Asian Infrastructure Investment Bank (AIIB) – Objectives, Achievements and Criticism

Recently, Pakistan received US$500 million from AIIB as co-financing for the BRACE (Building Resilience with Active Countercyclical Expenditures Program). The program aims at countering the social fallouts of the economic crisis. The move comes when Pakistan is struggling with its foreign exchange reserves and AIIB’s assistance shows how it is working on its goals of ensuring prosperity and economic development in Asia to contribute to local, regional and global sustainability.

This topic of “Asian Infrastructure Investment Bank (AIIB) – Objectives, Achievements and Criticism” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

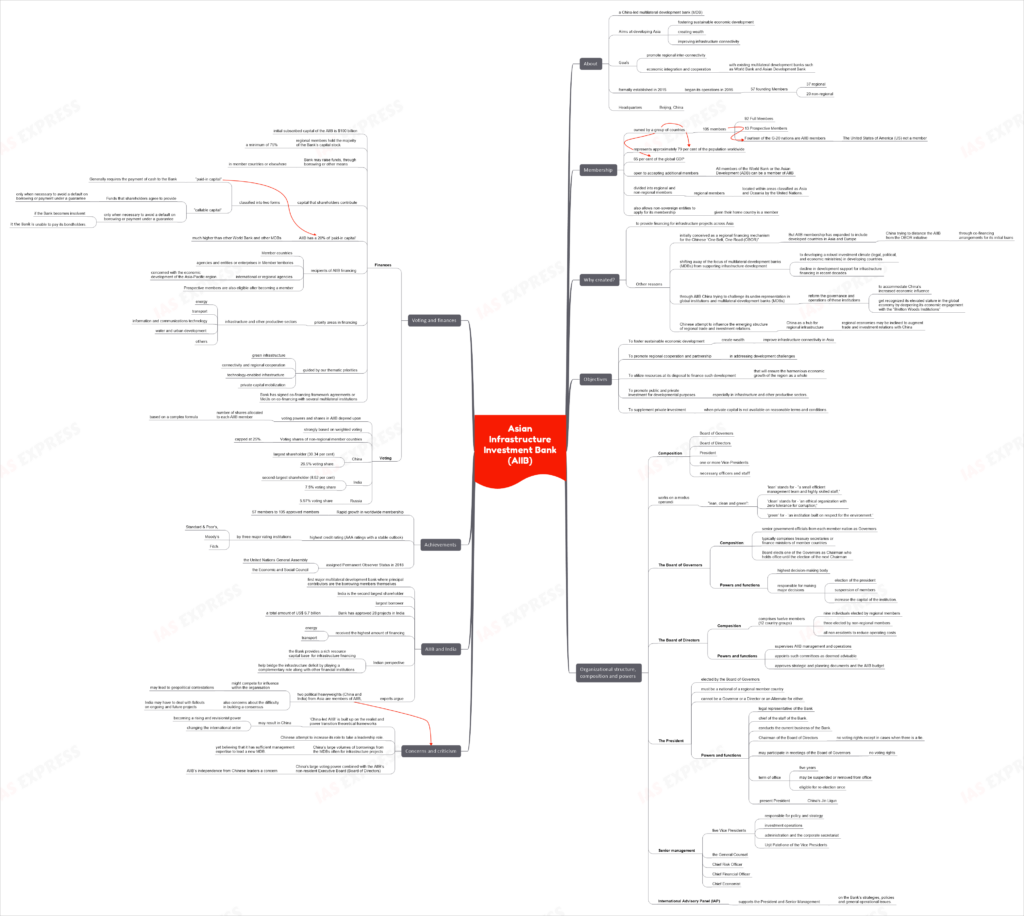

About

- Asian Infrastructure Investment Bank (AIIB) is a China-led multilateral development bank (MDB) aimed at developing Asia, fostering sustainable economic development, creating wealth and improving infrastructure connectivity.

- The goal is to promote regional interconnectivity, economic integration and cooperation with existing multilateral development banks such as World Bank and the Asian Development Bank (ADB).

- It was formally established in 2015 and began its operations in 2016 with 57 founding Members (37 regional and 20 non-regional).

- It is headquartered in Beijing, China.

Membership

- AIIB is owned by a group of countries. It has 105 members (92 Full Members and 13 Prospective Members) representing approximately 79 per cent of the population worldwide and 65 per cent of the global GDP.

- It is also open to accepting additional members. All members of the World Bank or the Asian Development (ADB) can be a member of AIIB.

- Fourteen of the G-20 nations are AIIB members.

- The United States of America (US) is not a member of the Bank.

- It is divided into regional and non-regional members.

- Regional members are those located within areas classified as Asia and Oceania by the United Nations.

- It also allows non-sovereign entities to apply for its membership given their home country is a member i.e., sovereign wealth funds or state-owned enterprises of member countries could potentially join the Bank.

Why was it created?

The AIIB was established to provide financing for infrastructure projects across Asia. However, there are some other reasons as well that led to its development. Some of them are mentioned below:

- AIIB was initially conceived as a regional financing mechanism for the Chinese “One Belt, One Road (OBOR)” initiative which aims at boosting economic connectivity (trade promotion, infrastructure development, and regional connectivity) from China to Central and South Asia, the Middle East and Europe (the Silk Road Economic Belt) and, along a maritime route, from Southeast Asia to the Middle East, Africa, and Europe (the 21st Century Maritime Silk Road).

- However, as AIIB membership has expanded to include developed countries in Asia and Europe, China has since tried to distance the AIIB from the OBOR initiative through co-financing arrangements for its initial loans.

- Secondly, the shifting away of the focus of multilateral development banks (MDBs) from supporting infrastructure development, especially heavy and basic infrastructure lending to developing a robust investment climate (legal, political, and economic ministries) in developing countries and the decline in development support for infrastructure financing in recent decades is another reason why AIIB was created.

- Thirdly, through AIIB China may have been trying to challenge its under-representation in global institutions and multilateral development banks (MDBs) and reform the governance and operations of these institutions to accommodate China’s increased economic influence and get recognized its elevated stature in the global economy by deepening its economic engagement with the “Bretton Woods Institutions” —the World Bank, International Monetary Fund (IMF) and the regional development banks.

- Lastly, AIIB may be a Chinese attempt to influence the emerging structure of regional trade and investment relations.

- It may also reinforce a regional infrastructure that has China as its hub which may in turn result in regional economies being inclined to augment trade and investment relations with China rather than with other economies.

Objectives

- To foster sustainable economic development, create wealth and improve infrastructure connectivity in Asia by investing in infrastructure and other productive sectors.

- To promote regional cooperation and partnership in addressing development challenges by working in close collaboration with other multilateral and bilateral development institutions.

- To utilize resources at its disposal to finance such development that will ensure the harmonious economic growth of the region as a whole, particularly of the less developed members in the region.

- To promote public and private investment for developmental purposes, especially in infrastructure and other productive sectors.

- To supplement private investment when private capital is not available on reasonable terms and conditions.

Organisational structure, composition and powers

- The Bank has a Board of Governors, a Board of Directors, a President, one or more Vice-Presidents, and such other officers and staff as may be considered necessary.

- It works on a modus operandi of “lean, clean and green”: Here ‘lean’ stands for – “a small efficient management team and highly skilled staff,’ ‘clean’ stands for – ‘an ethical organization with zero tolerance for corruption;’ and ‘green’ for – ‘an institution built on respect for the environment.’

- The Board of Governors

- Composition: It consists of senior government officials from each member nation as Governors. It typically comprises treasury secretaries or finance ministers of member countries.

- At each annual meeting, the Board elects one of the Governors as Chairman who holds office until the election of the next Chairman.

- Powers and functions: It is the highest decision-making body and is responsible for making major decisions involving such as changes in AIIB membership, the election of the president, suspension of members and whether to increase the capital of the institution.

- Composition: It consists of senior government officials from each member nation as Governors. It typically comprises treasury secretaries or finance ministers of member countries.

- The Board of Directors

- Composition: It comprises twelve members (12 country groups) in total, nine individuals elected by regional members and three elected by non-regional members. They are all non-residents to reduce operating costs.

- Powers and function: It supervises AIIB management and operations, appoints such committees as deemed advisable, and approves strategic and planning documents and the AIIB budget.

- The President

- He/she is elected by the Board of Governors, through an open, transparent and merit-based process.

- He must be a national of a regional member country.

- The President, while holding office, cannot be a Governor or a Director or an Alternate for either.

- Powers and functions:

- The President acts as the legal representative of the Bank and is chief of the staff of the Bank.

- Under the direction of the Board of Directors, he/she conducts the current business of the Bank.

- The President is the Chairman of the Board of Directors but has no voting rights except in cases when there is a tie.

- He/she may participate in meetings of the Board of Governors but cannot vote.

- The term of office for the President is five years and he may be suspended or removed from office when the Board of Governors takes such a decision. He/she is eligible for re-election once.

- Senior management

- The President is supported by the Senior Management of AIIB.

- It includes five Vice Presidents responsible for policy and strategy, investment operations, administration and the corporate secretariat and the General Counsel, Chief Risk Officer, Chief Financial Officer and Chief Economist.

- China’s Jin Liqun is the present President of AIIB and India’s Former Reserve Bank of India (RBI) Governor Urjit Patel is a Vice President of the bank.

- International Advisory Panel (IAP)

- The Bank also consists of an International Advisory Panel (IAP) that supports the President and Senior Management on the Bank’s strategies, policies and general operational issues.

Voting and finances

- Finances

- The initial subscribed capital of the AIIB is $100 billion. Its regional members hold the majority of the Bank’s capital stock, i.e., a minimum of 75%, except as otherwise agreed by the Board of Governors.

- The Bank may raise funds, through borrowing or other means, in member countries or elsewhere, following the relevant legal provisions.

- The capital that shareholders contribute to the AIIB is classified into two forms: “paid-in capital” and “callable capital”.

- Paid-in capital – Generally requires the payment of cash to the Bank.

- Callable capital – Funds that shareholders agree to provide, but only when necessary to avoid a default on borrowing or payment under a guarantee. It cannot be used to finance loans, but only to pay off bondholders if the Bank becomes insolvent and is unable to pay its bondholders.

- AIIB has a 20% of ‘paid-in capital’ which is a much higher share of paid-in capital than the World Bank and other MDBs.

- The recipients of AIIB financing may include Member countries (or agencies and entities or enterprises in Member territories), as well as international or regional agencies concerned with the economic development of the Asia-Pacific region.

- Prospective members are also eligible for financing after they become a member.

- AIIB priority areas in the financing include infrastructure and other productive sectors. Areas of some particular interest are energy, transport, information and communications technology, water and urban development though not limited to these only.

- AIIB financing decisions are guided by our thematic priorities. These are green infrastructure, connectivity and regional cooperation, technology-enabled infrastructure and private capital mobilization.

- The Bank has signed co-financing framework agreements or MoUs on co-financing with several multilateral institutions, including the World Bank, the African Development Fund, the Asian Development Bank, the Eurasian Development Bank, and the European Bank for Reconstruction and Development.

- Voting

- The voting powers and shares in AIIB depend upon the number of shares allocated to each AIIB member which is based on a complex formula that takes into account the size of the economy and whether they are a regional or non-regional member.

- It is strongly based on weighted voting.

- Voting shares of non-regional member countries are capped at 25%.

- China is the largest shareholder (30.34 per cent) of the AIIB with a 26.5% voting share. India is the second-largest shareholder (8.52%), with a 7.5% voting share, followed by Russia, which has a 5.97% voting share.

- The voting powers and shares in AIIB depend upon the number of shares allocated to each AIIB member which is based on a complex formula that takes into account the size of the economy and whether they are a regional or non-regional member.

Achievements

- Rapid growth in worldwide membership. It began with 57 members and now it has 105 approved members.

- The highest credit rating (AAA ratings with a stable outlook) has been assigned to AIIB by three major rating institutions – Standard & Poor’s, Moody’s and Fitch.

- It has been assigned Permanent Observer Status in the United Nations General Assembly and the Economic and Social Council, the two development-focused principal organs of the global body in 2018.

AIIB and India

- AIIB is the first major multilateral development bank where principal contributors are the borrowing members themselves.

- India is the second largest shareholder but is the largest borrower of Asian Infrastructure Investment Bank (AIIB) lending since the time the Bank started its operations.

- The Bank has approved 28 projects in India, with a total amount of US$ 6.7 billion.

- The energy and transport sectors have received the highest amount of AIIB financing.

- From the Indian perspective, the Bank provides a rich resource capital base for infrastructure financing, which is good for development in Asia.

- AIIB will also help bridge the infrastructure deficit by playing a complementary role along with other financial institutions like ADB and IMF and working for good governance.

- However, some experts argue that when two political heavyweights (China and India) from Asia are members of AIIB, they might compete for influence within the organisation and it may lead to geopolitical contestations.

- There are also concerns about the difficulty in building a consensus for which India may have to deal with fallouts on ongoing and future projects.

Concerns and criticism

- Many critics argue that ‘China-led AIIB’ is built up on the realist and power transition theoretical frameworks that may result in China becoming a rising and revisionist power and changing the international order.

- Another argument is that AIIB is an attempt by China to increase its role to take a leadership role.

- Critics also question China’s large volumes of borrowings from the MDBs, often for infrastructure projects, yet its belief that it has sufficient management expertise to lead a new MDB.

- There are concerns regarding China’s large voting power combined with the AIIB’s non-resident Executive Board (Board of Directors). Analysts question AIIB’s independence from Chinese leaders.

Way Forward

AIIB’s initial achievements show that it is overcoming the infrastructure deficit by adhering to good governance and playing a complementary role along with other financial institutions rather than seeking a radical change in the existing international financial system. Thus, expectations and opportunities are high that it will have a positive impact, especially on the complex Indo-China (the two largest shareholders) relations where they would work on their stronger commonality of interests. AIIB will ensure prosperity and economic development in Asia thus contributing to local, regional and global sustainability.

Practice Question

Q. Comment on the role and scope of the Asian Infrastructure Investment Bank (AIIB) in developing Asian infrastructure in the long run.