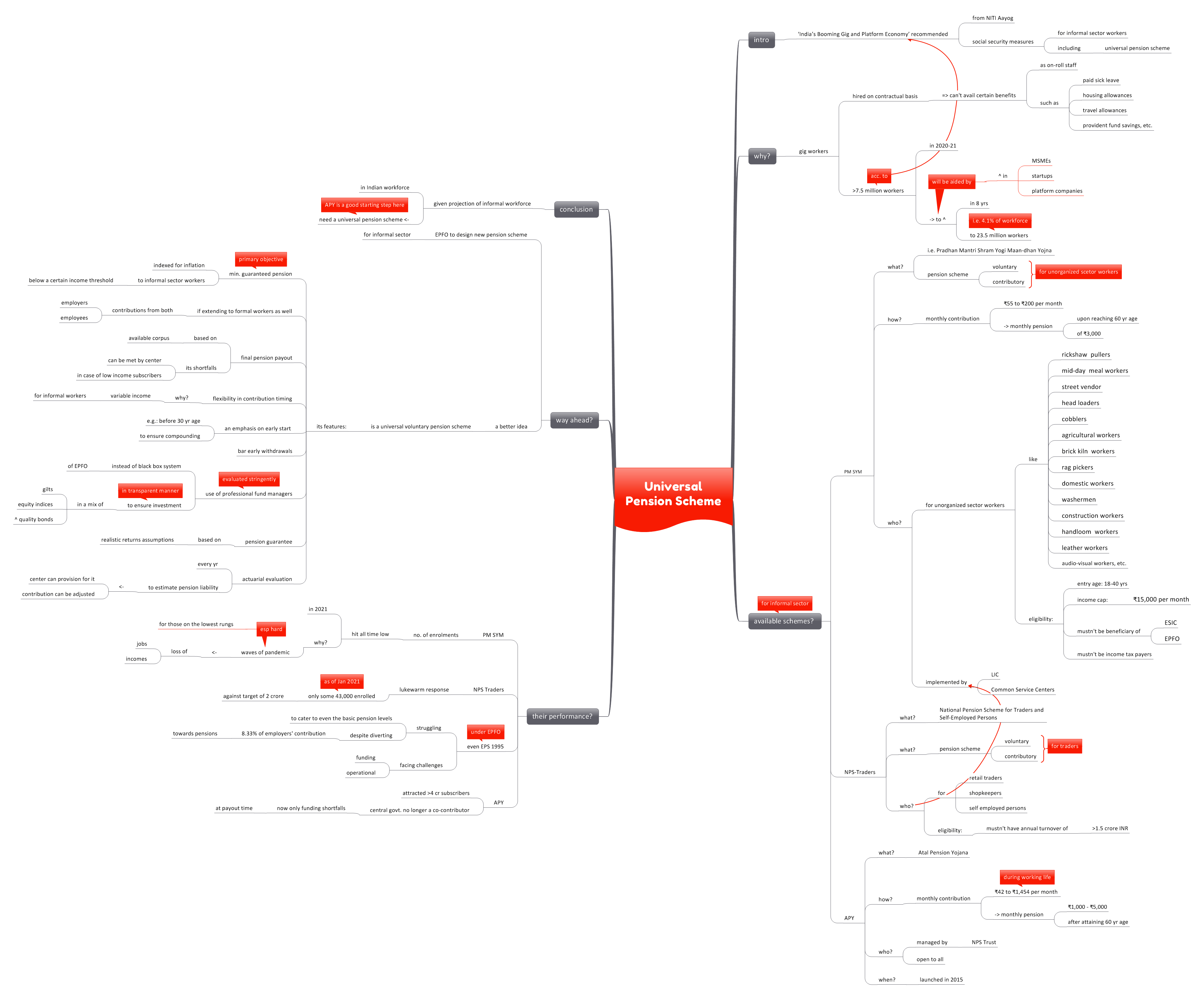

In its recent report, ‘India’s Booming Gig and Platform Economy’, NITI Aayog has recommended several measures to ensure social security of the informal sector workers. These include a universal pension scheme.

This topic of “Universal Pension Scheme” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Why is a universal pension scheme needed?

- Gig workers are hired on a contractual basis and hence, aren’t considered as employees of the company. As a result, they don’t receive the same benefits as on-roll staff– such as, paid sick leaves, housing allowance, travel allowance, provident fund savings, etc.

- In 2020-21, over 7.5 million workers were engaged in the gig economy, according to the recent NITI Aayog report. This could expand to 23.5 million workers in the next 8 years– accounting for 4.1% of the workforce.

- The Indian economy is witnessing an increase in the number of MSMEs, startups and platform companies. This would expand the gig workforce.

What are the currently available scheme for informal sector?

- PM SYM or Pradhan Mantri Shram Yogi Maan-dhan Yojna

- It is a voluntary and contributory pension scheme for unorganized sector workers.

- It is meant for social security of unorganized sector workers in their old age. This covers rickshaw pullers, mid-day meal workers, street vendor, head loaders, cobblers, agricultural workers, brick kiln workers, rag pickers, domestic workers, washermen, construction workers, handloom workers, leather workers, audio-visual workers, etc.

- The entry age is 18 to 40 years and the beneficiary mustn’t be a member of ESIC/EPFO. The beneficiary mustn’t be an income tax payer. There is an income cap of ₹15,000 per month.

- The members contribute between ₹55 and ₹200 per month to receive a monthly pension of ₹3,000 after attaining the age of 60 years.

- The scheme is implemented by LIC and Common Service Centers.

- NPS- Traders or National Pension Scheme for Traders and Self-Employed Persons

- This is also a voluntary and contributory pension scheme, but for retail traders, shopkeepers and self-employed persons.

- The beneficiary mustn’t have an annual turnover of more than 1.5 crore INR.

- This scheme is also implemented by LIC and Common Service Centers.

- APY or Atal Pension Yojana

- This pension scheme was launched in 2015.

- It is managed by NPS Trust.

- It is open to all and requires members to contribute ₹42 to ₹1,454 per month during their working life.

- It provides a pension, after the age of 60 years, between ₹1,000 and ₹5,000 per month.

How well are the schemes performing?

- The number of fresh enrolments in the PM SYM hit all-time lows in 2021. This stagnation in enrolment came amid job and income loss following the pandemic waves. The pandemic hit those at the lowest rungs the hardest.

- The NPS Traders scheme too had a lukewarm response. Against a target of 2 crore, only some 43,000 traders had enrolled themselves for the social security scheme (as of January 2021).

- Meanwhile, even the Employee Pension Scheme 1995, managed by EPFO, has been struggling to cater to even the basic level of pension. Despite diverting 8.33% of employers’ contribution towards pensions, it has been facing challenges in funding and operations.

- On the other hand, the APY has managed to attract over 4 crore subscribers. Initially, the central government was a co-contributor. Recently, it has stuck to funding only the shortfalls at the time of pension payout.

What is the way ahead?

- The EPFO has been tasked with devising a pension scheme specifically for the informal workers.

- However, experts opine that a better option would be to design a universal voluntary pension scheme.

- According to the learnings from the experiences with EPFO, EPS and NPS, such a universal pension scheme should have the following features:

-

- Minimum guaranteed pension, indexed for inflation, should be offered to informal workers below a specific income threshold. This should be the primary objective.

- If it is to be extended to the formal workers as well (instead of EPS), the employers’ contribution must supplement the employees’ contributions.

- Final pension payout should be based on available corpus. The central government can meet the shortfall in the corpus of low-income subscribers.

- The scheme should allow for flexible timing of contribution as the informal workers face the issue of variable income.

- However, an emphasis on early start (for instance, before the age of 30 years) is needed to ensure compounding.

- Early withdrawals must be barred as they could deplete the corpus.

- The scheme must use professional fund managers, instead of the black box structure used by EPFO. This will ensure that the fund is invested in a mix of equity indices, gilts and high quality bonds, for a low fee and in a transparent manner. Notably, the NPS has achieved 10-12% returns from equities and 7-9% from bonds, using this structure.

- Pension guarantee must be based on returns assumptions that are realistic.

- Fund manager performance must be evaluated stringently.

- Actuarial evaluation must be undertaken every year to estimate pension liability. The center can then provision for it or the contributions can be adjusted over time.

Conclusion:

Giving the projections regarding the proportion of informal workers in India’s workforce, it is a good idea to look at the option of a universal pension scheme. The APY can be a good starting point for designing such a scheme.