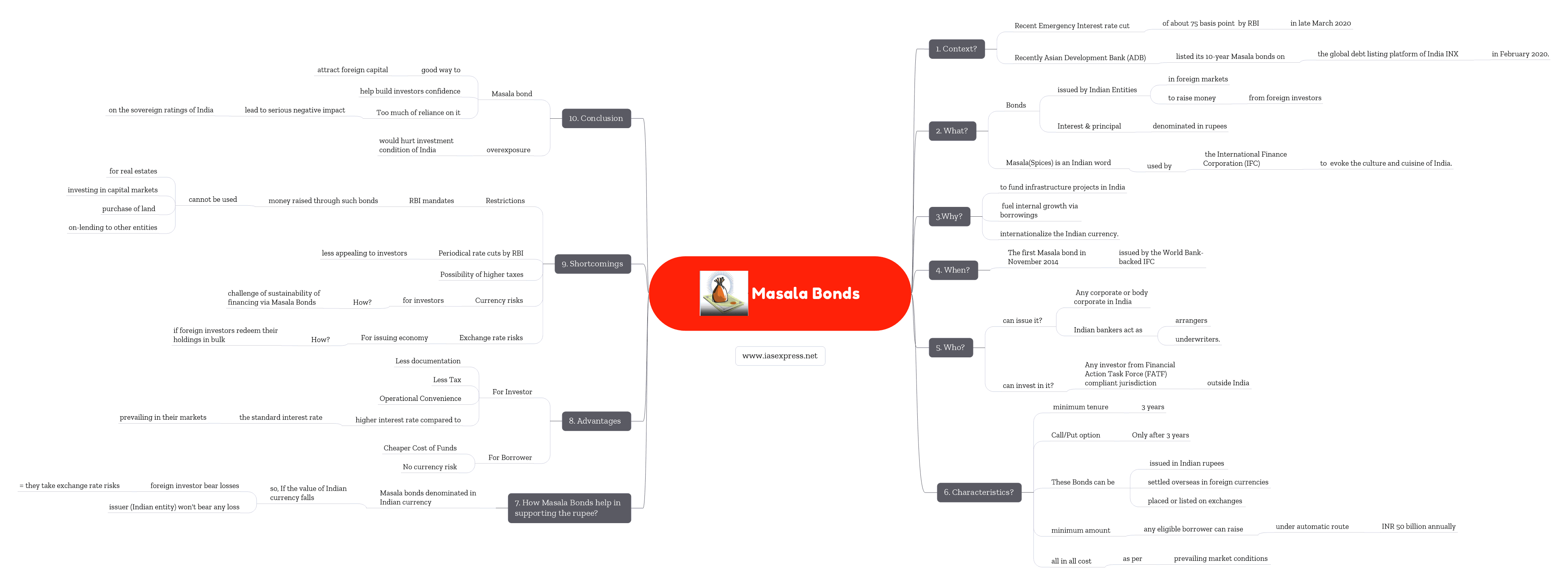

Masala Bonds: Advantages & Disadvantages

Context

India is on the lookout for capital to fund its infrastructure projects and has even invited Russia to invest in masala bonds as a first step.

What are Masala Bonds?

- A Masala Bond is a debt instrument issued by an Indian entity in foreign markets to raise money and the interest payments and principal reimbursements from it are denominated (expressed) in rupees rather than dollars or local currency.

- Masala means spices in India and it is the International Finance Corporation(IFC) used the term to symbolize the culture and cuisine of India.

- The main difference associated with the Masala bond is that it makes the investor to bear the currency risk not the borrower as opposite to the dollar bonds.

- It was the World Bank– backed IFC issued the first Masala bond in November 2014 to fund infrastructure projects in India.

- On September 29, 2015, RBI allowed Indian corporate to raise money through the issuance of rupee bonds (also called Masala bonds) outside India.

- The framework for issuance of rupee bonds overseas falls within the External Commercial Borrowings (ECB)

- The major objectives of Masala Bonds are to fund infrastructure projects, ignite internal growth (via borrowings) and internationalize the Indian rupee.

- An Indian company is protected from the risk of currency fluctuation by issuing bonds in Indian rupees, usually associated with borrowing in foreign currency, and the cost of borrowing can also be reduced than domestic markets.

What are its characteristics?

- The minimum tenure on these bonds is 3 years.

- Call/Put option if any will be available only after 3 years. (From a buyer’s perspective a bond call option is a contract that gives the bondholder the right to buy a debt instrument by a particular date for a predetermined price. A put option on a bond is a provision that allows the holder of the debt instrument the right to force the issuer to pay back the principal on the bond.)

- Bonds are issued in Indian rupees and can be settled overseas in foreign currencies.

- Bonds can either be placed or listed on exchanges as per the host country’s regulations.

- The minimum amount that any eligible borrower can raise through issuance of these bonds under automatic route is INR 50 billion or its equivalent during a financial year. This limit is over and above the amount permitted to be raised under automatic route by an entity eligible to raise External Commercial Borrowings (ECB).

- All in all cost of such borrowings would be as per prevailing market conditions and comparable with the cost at which the borrowing company is able to raise money in India..

Who can issue Masala Bonds?

- Any corporate or body corporate in India can use this mode of raising money.

- Indian bankers act as arrangers and underwriters.

Who can invest in Masala Bonds?

- Any investor from Financial Action Task Force (FATF) compliant jurisdiction outside India can purchase these bonds.

- Foreign investors who want to invest in Indian assets and are restricted or constrained from doing it directly in the Indian market or prefer to do so from their own locations.

Where can the proceeds from Masala bonds be used?

- The proceeds from the Masala bond can’t be used for real estate activities or capital market investment.

- However, the proceeds from these bonds can be utilized for the development of an integrated township/affordable housing project or any other infrastructural development project.

How Masala Bonds help in supporting the rupee?

- The investors will directly take the currency risk or exchange rate risks as the bonds are directly pegged to the Indian currency.

- When the value of Indian currency falls, the foreign investor will have to bear the losses, not the issuer (Indian entity or a corporate).

- It can help in the diversification of funding sources.

- The costs of borrowing via Masala bonds will be lower than from the domestic markets.

Why the Masala bonds are attractive for foreign investors?

- The rupee-denominated bonds (Masala bond) are attractive for a foreign investor as it will give him a higher return (interest rate) compared to the standard interest rate existing in their markets.

- An interest rate of 2 to 3% higher compared to the

London Interbank Offer Rate (LIBOR). - It will stimulate foreign investors to deal more in Indian rupees hence internationalization of Indian rupees can be promoted by Masala bonds.

Advantages

What are the shortcomings?

- Restrictions: The money raised through such bonds cannot be used for real estate activities other than for the development of integrated township or affordable housing projects as per RBI mandates. It also can’t be used for investing in capital markets, purchase of land, and on-lending to other entities for such activities like real estate activities other than as mentioned in the beginning. These restrictions may dilute the core objective of Masala bonds.

- Periodical rate cuts by RBI have made Masala Bonds less appealing to investors.

- The possibility of higher taxes also has undermined the utility of the instrument.

- Investors are expected to be cautious in taking on currency risks from emerging markets as the sustainability of financing via Masala Bonds is a challenge (As per Moody’s)

Conclusion

- Masala bond is a good way to attract foreign capital keeping in mind India’s dream to be a global power and its ambitious goals like developing smart cities, digital India, Make in India and the fund needed. India needs to find ways and means to attract foreign investors and capital for this.

- As Masala Bonds deals with the Capital account of the Balance of Payment, it will help in building investors confidence and also benefit Government, which has undertaken vision 2024 as its mission, so these bonds may gain more exposure in the near future.

- However, too much reliance on external debt aided by the issuance of Masala Bonds apart from the traditional ECBs can lead to a serious negative impact on the sovereign ratings of India, and thereby creating a problem in attracting investments to India.

- So overdependence on the rupee-denominated bonds (Masala bond) would hurt the investment condition of India.

Mains Practice Question

What are Masala Bonds? How can Masala bonds help in infrastructure development? (250 Words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Maximum limit is INR 50 Billion