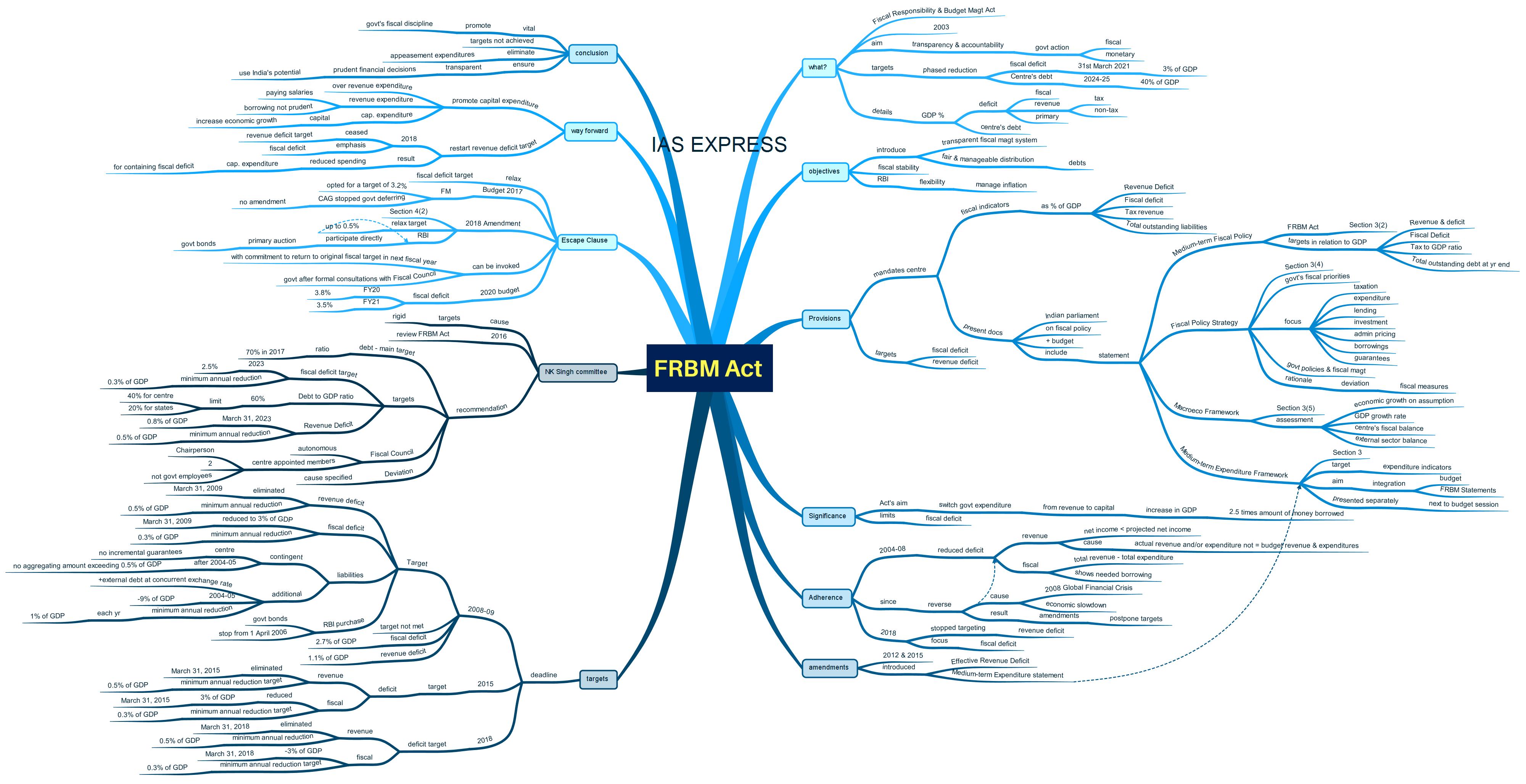

Fiscal Responsibility and Budget Management (FRBM) Act

With the decreasing revenue and increasing expenditure, the Finance Minister took the fiscal expansion path not just for the current fiscal, but also for the next fiscal. This is despite over 37% reduction in food subsidy and nearly 11% reduction in fertilizer subsidy. The deficit for the current fiscal is to be 3.8% as against 3.3% announced in the last year’s budget. This was done by making use of Section 4(2) of the FRBM Act that provides for the deviation from the estimated fiscal deficit. The government argued that this fiscal path aims for fiscal consolidation without compromising the investment needs from the public funds. This shows that there is a need for a comprehensive investment on the capital front to ensure an increase in the revenue for the government and reform in the FRBM Act to make sure that the targets set by this law are achieved.

This topic of “Fiscal Responsibility and Budget Management (FRBM) Act” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is the FRBM Act?

- The Fiscal Responsibility and Budget Management (FRBM) Act came to force in 2003.

- It aims to bring transparency and accountability of the fiscal and monetary actions of the government.

- The Act sets targets for the phased reduction of the fiscal deficit to acceptable levels.

- It requires the government to limit the fiscal deficit to 3% of the GDP by 31st March 2021 and the Central Government’s debt to 40% of the GDP by 2024-25, among others.

- This Act provides room for deviation from the annual fiscal deficit target under certain conditions.

- The government is also required to provide the details of fiscal indicators as fiscal, revenue and primary deficit, tax and non-tax revenues and central government’s debt as a percentage of GDP.

What are the objectives of the FRBM Act?

This Act mainly aims to:

- Introduce transparent fiscal management systems in India

- Introduce a more fair and manageable distribution of the country’s debts over the years.

- Ensure fiscal stability for India in the long-run.

- Provide needed flexibility to the Reserve Bank of India for managing India’s inflation.

What are the provisions of the Act?

- The FRBM Act mandates the centre to project four fiscal indicators in the medium-term fiscal policy statement. The fiscal indicators include:

- Revenue Deficit as a percentage of GDP

- Fiscal deficit as a percentage of GDP

- Tax revenue as a percentage of GDP

- Total outstanding liabilities as a percentage of GDP

- This Act also sets targets for fiscal deficit and revenue deficit.

- It also decrees the tabling of certain documents pertaining to India’s fiscal policy in the Indian parliament along with the Budget once a year. These include:

- Medium-term Fiscal Policy Statement

- Fiscal Policy Strategy Statement

- Macroeconomic Framework statement

- Medium-term Expenditure Framework Statement

- Medium-term Fiscal Policy Statement should be presented under Section 3(2) of the FRBM Act. It sets targets for four specific fiscal indicators in relation to GDP at market prices. The fiscal indicators include:

- Revenue and deficit

- Fiscal Deficit

- Tax to GDP ratio

- Total outstanding debt at the end of the year

The statement includes the underlying assumptions, an assessment of sustainability relating to the balance between revenue receipt and revenue expenditure and the use of capital receipts including market borrowings for the generation of productive assets.

- Fiscal Policy Strategy Statement, presented under Section 3(4) of the FRBM Act, summarises the government’s strategic priorities in the fiscal area for the ensuing financial year. It focuses on taxation, expenditure, lending and investment, administered pricing, borrowings and guarantees. This statement explains how the current policies are on par with the sound fiscal management principles and give the rationale for any major deviation in key fiscal measures.

- Macroeconomic Framework Statement is presented to the parliament as per Section 3(5) of the FRBM Act. It focuses on the assessment of growth prospects of the economy with certain assumptions. It contains the assessment pertaining to the GDP growth rate, fiscal balance of the central government and the external sector balance of the economy.

- Medium-term Expenditure Framework Statement is presented to the parliament under Section 3 of the FRBM Act. It sets a three-year rolling target for the expenditure indicators with a measurement of underlying assumptions and risks involved. It aims to give closer integration between the budget and the FRBM Statements. This statement is presented separately in the session next to the in which Budget is presented (normally in the Monsoon Session).

What is the significance of the FRBM Act?

- The popular understanding of the FRBM Act is that its main goal is to restrict government expenditure. This is not true.

- This Act is not to reduce the government’s expenditure, but to switch the expenditure of the government from revenue to capital for increasing the country’s GDP.

- That is, when the revenue deficit (funding for revenue expenditure) is reduced and there is an increase in the borrowing for capital expenditure, there will be an increase in the overall GDP by 2.5 times the amount of money borrowed.

Has India adhered to the FRBM Act?

- Between 2004 and 2008, the Indian government made giant strides to reduce both the revenue deficit and fiscal deficit.

- However, this process was reversed thereafter due to the Global Financial Crisis in 2008 and the economic slowdown.

- Since then, the government had made several amendments to the Act to postpone the targets.

- However, the worst development happened in 2018, when the Union government stopped the targeting of revenue deficit and instead focused on fiscal deficit.

- The revenue deficit is the situation wherein the net income is less than the projected net income. This happens when the actual amount of revenue and/or the actual amount of expenditure do not correspond with the budget revenue and expenditures.

- The Fiscal deficit is the difference between the government’s total revenue and total expenditure in a financial year. Since the government borrowed from the market to bridge this gap, it also shows the borrowings needed by the government during the financial year.

What are the amendments made to this Act?

- The FRBM Act underwent amendment in 2012 and 2015, leading to relaxation of target realisation under this Act.

- The new concept called Effective Revenue Deficit was also introduced under the amended Act.

- The Medium-term Expenditure statement was also added following the amendment.

What are FRBM targets set under this Act?

Earlier targets set under FRBM Act (to be met by 2008-09) include:

- Revenue Deficit Target: Revenue deficit should be eliminated completely by March 31, 2009. The minimum annual reduction target was 0.5% of the GDP.

- Fiscal Deficit Target: Fiscal deficit should be reduced to 3% of the GDP by March 31, 2009. The minimum annual reduction target was 0.3% of the GDP.

- Contingent liabilities: The Centre should not give incremental guarantees aggregating an amount exceeding 0.5% of the GDP in any financial year after 2004-05.

- Additional Liabilities (including external debt at concurrent exchange rate) should be brought down to 9% of the GDP by 2004-05. The minimum annual reduction target in each succeeding year should be at 1% of the GDP.

- The RBI purchase of government bonds should stop from 1 April 2006. This means that the government should not borrow directly from the RBI after April 1, 2006.

Were the targets met?

- No, the targets were not met by the government.

- Through the implementation of this Act, the government had brought down the fiscal deficit to 2.7% of the GDP and revenue deficit to 1.1% of the GDP in 2007-08.

- The 2008 global financial crisis forced the government to introduce resources in the economy as the fiscal stimulus in 2008, leading to the temporary postponement of the fiscal target.

FRBM targets post 2012 Amendment (to be achieved by 2015)

- Revenue Deficit Target: The revenue deficit should be eradicated completely by March 31, 2015. The minimum annual reduction target was 0.5% of the GDP.

- Fiscal deficit target: The Fiscal Deficit should be reduced to 3% of the GDP by March 31, 2015. The minimum annual reduction target was 0.3% of the GDP.

FRBM targets post 2015 amendment (to be achieved by 2018)

- Revenue Deficit Target: The revenue deficit should be eradicated completely by March 31, 2018. The minimum annual reduction target was 0.5% of the GDP.

- Fiscal Deficit Target: The fiscal deficit should be brought down to 3% of the GDP by March 31, 2018. The minimum annual reduction target was 0.3% of the GDP.

What were recommendations made by the FRBM Review Committee headed by NK Singh?

- As the government believed that the targets were too rigid, it had set up a committee headed by NK Singh in 2016 to review the FRBM Act. This committee gave the following recommendations:

- Debt as the main target: The Committee recommended the use of debt as its foremost target. This ratio was 70% in 2017.

- The targets set by the committee are:

- Debt to GDP ratio: The committee called for a Debt to GDP ratio of 60% to be targeted with a 40% limit for the centre and 20% limit for the states.

- Revenue Deficit Target: revenue deficit should be reduced to 0.8% of the GDP by March 31, 2023. The minimum annual reduction should be 0.5% of the GDP.

- Fiscal Deficit Target: The fiscal deficit should be cut down to 2.5% of the GDP by March 31, 2023. The minimum annual reduction target was 0.3% of the GDP.

- Fiscal Council: The Committee recommended the setting up of an autonomous Fiscal Council with a Chairperson and two members appointed by the Centre. The chairperson and members should have a non-renewable four-year term in this council. Also, they must not be employees in the central and state governments during the time of appointment.

- Deviation: The committee suggested that the grounds on which the government can deviate from the FRBM targets should be clearly specified and the government should not be allowed to modify under any other circumstances.

What is the Escape Clause in the FRBM Act that was invoked during the Budget 2020-21?

- The escape clause provides flexibility for relaxation of the fiscal deficit roadmap during the time of stress.

- The term “escape clause” was revolutionised by the NK Singh Committee.

- In Budget 2017, the Finance Minister delayed the fiscal deficit target of 3% of the GDP and opted for a target of 3.2%, citing the MK Singh report.

- However, the Comptroller and Auditor General of India (CAG) stopped the government for deferring the targets without amending the Act.

- In 2018, the FRBM Act was amended and certain details were updated in Section 4(2). The clause allows the government to relax the fiscal deficit target for up to 0.5%.

- Under the FRBM Act, if the escape clause is used to breach the fiscal deficit target, the RBI is allowed to participate directly in the primary auction of government bonds, thus formalising deficit financing.

- The escape clause should be invoked:

- By the government after formal consultations with the Fiscal Council.

- With a clear commitment to return to the original fiscal target in the coming fiscal year.

- This year, it was invoked to increase the fiscal deficit for FY20 to 3.8% and pegged the target for FY21 to 3.5%.

What can be the way forward?

Opting for capital expenditure over revenue expenditure:

- Due to the current economic slowdown, there have been growing pressure on the government to breach the FRBM tenet and spend more than fiscal deficit targets in a bid to reboot the domestic economic growth.

- Others, in contrast, continue to caution the real fiscal deficit is already far more than the official number, and as such, there is no room for further increasing the expenditure by the government.

- However, both the narratives are false and one needs to understand the different types of deficit and why it matters to limit them.

- As previously mentioned, the fiscal deficit is the excess of what the amount the government plans to spend over what the government expects to receive.

- However, no government expenditures are of the same kind.

- For example, if the expenditure is for paying salaries, then it is a revenue expenditure and it does not provide for the increased production. In contrast, if the expenditure is for building a road or a factory, it is counted as capital expenditure as it increases the economy’s capacity to produce more.

- As a broad rule, it is considered financially not prudent for the government to borrow for revenue purposes.

- Thus, the FRBM Act mandated the limiting for fiscal deficit to 3% of the nominal GDP and the revenue deficit to 0%.

- Preferring capital expenditure to revenue expenditure can allow for the growth of the economy.

- When the government spends money or cuts taxes, it has an impact on the economic activity of the country (measured through nominal GDP or total income). However, the impact on the economy is different for revenue expenditure and capital expenditure.

- For instance, if the government spends Rs.100 for increasing the salaries in India, the economy grows by a little less than Rs.100. However, if the government uses the money to build roads or bridges, the GDP grows by Rs.250.

- Also, if governments spend on capital building instead of squandering the money on populist schemes like higher salaries or concessions, the economy would benefit by two-and-a half-times more.

- Thus, the government should focus more on investing in capital expenditure rather than on increasing the emphasis on gaining popular support.

Restarting the targeting of the revenue deficit:

- In 2018, the Union government ceased the targeting of the revenue deficit and instead gave high emphasis only on fiscal deficit.

- Since there was no compulsion to reduce revenue deficit, the government, in recent years, has been containing the fiscal deficit by reducing its capital expenditure.

- This led to a point where adhering to the FRBM Act means reducing the expenditure on aspects that promote economic growth.

- Therefore, there is a need to revert to the original FRBM Act, 2003 by recognising and prioritising the reduction of the revenue deficit.

- This will allow the government to boost the kind of expenditure that actually increases the GDP.

Conclusion:

FRBM Act is a necessary tool to promote the fiscal discipline of the government. However, it had not made the government to successfully achieve the targets. For achieving the set targets, the government must do away with appeasement expenditures and must take prudent financial decisions transparently to promote the economic growth as India, with its natural resources and demography, has the enormous potential to involve itself in enhanced and rapid economic growth and development.

Test yourself:

What is the FRBM Act? How can the government use it to promote economic growth? (250 Words)