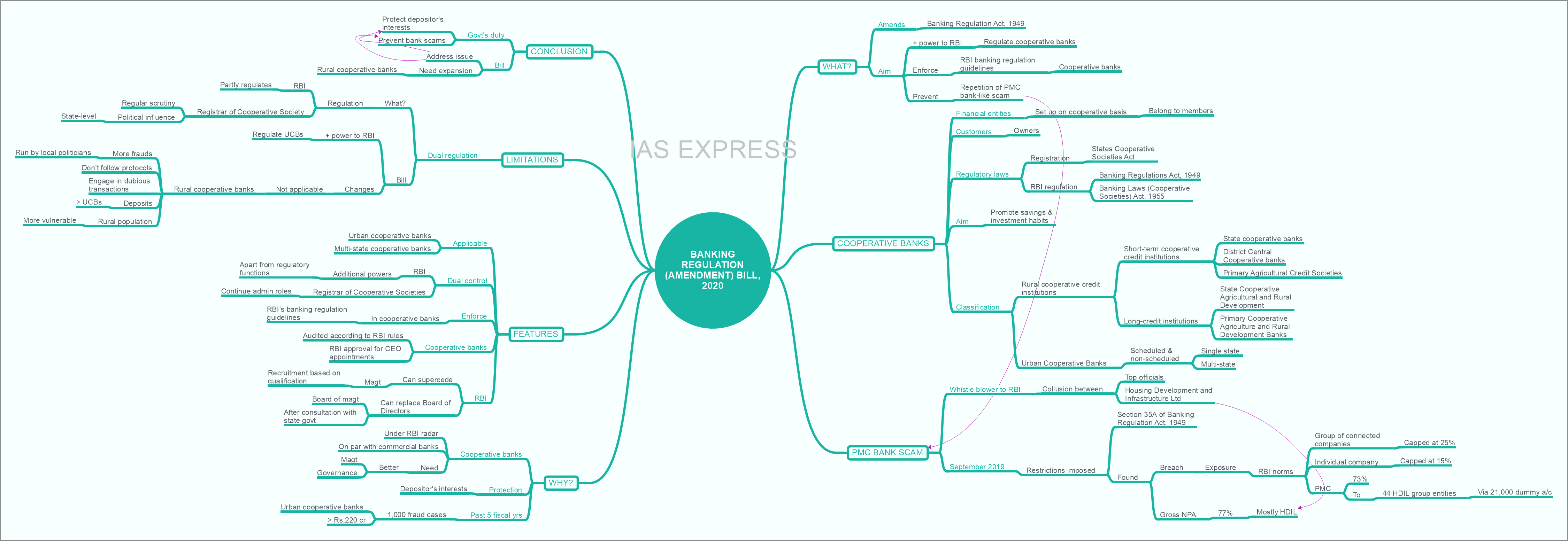

Banking Regulation (Amendment) Bill, 2020 – Need, Features, Limitations

Banking Regulation (Amendment) Bill, 2020 was introduced in Lok Sabha on 3rd March 2020 to improve cooperative banks’ management and regulation so as to protect the interests of the depositors. It also proposed to strengthen the cooperative banks by increasing professionalism, enabling access to capital, improving governance and ensuring sound banking through the RBI. This bill seeks to ensure that PMC-like frauds are not repeated in the future.

This topic of “Banking Regulation (Amendment) Bill, 2020 – Need, Features, Limitations” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is Banking Regulation (Amendment) Bill, 2020?

- The Banking Regulation (Amendment) Bill, 2020 aimed to amend the Banking Regulation Act, 1949.

- This bill seeks to give the Reserve Bank of India (RBI) the powers to regulate the cooperative banks.

- It also looks to enforce banking regulation guidelines of the RBI in cooperative banks, while the Registrar of Cooperative deals with administrative issues.

- This bill comes in response to the PMC bank crisis.

What are cooperative banks?

- Cooperative banks are financial entities set up on a co-operative basis and belonging to their members.

- This means that the customers of a cooperative bank are also its owners.

- They are registered under the States Cooperative Societies Act and they come under the RBI regulation under two laws:

- Banking Regulations Act, 1949

- Banking Laws (Cooperative Societies) Act, 1955

- They aim to promote savings and investment habits among people, especially in rural areas.

- These banks are broadly classified under two categories – Rural and Urban.

- The rural cooperative credit institutions can be further classified into:

- Short-term cooperative credit institutions

- Long-credit institutions

- The short-term credit institutions can further be sub-divided into:

- State cooperative banks

- District Central Cooperative banks

- Primary Agricultural Credit Societies

- Long-term institutions can either be:

- State Cooperative Agricultural and Rural Development Banks (SCARDBs), or

- Primary Cooperative Agriculture and Rural Development Banks (PCARDBs)

- Urban Cooperative Banks (UCBs) can be further classified into scheduled and non-scheduled.

- The scheduled and unscheduled can either be operating in a single state or multi-state.

What is PMC bank scam?

- Punjab and Maharashtra Cooperative Bank (PMC Bank) is facing regulatory actions and investigations over suspected irregularities in certain loan accounts.

- PMC bank scam involves collusion between the bank’s top officials and the Housing Development and Infrastructure Ltd (HDIL).

- This scam was exposed to the RBI by a whistle-blower, leading to the central bank clamping down the bank’s activities.

- In September last year, restrictions were imposed upon the bank under Section 35A of the Banking Regulation Act, 1949.

- Following this clampdown, the RBI found that about 6500 crores worth of loans (73% of bank’s total assets) were given to 44 HDIL group entities.

- After the Central bank’s scrutiny, the percentage of gross NPA had spiked to 77% overnight, most of which belonged to HDIL.

- PMC bank had violated the RBI norms of exposure.

- According to the RBI norms of exposure, bank’s exposure to a group of connected companies is capped at 25% of its core capital, while it is capped at 15% for an individual company.

- In this case, the exposure was 73% i.e., 73% of the total loans advanced were given to the HDIL group.

- To breach the RBI norms of exposure, the bank had created approximately 21,000 dummy accounts. Through these accounts, the bank advanced loans to 44 HDIL group entities.

- Whenever RBI inspects or an auditor looks at bank’s books, they conduct a sample check of about 50 to 100 accounts only.

- The 50 to 100 accounts shown by the PMC bank officials did not contain the undisclosed HDIL accounts.

- Furthermore, these accounts were reported as standard accounts, which did not have defaults.

- Due to these fraudulent activities, the extent of the violation was very low and thus was not exposed earlier.

Why do we need Banking Regulation (Amendment) Bill, 2020?

- The bill aims to bring multi-state cooperative banks under the radar of the RBI and prevent the repetition of a PMC-like crisis.

- It also aims to bring cooperative banks at par with the commercial banks.

- The changes proposed by this Bill are necessary to protect the interests of depositor

- Currently, there are 1,540 cooperative banks in India, with about 8.60 depositors having savings worth approximately Rs.5 lakh crore.

- In the past five fiscal years, there were nearly 1,000 fraud cases among urban cooperative banks worth more than Rs.220 crore.

- The PMC bank scam had prompted the need for improved laws that can ensure better management and governance of these banks.

What are the salient features of the Banking Regulation (Amendment) Bill, 2020?

- The recent amendments apply only to multi-state cooperative banks and urban cooperative banks.

- The Cooperative banks are currently under the dual control of both the RBI and the Registrar of Cooperative Societies.

- If this amendment bill is enforced, the RBI will have additional powers apart from regulatory functions. However, the Registrar of Cooperative Societies will continue to deal with the administrative issues of these banks.

- This bill aims to enforce RBI’s banking regulation guidelines in cooperative banks.

- These banks will be audited according to the RBI rules.

- The bill mandates RBI’s approval for CEO appointments, similar to that of commercial banks.

- The apex bank can supersede management in case of liquidation or failure of a cooperative bank. Recruitment will be based on certain qualifications.

- The central bank can also replace the Board of Directors with a Board of management consisting of professionals if any cooperative banks are facing stress. This is done after consultation with the state government.

- This is to increase professionalism and ensure improvement in cooperative governance.

What are the limitations of this Bill?

- According to this Bill, larger cooperative banks will now be regulated like commercial banks.

- This proposed amendment gives the RBI more power to audit urban cooperative banks, appoint CEOs etc.

- This bill significantly addresses the problem of dual regulation between the RBI and Registrar of Cooperative Society (RCS).

- Under the dual regulation system, RBI only partly regulates these banks as these entities also come under the government’s purview.

- For instance, when it comes to taking stocks of the operations, the RCS is the primary authority on behalf of the government.

- Usually, an IAS officer on the verge of retirement takes charge as RCS. The RCS is in charge of conducting regular scrutiny of these banks and compiling the numbers.

- However, the political influence at the state-level dominates the running of these banks and the RCSs are either powerless or part of the corruption.

- This system has worsened the situation of cooperative banks.

- This proposed Bill provides additional power to the Reserve Bank of India in regulating the UCBs.

- While this will help improve the UCBs, the rural cooperative banks are not part of this regulatory overhaul.

- It should be noted that the issue of misgovernance and fraud is more in smaller cooperative banks since they are largely run by local politicians.

- More often than not, these banks do not follow protocol and engage in dubious transactions.

- According to the RBI data, the combined deposits of the rural cooperative banks are higher than those of UCBs.

- Furthermore, the rural population is more dependent on these financial institutions than the urban populations.

- Thus, the government must provide sufficient power to the RBI to govern rural cooperative banks while also ensuring stricter inspection and governance.

Conclusion:

It is the government’s duty to protect depositors’ interests and prevent fraud and corruption within banks. This bill seeks to provide the same. The government must take steps in expanding Bill’s ambit to rural cooperative banks to improve the rural economy’s growth and development

Practice Question for Mains:

Critically examine how the Banking Regulation (Amendment) Bill, 2020 seeks to protect depositors’ interests. What are the measures that can be taken to further improve the cooperative banks in India? (250 words)

Will it now help to recover money invested in co-op banks which are out of operation already ?