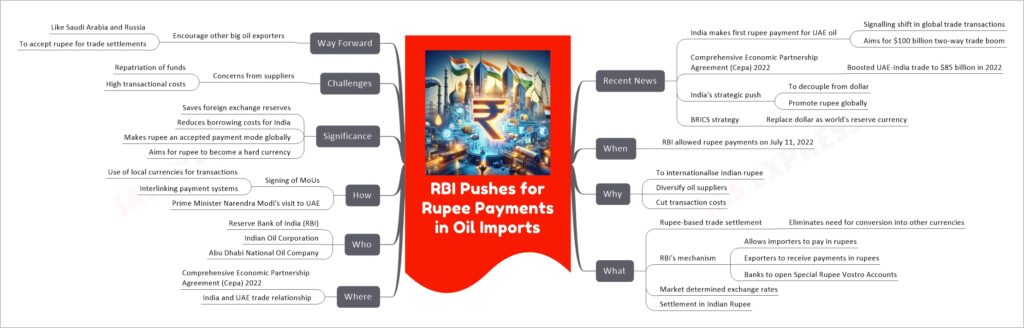

RBI Pushes for Rupee Payments in Oil Imports

The Reserve Bank of India (RBI) has made a significant move towards internationalizing the Indian Rupee by allowing rupee payments for oil imports, particularly marking its first-ever rupee payment for crude oil purchased from the UAE. This step signals a potential shift in global trade transactions, traditionally dominated by the dollar, and is aimed at bolstering the booming trade between India and the UAE, with aspirations to surpass the $100 billion mark. The RBI’s initiative is part of a broader strategy, aligned with the BRICS’ objectives, to promote the rupee on a global scale and diversify oil suppliers to reduce transaction costs and dependency on the dollar. This move is supported by the establishment of Special Rupee Vostro Accounts for facilitating trade transactions and is seen as a step towards reducing foreign exchange costs, making the rupee a globally accepted mode of payment, and potentially positioning it as a hard currency. However, this initiative faces challenges, including concerns from suppliers about fund repatriation and transaction costs.