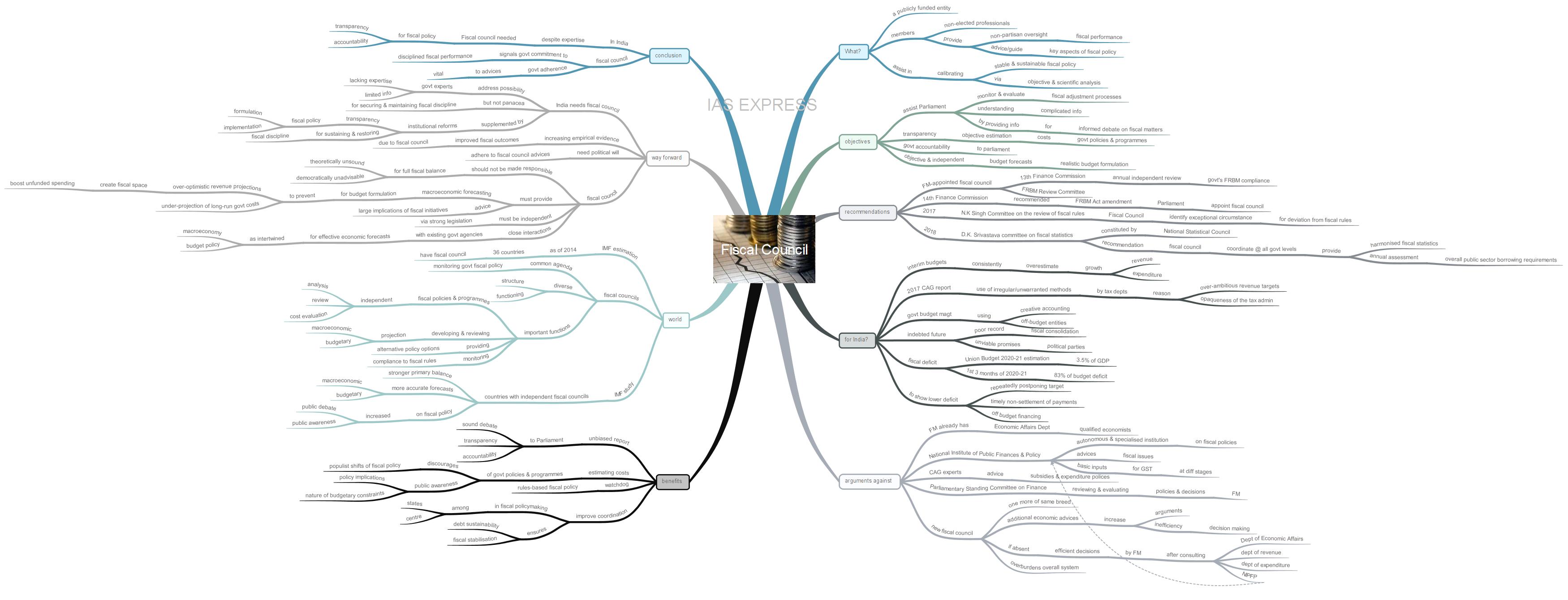

Fiscal Council – Need, Issues, Way Ahead

The fiscal situation in India has been under severe stress even before the pandemic and the coronavirus crisis has only exacerbated it. Amid the unprecedented global economic crisis due to the pandemic, there is a growing demand for the government to return to a credible fiscal consolidation path once the predicament subsides. For this to happen, a fiscal council that provides unbiased advice on aspects of fiscal policy is a need of the hour.

This topic of “Fiscal Council – Need, Issues, Way Ahead” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is a fiscal council?

- A fiscal council is a publicly funded entity manned by non-elected professionals involved in providing non-partisan oversight of fiscal performance and/or advising and guiding the key aspects of fiscal policy of a country.

- Such institutions assist in calibrating stable and sustainable fiscal policy by making objective and scientific analysis.

What are the objectives of a fiscal council?

- Assisting the Parliament in monitoring and evaluating the fiscal adjustment processes

- Impart greater transparency by objectively estimating the costs of various government policies and programmes

- Enhancing executive’s accountability to the Parliament

- Undertake objective and independent evaluations of budget forecasts to impart greater realism to the budget formulation

- Help parliamentarians in understanding complex issues and providing them with the information to facilitate informed debate on fiscal matters.

Who recommended setting up a fiscal council in India?

- The 13th Finance Commission recommended setting up of committee whose members are appointed by the Ministry of Finance for it to be eventually transformed into a fiscal council.

- The intension was to conduct an annual independent review of compliance to Fiscal Responsibility and Budget Management Act by the government in its functioning and policies.

- The FRBM Review Committee also made a similar recommendation highlighting the need for an independent review by the Finance Ministry-appointed Fiscal Council.

- The issue with these recommendations was that the finance ministry should appoint such a council, which would then send a report to the ministry. This provides little independence for the fiscal council.

- In contrast, the 14th Finance Commission recommended the amending of FRBM Act for setting up of an independent Fiscal Council that would be appointed by and reporting to the Parliament.

- Two other expert committees also advocated for the setting up of fiscal council in recent years.

- In 2017, the K Singh Committee on the review of fiscal rules set up by the finance ministry recommended the establishment of an independent fiscal council that would advise the government on whether conditions exist for deviation from the mandated fiscal rules.

- In 2018, the K. Srivastava committee on fiscal statistics constituted by the National Statistical Council also suggested the establishment of a council that would coordinate with all levels of the government to provide harmonised fiscal statistics and provide an annual assessment of overall public sector borrowing requirements.

- All of these recommendations advocate for the establishment of a fiscal council agency to review the government’s adherence to fiscal rules and to provide an independent assessment of budget proposals.

Does India need a Fiscal Council?

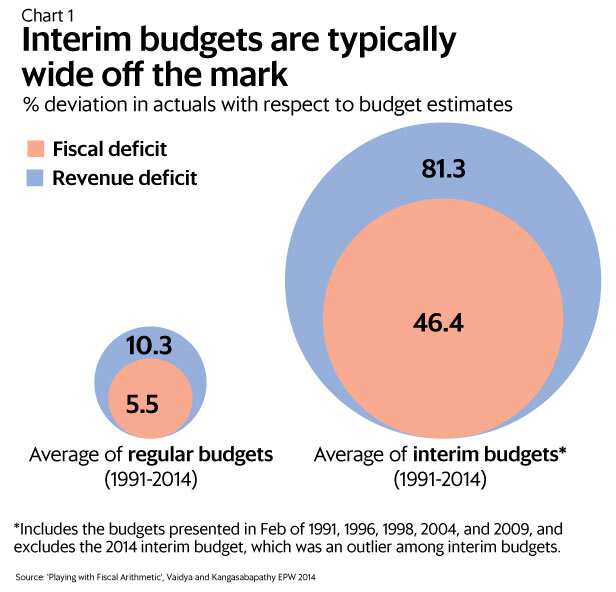

- Historically, interim budgets have consistently overestimated revenue and expenditure growth.

- According to a 2017 Comptroller and Auditor General report, over-ambitious revenue targets along with the opaqueness of the tax administration has led to tax department resorting to “irregular” and “unwarranted” methods to meet such targets.

- There is also the issue of the use of ‘creative accounting’ and the use of off-budget entities to manage the government’s budget needs.

- Poor record of the fiscal consolidation process and the tendency of the political parties to make unviable promises bind the future generation to indebtedness.

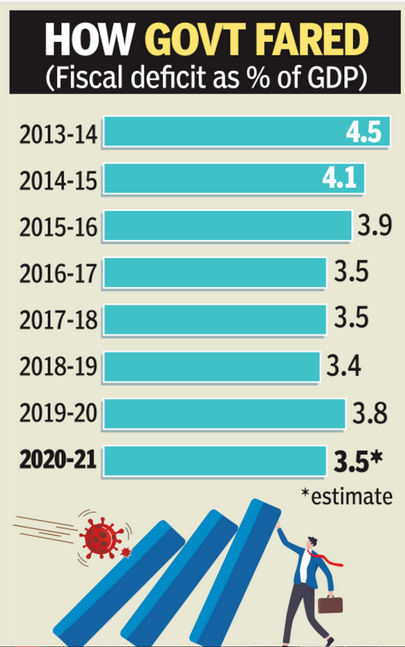

- The government’s fiscal deficit target estimated in the Union Budget 2020-21 was 7.96 lakh crore or 3.5% of the GDP.

- During the first three months of 2020-21, the pandemic-led economic crisis has led to Centre’s fiscal deficit reaching Rs.6.62 lakh crore or 83% of the budget estimate.

- Some private economists estimate the FY21 fiscal deficit to be as high as 8% of the GDP.

- With India’s GDP contracting 23.9% in the first quarter of the current year, the situation looks grim of the Indian economy.

- Apart from large deficits and debts, there also exists the prevalence of repeated postponement of targets, timely non-settlement of bill payments and off-budget financing to show lower deficits.

- These issues can be addressed by an independent Fiscal Council that ensures accountability and transparency in the fiscal consolidation processes.

What are the arguments against the need for a fiscal council in India?

- The argument is that Finance Minister already has a large number of qualified economists in the Economic Affairs Department to provide advice on fiscal councils

- There also exists the National Institute of Public Finances and Policy (NIPFP), an autonomous and specialised institution on fiscal policies.

- This institution has played a critical role in providing consultation on fiscal issues.

- Before the introduction of service tax in 1994, basic research was done by the NIPFP.

- It had also provided basic inputs for GST at different stages.

- The Comptroller and Auditor General, with its expert officers, also provided expert advice on subsidies and expenditure policies when they go wrong.

- Parliamentary Standing Committee on Finance is also involved in reviewing and evaluating the policies and decisions of the union finance ministry and other related government entities.

- With these institutions involved in providing expert assistance to the finance ministry, there is no need for another organisation.

- If their reviews and advice are ignored by the Finance Minister, the same can happen even with the fiscal council.

- This is because the nothing binds finance minister.

- It is also argued that additional economic advice to the government via the new fiscal council would only increase disagreements and arguments among the economists because of differences in opinions. This, in turn, increases inefficiencies in the policy decision-making

- Careful and efficient decisions can be taken after the consultations with the Departments of Economic Affairs, Expenditure and Revenue and even the NIPFP in some case in the absence of a fiscal council.

- Adding a new independent entity would only add one more of the same breed and as a result, overburdening the overall system.

What are the benefits of the Fiscal Council?

- As it provides an unbiased report, it ensures sound debates in the Parliament, guaranteeing transparency and accountability within the government.

- Costing of various government policies and programmes via an unbiased analysis can discourage populist shifts in fiscal policy.

- Scientific estimates of the cost of programmes and assessment of forecasts could also help in raising public awareness about their fiscal implications and make people understand the nature of budgetary constraint.

- The council will act as a watchdog by monitoring rules-based fiscal policy and rising awareness and the level of debate within and outside the Parliament.

- Fiscal Council can improve coordination between the Centre and the states and among states in fiscal policymaking.

- Improved coordination ensures fiscal stabilisation and debt sustainability.

How are fiscal councils functioning across the world?

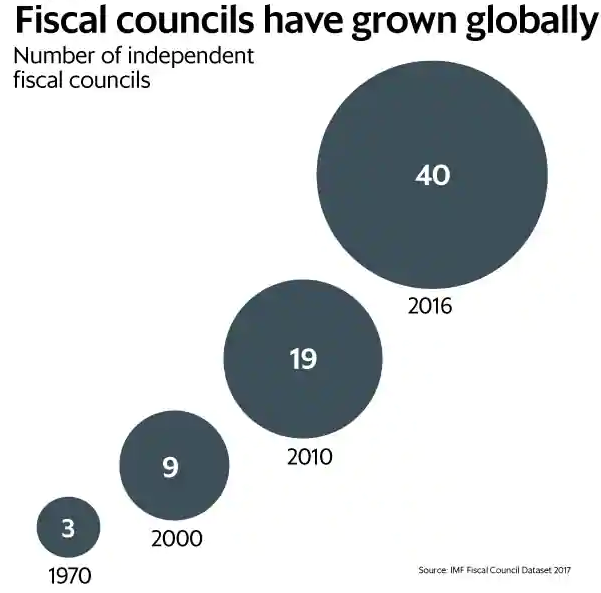

- International Monetary Fund data revealed that 36 countries have independent fiscal councils as of 2014. More have been established since.

- Though all of these independent fiscal institutions have a common agenda of being watchdogs, there is considerable diversity in their structure and functioning.

- Their important functions are as follows:

- Independent analysis, reviewing, monitoring and evaluating government’s fiscal policies and programmes

- Developing and reviewing macroeconomic and/or budgetary projections

- Costing of budget and policy proposals and programmes

- Providing alternative policy options for the government

- Monitoring compliance with fiscal rules

- A study by the International Monetary Fund has found that the countries with independent fiscal institutions have:

- Stronger primary balances

- More accurate macroeconomic and budgetary forecasts

- Increased public awareness and public debate on fiscal policy

- Case studies of Belgium, Chile and the UK show that they have significantly contributed to the improvement in fiscal performances.

What can be the way forward?

- Though the Indian government already has numerous experts who can provide advice on fiscal policies, there is also the possibility of them suffering from a lack of information and necessary expertise.

- Such a situation that may be addressed through a high-quality unbiased analysis by a fiscal council.

- A fiscal council can contribute to improved fiscal performance in various ways. However, it is not the panacea for securing and maintaining fiscal discipline.

- There is an increasing, though very limited, empirical evidence on the improvement of fiscal outcomes due to the presence of a fiscal council.

- A fiscal council can be efficient only when there is a political will to adhere to the advice provided by the independent institution.

- As an independent fiscal council has very limited influence on the government’s fiscal policies, its establishment needs to be supplemented with institutional reforms, including all those that increase the transparency of fiscal policy formulation and implementation. These reforms are vital for restoring and sustaining fiscal discipline.

- Regardless of all the reforms, rules can still be breached even as appearances may suggest otherwise for a while through creative accounting and off-budget transactions.

- This is where the independent fiscal council plays a role by helping in enhancing the transparency of policy and depoliticising key aspects of the fiscal policy.

- The fiscal council, however, must not be made fully responsible for the fiscal balance, as it is theoretically unsound and democratically unadvisable.

- Thus, the fiscal council’s normative mandates must be supplemented with strong legislations.

- At the same time, the fiscal council can be provided with the responsibility of presenting macroeconomic forecasting for budget formulation and to reduce bias.

- This prevents over-optimistic revenue projections (creates fiscal space to boost unfunded spending) and under-projection of long-run costs of legislative initiatives.

- It can also be provided with the mandate of advising the government on the large implications of fiscal initiatives so as to pre-empt deficit bias.

- The fiscal council can be effective only if it is independent and its analysis is unfettered. This must be ensured through strong legislation.

- As the macroeconomy and budget policy are highly interrelated, most effective economic forecasting would be obtained when there is a close interaction between the existing government agencies most responsible for the budget formulation and the forecasting fiscal council, as in several countries like Belgium and the Netherlands.

Conclusion:

In India’s context, it is evident that despite the existence of expertise in the government’s domain, there persists the need for transparency and accountability to the fiscal policies. A good fiscal council signals government’s commitment to achieving disciplined fiscal performance. Yet, its existence alone is insufficient in the absence of strong and sustained political commitment to the adherence to the fiscal council’s advice.

Practice question for mains:

Examine the relevance and the need for the fiscal council in India amid the financial issues faced by the country. (250 words)