Economic Crisis in Sri Lanka – Causes and Consequences

Sri Lanka, being considered as one of the well-known South Asian nations to have better socio-economic indicators than its neighbouring counterparts and having the status of an upper-middle-income nation is facing its worst-ever economic crisis, with electricity blackouts and shortage of essential goods being normal affairs nowadays. The nation is going through a severe foreign exchange crisis leading to a rise in petroleum prices and inflation. Many Sri Lankan nationals are also fleeing to other countries to escape the crisis.

This topic of “Economic Crisis in Sri Lanka – Causes and Consequences” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

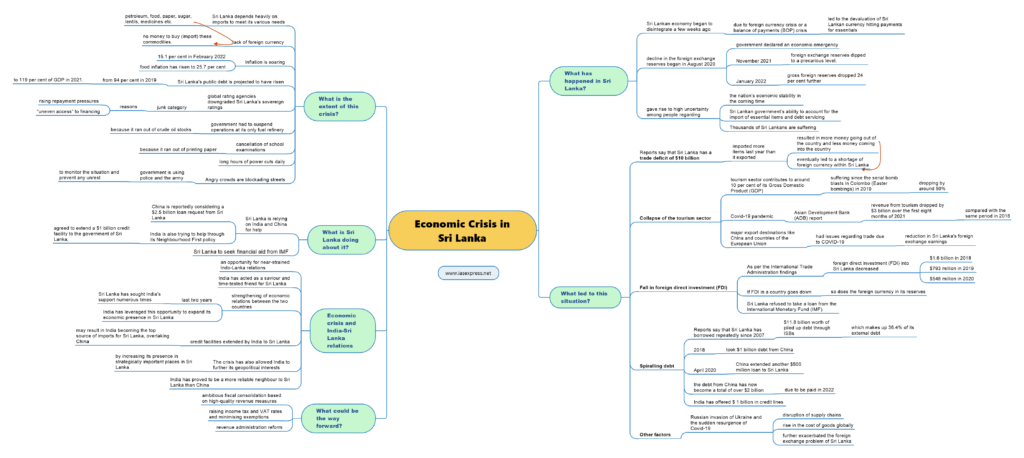

What has happened in Sri Lanka?

- Sri Lankan economy began to disintegrate a few weeks ago when the country began to face the issue of the foreign currency crisis or a balance of payments (BOP) crisis that led to the devaluation of Sri Lankan currency hitting payments for essentials.

- The decline in the foreign exchange reserves began in August 2020 leading to the government declaring an economic emergency but in November 2021, the foreign exchange reserves dipped to a precarious level. Reportedly, the gross foreign reserves dropped 24 per cent further in January 2022 to US$ 2.3 billion.

- This gave rise to high uncertainty among people regarding the nation’s economic stability in the coming time and the Sri Lankan government’s ability to account for the import of essential items and debt servicing.

- Thousands of Sri Lankans are suffering in this crisis with petroleum prices going up and a shortage of essential items. At some places, food or fuel is either unavailable or exorbitantly priced. The crisis is wreaking havoc on people and disrupting their lives in several ways.

What is the extent of this crisis?

- Sri Lanka depends heavily on imports to meet its various needs such as petroleum, food, paper, sugar, lentils, medicines, and transportation equipment, among other essential items.

- A lack of foreign currency means the country does not have the money to buy (import) these commodities.

- Inflation is soaring, hitting 15.1 per cent in February 2022. Government data shows that food inflation has risen to 25.7 per cent.

- Sri Lanka’s public debt is projected to have risen from 94 per cent in 2019 to 119 per cent of GDP in 2021.

- Amidst the balance of payments (BOP) crisis, global rating agencies such as Moody’s, S&P and Fitch have all downgraded Sri Lanka’s sovereign ratings.

- Many rating agencies downgraded Sri Lanka’s sovereign ratings to the junk category citing rising repayment pressures and “uneven access” to financing as reasons.

- The situation is so critical that the government had to suspend operations at its only fuel refinery because it ran out of crude oil stocks.

- The crisis has resulted in the cancellation of school examinations because it ran out of printing paper.

- People are also facing long hours of power cuts daily.

- Angry crowds are blockading streets. The government is using police and the army to monitor the situation and prevent any unrest.

What led to this situation?

- The acute economic and energy crisis has been triggered due to a shortage of foreign exchange. However, the question that remains is what led to this forex crisis in Sri Lanka.

- Reports say that the country has a trade deficit of $10 billion. It means that the country imported more items last year than it exported which resulted in more money going out of the country and less money coming into the country. This eventually led to a shortage of foreign currency within Sri Lanka.

- Collapse of the tourism sector

- Sri Lanka relies heavily on tourism revenues which contribute to around 10 per cent of its Gross Domestic Product (GDP).

- The tourism sector has been suffering since the serial bomb blasts in Colombo (Easter bombings) in 2019 dropping by around 50%.

- The Covid-19 pandemic made it worse. According to the Asian Development Bank (ADB) report, revenue from tourism dropped by $3 billion over the first eight months of 2021, compared with the same period in 2018.

- Even its major export destinations like China and countries of the European Union had issues regarding trade due to COVID-19 resulting in a reduction in Sri Lanka’s foreign exchange earnings.

- Fall in foreign direct investment (FDI)

- As per the International Trade Administration findings, foreign direct investment (FDI) into Sri Lanka decreased to $548 million in 2020, compared to $793 million in 2019 and $1.6 billion in 2018.

- If the FDI in a country goes down, so does the foreign currency in its reserves.

- Additionally, Sri Lanka refused to take a loan from the International Monetary Fund (IMF).

- Spiralling debt

- Reports say that Sri Lanka has borrowed repeatedly since 2007 leading to $11.8 billion worth of piled up debt through ISBs which makes up 36.4% of its external debt.

- The debt issue did not begin in 2020. Since the end of the ethnic war in 2009, Sri Lanka was struggling to keep its economy afloat.

- The nation started taking up loans and issuing bonds to keep its foreign exchange reserves intact.

- In 2018, it took debt worth $1 billion from China. It also leased its Hambantota port to China which helped it to boost foreign currency reserves and bridge its fiscal deficit.

- In April 2020, China extended another $500 million loan to Sri Lanka and has become the largest bilateral lender and FDI provider to Sri Lanka. However, the debt has now become a total of over $2 billion and is due to be paid in 2022.

- India has offered $ 1 billion in credit lines to supply essential commodities for procurement of food, medicine and other essential items.

- In February, Sri Lanka signed a $500 million credit line with India to import fuel.

- Other factors

- The Russian invasion of Ukraine and the sudden resurgence of Covid-19 cases in China have further exacerbated the foreign exchange problem of Sri Lanka since they have resulted in the disruption of supply chains and a rise in the cost of goods globally.

What is Sri Lanka doing about it?

- Sri Lanka is relying on India and China for help.

- China is reportedly considering a $2.5 billion loan request from Sri Lanka.

- Similarly, India is also trying to help the island nation through its Neighbourhood First Policy by agreeing to extend a $1 billion credit facility to the government of Sri Lanka, which will ensure that the latter can procure food, medicines and other essential commodities for the people.

- Although Sri Lanka was resistant to taking loans from IMF initially, it has now agreed to finally seek aid from it.

Economic crisis and India-Sri Lanka relations

- The crisis has proved to be an opportunity for near-strained Indo-Lanka relations since China was occupying more space in Sri Lanka’s foreign policy priorities.

- China was not the only country from which Sri Lanka sought support. India has also acted as a saviour and time-tested friend for Sri Lanka.

- The crisis has resulted in the strengthening of economic relations between the two countries.

- Over the last two years, Sri Lanka has sought India’s support numerous times.

- India too has leveraged this opportunity to expand its economic presence in Sri Lanka in light of an increasing Chinese economic presence in India’s close neighbour.

- The credit facilities extended by India to Sri Lanka would certainly result in India becoming the top source of imports for Sri Lanka, overtaking China.

- The crisis has also allowed India to further its geopolitical interests by increasing its presence in strategically important places in Sri Lanka.

- In totality, India has proved to be a more reliable neighbour to Sri Lanka than China.

What could be the way forward?

Experts opine that Sri Lanka’s forex reserves have reached bottom-low and it faces mounting challenges in the form of rising unsustainable public debts, low international reserves and the need for large financing in coming years. Thus, there is a need for ambitious fiscal consolidation based on high-quality revenue measures, raising income tax and VAT rates and minimising exemptions, complemented with revenue administration reform. Overall, the nation requires immediate economic reforms to have stable economic health in the long run.

Practice Question

Q. Discuss the regional and global ramifications of the economic crisis in Sri Lanka.

- https://www.outlookindia.com/international/what-led-to-sri-lanka-s-worst-economic-crisis-in-recent-history-what-is-the-way-forward–news-188139

- https://www.ndtv.com/world-news/sri-lanka-crisis-india-helps-china-holds-back-full-transcript-2843194

- https://thediplomat.com/2022/03/china-india-and-sri-lankas-unprecedented-economic-crisis/

- https://www.nytimes.com/2022/03/25/world/asia/sri-lanka-economic-crisis.html

- https://www.thequint.com/explainers/explained-sri-lanka-foreign-currency-crisis-economy#read-more

- https://www.cnbc.com/2022/03/04/sri-lankas-economy-inflation-and-debt-burden-worsen-economic-crisis.html

- https://www.financialexpress.com/economy/sri-lankas-economic-crisis-how-skyrocketing-food-fuel-prices-in-colombo-is-forcing-citizens-to-flee/2470891/