IMF Bailout- Working, Pros & Cons

6 months after Sri Lanka qualified for an IMF bailout, the institution’s Executive Board recently signed off on the $3 billion arrangement. This comes after financial assurances from the country’s largest bilateral lenders- China, India and Japan.

This topic of “IMF Bailout- Working, Pros & Cons” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Recent Developments:

- Recently, the IMF Executive Board approved a $3 billion bailout for Sri Lanka.

- Sri Lanka has been suffering significant increases in domestic prices and falling currency exchange value.

- Of the $3 billion Extended Fund Facility, some $333 million is to be immediately disbursed to address the humanitarian crisis in the island nation.

- Notably, China had thrown in roadblocks in the country’s attempts to access IMF funds, by denying requests to restructure a $4 billion loan. The IMF had set debt restructuring guarantees from the country’s major bilateral lenders as one of the conditions for bailout. Note that 20% of Sri Lanka’s external debts is owed to China.

- China moved only after India and Japan stepped up on their parts. Meanwhile, the country missed key IMF deadlines.

- The IMF staff are negotiating with Pakistan for a $1.1 billion bailout.

- This is a part of the $6.5 billion bailout that was agreed upon in 2019.

- The country is facing severe economic crisis with falling currency value and spiking domestic prices.

- It too faced similar impediments due to China dragging its feet on loan restructuring.

- Both countries are in urgent need of these funds to address their foreign debts and purchase essential imports.

- In addition to these 2 south Asian countries, Bangladesh has approached the institution as a precautionary measure, given its depleting forex reserves.

- The country approached IMF for a $4.7 billion stabilization package.

- In addition to forex depletion, it is also facing energy shortages and declining domestic production and exports.

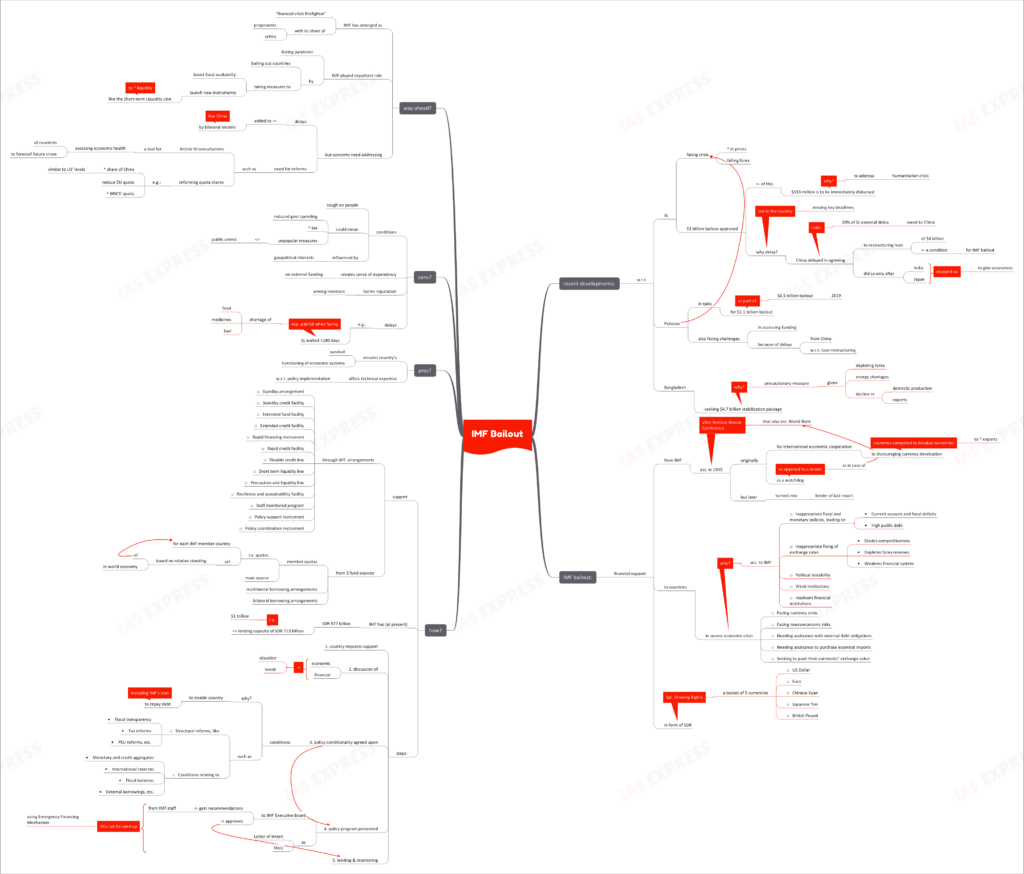

What are IMF bailouts?

- The International Monetary Fund, a result of the Bretton Woods Conference (which also led to the creation of the World Bank), was established in 1945.

- It was originally set up with the objective of international economic cooperation to discourage countries from devaluing their currencies in pursuit of more competitive exports. It was conceived as a watchdog, as opposed to a lender as in the case of World Bank.

- However, it eventually emerged as a lender of last resort to countries in severe economic crisis.

- The IMF lends support in the form of SDRs (Special Drawing Rights)- a basket of 5 currencies:

- US Dollar

- Euro

- Chinese Yuan

- Japanese Yen

- British Pound

- Countries seek IMF bailouts when:

- Facing currency crisis

- Facing macroeconomic risks

- Needing assistance with external debt obligations

- Needing assistance to purchase essential imports

- Seeking to push their currencies’ exchange value

- According to IMF, such situations arise because of:

- Inappropriate fiscal and monetary policies, leading to:

- Current account and fiscal deficits

- High public debt

- Inappropriate fixing of exchange rates

- Erodes competitiveness

- Depletes forex reserves

- Weakens financial system

- Political instability

- Weak institutions

- Insolvent financial institutions

- Inappropriate fiscal and monetary policies, leading to:

How does it work?

- The IMF lends support through different arrangements, designed to suit the purpose:

- Standby arrangement

- Standby credit facility

- Extended fund facility

- Extended credit facility

- Rapid financing instrument

- Rapid credit facility

- Flexible credit line

- Short term liquidity line

- Precaution and liquidity line

- Resilience and sustainability facility

- Staff monitored program

- Policy support instrument

- Policy coordination instrument

- IMF’s funds have 3 sources:

- Member quotas- each IMF member contributes funds according to a quota set based on its relative standing in the world economy. This is the institution’s main fund source.

- Multilateral borrowing agreements

- Bilateral borrowing agreements

- The IMF has a SDR 977 billion in total resources at present. This translates into a lending capacity of SDR 713 billion, which is about $1 trillion.

Steps involved:

- The country makes a request for financial support to the IMF.

- The IMF staff and the country’s government discuss the latter’s economic and financial situation and needs.

- Even before the IMF lends financial support, both the parties agree on a program of economic policies. This ‘policy conditionality’ is an integral component of the lending process.

- After the parties agree on the terms, the policy program is presented to the IMF Executive Board.

- This is detailed in a Letter of Intent and a Memorandum of Understanding.

- The IMF staff makes recommendations to the Board on endorsing the policy intentions and financing.

- This process can be accelerated through the institution’s Emergency Financing Mechanism.

- After the Board gives its approval, the IMF lends the financial support and monitors the country’s implementation of the policy program.

IMF Conditions:

- The IMF lays down conditions for a country to fulfil when seeking its financial support. This is to ensure that the country regains its economic and financial health and hence, is able to repay the loan.

- Some of the conditions include:

- Structural reforms, like

- Fiscal transparency

- Tax reforms

- PSU reforms, etc.

- Conditions relating to

- Monetary and credit aggregates

- International reserves

- Fiscal balances

- External borrowings, etc.

- Structural reforms, like

What are the pros and cons?

- On the plus side, these bailouts ensure a country’s survival during an economic crisis while also ensuring that its economic systems remain functional.

- The IMF often provides technical expertise to the country, with regards to implementing the reforms.

- On the other hand, the policy conditionality imposed by the IMF can be tough on the recipient country’s public.

- It could mean reduced government spending, higher taxes, unpopular measures that could result in public unrest, etc.

- It creates a sense of dependency on external funds and harms the country’s reputation among investors.

- The bailouts are often delayed. For instance, Sri Lanka waited more than 180 days for its $2.9 billion bailout. Such delays are especially painful when the country is facing pressing issues like shortage of food, medicine and fuel.

- Such conditions are prone to geopolitical influences, as these ‘reforms’ are decided by officials from different countries.

What is the way ahead?

- Over the years, the IMF has acquired the title of ‘financial crisis firefighter’. It has had its share of proponents and critics.

- In the wake of the pandemic, the institution has played a significant role in bailing out several countries. It took measures to boost fund availability and launched new instruments like the Short-term Liquidity Line to improve liquidity.

- However, delays have been a major concern. Bilateral lenders like China have been adding to the problem too.

- The IMF’s approach is also in need of reforms, such as:

- Restructuring of the Article IV consultations- a tool for assessing the countries’ economic health to forestall future financial crises.

- Reformation of quota shares- such as increasing China’s quota to levels similar to that of USA, reducing EU’s quota, increasing BRICS’ share, etc.

Conclusion:

The IMF’s approval of Sri Lanka’s bailout is a welcome development. However, the package alone isn’t sufficient for the country to tide over its crisis. The same holds true for Pakistan. It is vital that other large lenders, like China, expedite their support if the packages are to make any impact. The recipient countries too need to reform their financial systems and economies. Also, to effectively serve as a last resort lender, the IMF itself needs significant reformation.

Practice Question for Mains:

Examine IMF’s role as ‘financial crisis firefighter’, in light of its recent bailout of Sri Lanka. (250 words)