Pension Sector in India – Issues and Way Forward

India is a welfare state and thus the welfare of its citizens is its foremost priority. The Indian Constitution seeks to ensure social, economic and political justice to its citizens. To do so, the government from time to time has taken several steps. The pension system in India is one such initiative that seeks to ensure social and economic justice to the Indian labour force after the end of their working years. The pension sector in India not only provides financial support to the beneficiaries but also has a major role to play in the overall welfare of Indian society.

This topic of “Pension Sector in India – Issues and Way Forward” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

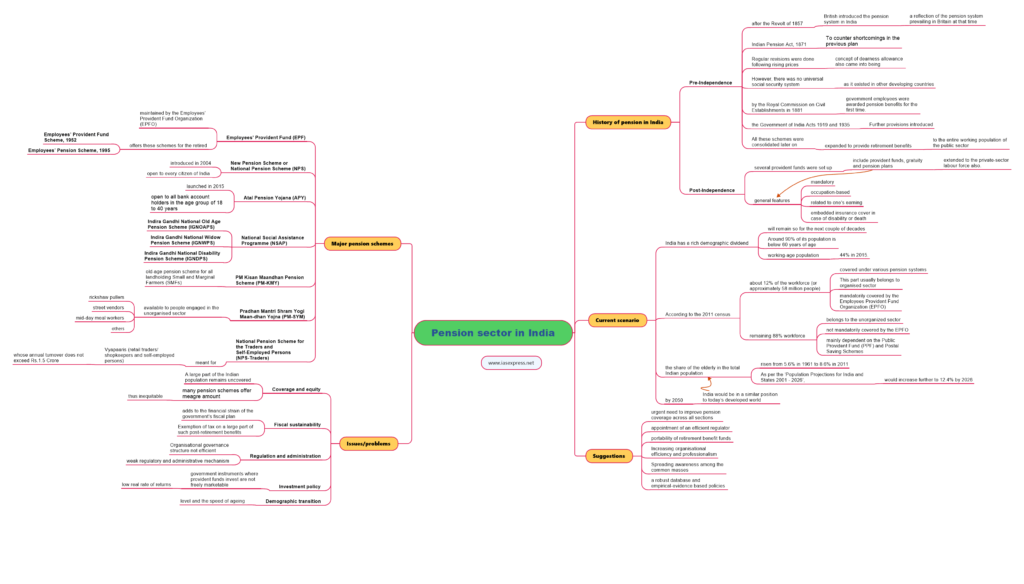

History of pension in India

- Pre-Independence

- It was after the Revolt of 1857 that the British introduced the pension system in India which was more or less a reflection of the pension system prevailing in Britain at that time.

- However, the provisions of the plan discouraged the employees from creating a financial cover for their post-retirement life.

- To counter the shortcomings that were present in the prevailing plan, the British came up with the Indian Pension Act, 1871.

- Regular revisions were done following rising prices and the concept of dearness allowance also came into being to satisfy pensioners.

- However, there was no universal social security system as it existed in other developing countries to protect the elderly or the aged-labour force from economic deprivation.

- It was by the Royal Commission on Civil Establishments in 1881 that the government employees were awarded pension benefits for the first time.

- Further provisions were introduced by the Government of India Acts 1919 and 1935.

- All these schemes were consolidated later on and expanded to provide retirement benefits to the entire working population of the public sector.

- It was after the Revolt of 1857 that the British introduced the pension system in India which was more or less a reflection of the pension system prevailing in Britain at that time.

- Post-Independence

- After independence, several provident funds were set up which extended to the private-sector labour force also.

- These include provident funds, gratuity and pension plans.

- Their general features are:

- They are mandatory.

- They are occupation-based.

- They are related to one’s earning.

- They have embedded insurance cover in case of disability or death.

- After independence, several provident funds were set up which extended to the private-sector labour force also.

Current scenario

- India has a rich demographic dividend, that is, most of its population is under the age of 25 years and will remain so for the next couple of decades.

- Around 90% of its population is below 60 years of age and the working-age population proportion stood at 44% in 2015.

- According to the 2011 census, about 12% of the workforce (or approximately 58 million people) are covered under various pension systems.

- This part of the workforce usually belongs to organized sectors and are employed by the government, government enterprises, public and private sector enterprises, which are mandatorily covered by the Employees Provident Fund Organization (EPFO).

- The remaining 88% workforce mainly belongs to the unorganized sector (self-employed, daily wage workers, farmers etc.) and some to the organized sector, but not mandatorily covered by the EPFO.

- This share of the workforce is mainly dependent on the Public Provident Fund (PPF) and Postal Saving Schemes that have traditionally been the main long-term savings instruments.

- However, these saving instruments have only catered to the pension needs of a relatively small section of this population.

- Estimates say that the share of the elderly in the total Indian population has risen from 5.6% in 1961 to 8.6% in 2011.

- As per the ‘Population Projections for India and States 2001 – 2026’, this would increase further to 12.4% by 2026.

- The projections also say that by 2050, India would be in a similar position to today’s developed world in terms of the share of the elderly in the population.

- Therefore, the governments at various levels have come up with several pension schemes to cater to the needs of a large and diverse population with differing needs and aspirations.

Major pension schemes in India

- Employees’ Provident Fund (EPF)

- Employee Provident Fund (EPF) is a retirement benefit scheme maintained by the Employees’ Provident Fund Organization (EPFO).

- The fund offers the following schemes for the retired. These are:

- Employees’ Provident Fund Scheme, 1952.

- Employees’ Pension Scheme, 1995.

- The employee and the employer contribute to the EPF scheme on monthly basis in equal proportions of 12% of the basic salary and dearness allowance.

- Out of the employer’s contribution, 8.33% is directed towards the Employee Pension Scheme.

- It is a statutory benefit available to the employees post-retirement or when they leave the services.

- New Pension Scheme or National Pension Scheme (NPS)

- It was introduced in 2004.

- It is a retirement benefit scheme introduced by the Government of India to facilitate a regular income post-retirement to all subscribers.

- It is open to every citizen of India whether they are in an organised or unorganised sector. It is also available to self-employed persons.

- The scheme is voluntary in nature.

- However, the scheme has been made mandatory for all new recruits to the services of the central government (except the armed forces) since 2004.

- The scheme is regulated by PFRDA (Pension Fund Regulatory and Development Authority).

- Atal Pension Yojana (APY)

- It was launched in 2015.

- It aims at creating a universal social security system for all Indians, especially the poor, the underprivileged and the workers in the unorganised sector.

- It is open to all bank account holders in the age group of 18 to 40 years.

- APY is administered by Pension Fund Regulatory and Development Authority (PFRDA).

- National Social Assistance Programme (NSAP)

- Under NSAP, numerous pension schemes are there for the elderly, widows and disabled. These are:

- Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

- It was introduced in 1995 as a part of NSAP.

- It aims at expanding the social safety net for the poor.

- It is a non-contributory scheme and provides a monthly income for citizens or to refugees above 60 years, who have no other source of income.

- Under this scheme, BPL persons aged 60 years or above are entitled to a monthly pension ranging from Rs. 600-1000 depending upon the state government’s share of the pension.

- Indira Gandhi National Widow Pension Scheme (IGNWPS)

- The Government of India launched this scheme in February 2009.

- Under this scheme, BPL widows in the age group of 40-64 years are provided with a pension of Rs. 600 per month.

- Indira Gandhi National Disability Pension Scheme (IGNDPS)

- It was also launched in February 2009.

- It provides pension to BPL persons with severe or multiple disabilities between the age group of 18-64 years.

- Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

- Under NSAP, numerous pension schemes are there for the elderly, widows and disabled. These are:

- PM Kisan Maandhan Pension Scheme (PM-KMY)

- It is an old-age pension scheme for all landholding Small and Marginal Farmers (SMFs) in the country.

- It is effective from the 9th of August, 2019.

- It is a voluntary and contributory pension scheme for the entry age group of 18 to 40 years.

- The Life Insurance Corporation of India (LIC) is the Pension Fund Manager and is responsible for pension pay-out.

- Pradhan Mantri Shram Yogi Maan-dhan Yojna (PM-SYM)

- This is a voluntary and contributory pension scheme.

- It is available to people engaged in the unorganised sector such as rickshaw pullers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washermen, home-based, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio-visual workers or in similar other occupations.

- It seeks to provide old-age protection and social security to the above-mentioned occupational groups.

- The entry age for the beneficiary is 18-40 years and he/she should not be a member of ESIC/EPFO or an income taxpayer.

- The scheme is implemented through the Life Insurance Corporation of India (LIC) Common Service Centres.

- The Life Insurance Corporation of India (LIC) is the Fund Manager and is responsible for pension pay-out.

- National Pension Scheme for the Traders and Self-Employed Persons (NPS-Traders)

- This scheme is meant for old age protection and social security of Vyapaaris (retail traders/ shopkeepers and self-employed persons) whose annual turnover does not exceed Rs.1.5 Crore.

- These retail traders / petty shopkeepers and self-employed persons include shop owners, retail traders, rice mill owners, oil mill owners, workshop owners, commission agents, brokers of real estate, owners of small hotels, restaurants and other Vyapaaris.

- The entry age for the scheme is 18-40 years and the beneficiary should not be a member of ESIC/EPFO/PM-SYM or an income taxpayer.

- The scheme is implemented through the Life Insurance Corporation of India (LIC) Common Service Centres.

- The Life Insurance Corporation of India (LIC) is the Fund Manager and is responsible for pension pay-out.

Issues/Problems in the pension sector in India

- Coverage and equity

- A large part of the Indian population remains uncovered under any pension scheme.

- Those who remain uncovered usually belong to the unorganised sector.

- Additionally, those persons who are covered under various pension schemes receive a very meagre amount that is not sufficient for their sustenance.

- Furthermore, the benefits net of contributions and implicit rate of returns vary across programs, occupations, sectors etc. and thus the pension covers, in turn, become inequitable.

- A large part of the Indian population remains uncovered under any pension scheme.

- Fiscal sustainability

- The pension sector adds to the financial strain of the government’s fiscal plan.

- Many studies reveal that the volume of expenses against the payment of pensions is growing at a faster pace than that of the taxes and duties.

- Exemption of tax on a large part of such post-retirement benefits further adds to the fiscal deficit and it is the high-income group that eventually benefits rather than the targetted ones.

- Regulation and administration

- A weak regulatory and administrative mechanism is another serious problem that is reflected in the quality of service in the mandatory schemes, delays in processing and crediting claims and in the issuance of annual statements.

- Organisational governance structure also needs improvement.

- India is going through a phase where higher labour mobility is being noticed across various sectors.

- However, there is a lack of portability in retirement benefit systems across different sectors due to government rules and regulations.

- Investment policy

- The government instruments where provident funds invest are not freely marketable and thus the rate settings are not market-based. This leads to a low real rate of returns.

- Demographic transition

- Although India has the advantage of a high share of the working-age population increasing from 60 per cent of the total population in 2005 to 63.5 per cent of the total population by 2040, the share of the elderly will also rise.

- By 2030, the population over 60 years of age (which is the current retirement age) will approach 200 million.

- The life expectancy at age 60 (16 years for male and 17 years for female in 2001) is expected to rise rapidly, requiring a longer period of retirement support for each elderly.

- The level and the speed of ageing will make India face huge challenges.

Suggestions

- There is an urgent need to improve pension coverage across all sections of the population.

- The appointment of an efficient regulator is important to supervise various activities of different players and develop a healthy and competitive pension market.

- The portability of retirement benefit funds across various sectors will provide a boost further.

- Increasing organisational efficiency and professionalism is also necessary.

- Spreading awareness among the common masses about the need for old age income security and changing social and financial scenarios will also help.

- Finally, a robust database and empirical‐evidence based policies are required to enhance the effectiveness of current policies and to reform them.

Conclusion

The pension sector in India is evolving. The governments at various levels are trying their best to fill the remaining gaps. Various initiatives such as the launching of the New Pension Scheme (NPS) and other occupation-based retirement benefits are a reflection of that. However, the lack of coverage and other regulatory issues are plaguing the sector. It is time that the government takes the issues seriously and come forward with immediate reforms so that the social security net covers the targeted ones.

Practise Question

Q. Is the present pension system in India sufficient enough to cater to the needs of the Indian population in the coming decades? Comment.

- https://crawford.anu.edu.au/acde/asarc/pdf/papers/2007/WP2007_19.pdf

- http://www.actuariesindia.org/downloads/gcadata/5thGCA/Pension%20Sector%20Reforms%20in%20India.pdf

- https://www.epw.in/journal/2006/45/h-t-parekh-finance-column-columns/pension-issue-and-challenges-facing-india.html

- https://www.imf.org/external/pubs/ft/wp/2001/wp01125.pdf

- https://pib.gov.in/PressReleasePage.aspx?PRID=1602068

- https://vikaspedia.in/agriculture/agri-insurance/pm-kisan-maandhan-yojana

- https://www.npscra.nsdl.co.in/scheme-details.php

- https://www.simpliance.in/provident-fund

- https://vikaspedia.in/schemesall/schemes-for-senior-citizens/indira-gandhi-national-old-age-pension-scheme

- https://www.pensionfundsonline.co.uk/content/country-profiles/india

- https://workforce.com/news/the-history-of-retirement-benefits

- https://securenow.in/insuropedia/what-is-the-pension-system-in-india/