Role of International Financial Institutions (IFIs) during COVID-19 Pandemic

The IFIs were created in response to the impacts of World War II and the Great Depression. Now, the COVID-19 situation has led to unprecedented demand for external financing for immediate relief and for bringing back stability. In this context, the role of IFIs in piecing the global economy back has come into focus.

This topic of “Role of International Financial Institutions (IFIs) during COVID-19 Pandemic” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

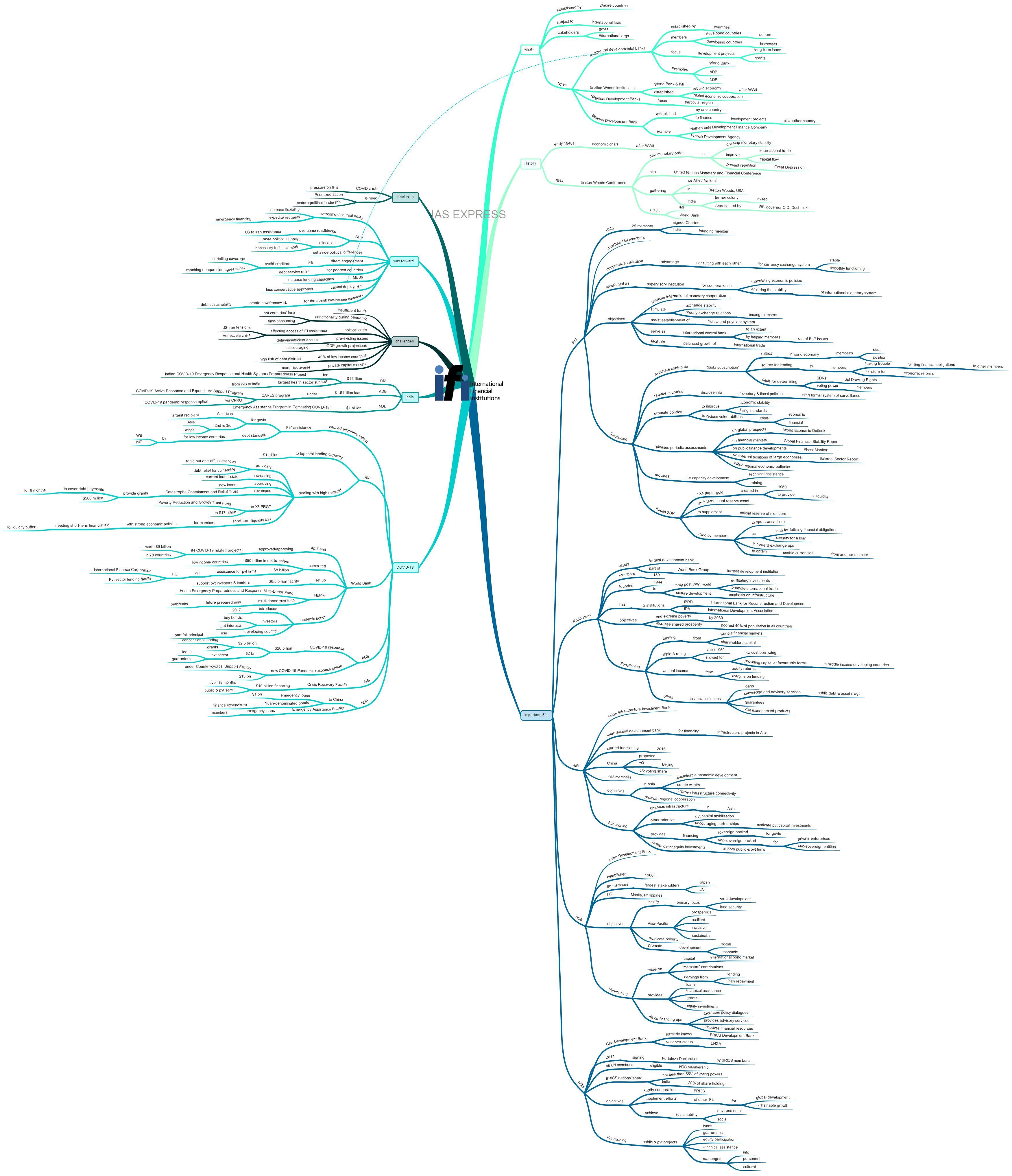

What is an international financial institution?

- Financial institutions that are established by two or more countries and subject to international laws are international financial institutions (IFIs).

- The stakeholders of these IFIs are generally national governments but other international institutions and other organizations may also be in such roles.

- There are different types of IFIs:

- Multilateral development banks: These are established by several countries and its membership includes both developed countries (that function as donors) and developing countries (that borrow). These IFIs focus on development projects which they finance through long term loans and grants. Eg: World Bank, Asian Development Bank, New Development Bank etc.

- Bretton Woods institutions: The World Bank and the International Monetary Fund are the Bretton Wood institutions. These were established to rebuild the economy that was shattered by the World War II and to promote economic cooperation

- Regional development banks: These IFIs focus on a particular region. Eg: Asian Development Bank.

- Bilateral development banks: These IFIs are established by one country to finance development projects in another country. Eg: Netherlands Development Finance Company, French Development Agency, etc.

How did these institutions come into being?

- In early 1940s, the global economy was reeling from the impacts of the World War II.

- At the Breton Woods Conference of 1944, a new monetary order was conceived to develop monetary stability and improve international trade and capital flow. The new international monetary system was mainly aimed at preventing the repetition of the 1930s’ mistake that led to the Great Depression.

- Also known as the United Nations Monetary and Financial Conference, it saw the gathering of members from 44 Allied Nations in Bretton Woods, USA. 2019 marked the 75th anniversary of this historical conference.

- India, which was still a British colony back then, was invited to the conference too. The then RBI governor D. Deshmukh was one of the representatives. The Indian delegation highlighted the need for providing financial assistance to developing nations– especially those affected by colonialism.

- The IMF and the World Bank were direct products of this conference. These IFIs were considered as a way to rebuild the shattered economy and to promote international economic cooperation.

What are some of the important IFIs?

IMF

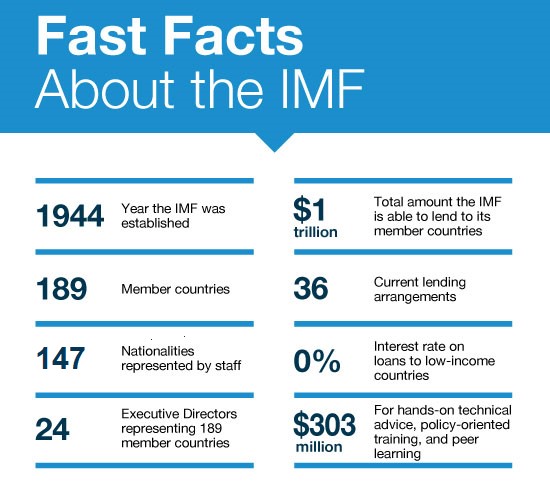

- The IMF came into existence in 1945 with 29 members signing its Charter. It currently has 189 member countries. India is one of the founding members.

- It is a cooperative institution and members joined it because of the advantage of consulting with each other to maintain a stable and smoothly functioning currency exchange system.

- The IMF was primarily envisaged as a supervisory institution for coordinating the efforts of the member nations to achieve better cooperation in formulating economic policies and ensuring the stability of the international monetary system.

Objectives:

- To promote international monetary cooperation.

- To stimulate exchange stability and orderly exchange relations among the member nations.

- To assist in establishment of a multilateral payment system.

- To an extent it has served as an international central bank to help countries out of their balance of payment (BoP) issues by protecting their exchange rates.

- It facilitates the balanced growth of international trade and its expansion.

Functioning:

- The members contribute a ‘quota subscription’ upon joining the IMF. These reflect the member’s size and position in the world economy.

- These contributions are pooled to form the source from which it lends to the members.

- The quota subscription forms the basis for determining the Special Drawing Rights (SDRs).

- It also determines the voting power of each member.

- As its core responsibility, it lends money to members having trouble fulfilling financial obligations to other members. In return, the IMF requires the borrowing country to undertake economic reforms.

- Though the IMF has no effective authority over its members’ domestic economic policies, it can require the disclosure of information regarding their monetary and fiscal policies.

- The IMF uses a formal system of surveillance to monitor the member nations’ policies as well as economic and financial developments.

- It also provides advice to the countries and also promotes policies designed to improve economic stability, living standards and reduce vulnerability to financial and economic crises.

- It releases periodic assessments like World Economic Outlook (on global prospects), Global Financial Stability Report (on financial markets), Fiscal Monitor (on public finance developments), External Sector Report (on external positions of countries with large economies) and other regional economic outlooks.

- It provides technical assistance and training for capacity development in member countries.

- It issues an international reserve asset called SDR to supplement the official reserve of the member nations. It is also called ‘paper gold’ and was created in 1969 to provide additional liquidity. This can be used by the members in spot transactions, as a loan for fulfilling financial obligations, as security for a loan, in forward exchange operations, to obtain usable currencies from another member, etc.

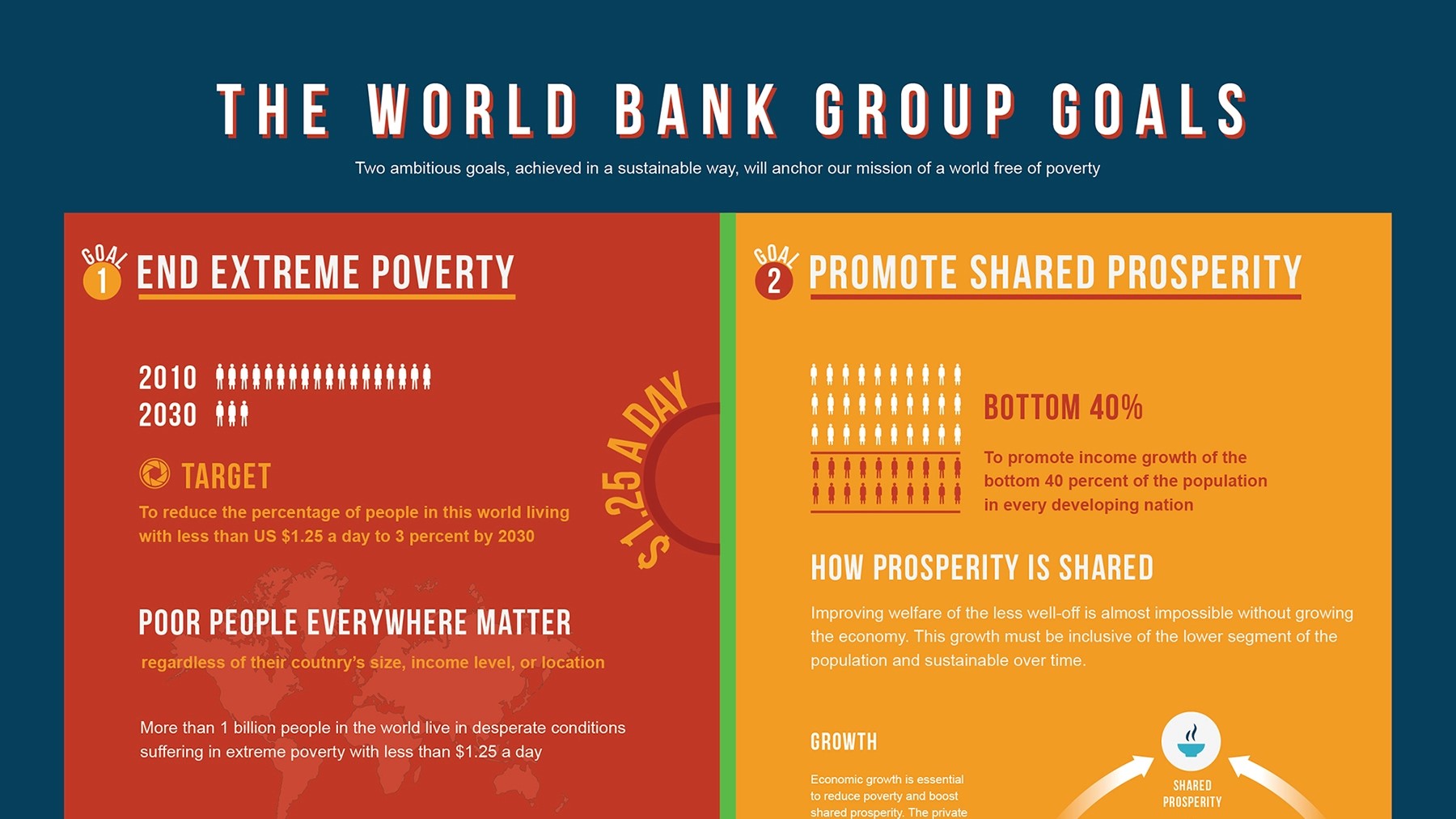

World Bank

- The World Bank is the largest development bank and is a part of the World Bank Group which is the largest development institution in the world. It too has 189 members.

- It was founded in 1944.

- It was established to help with the restoration of the war-affected economy by facilitating investment and promoting long-range but balanced growth of international trade. Over the time, its focus shifted from reconstruction to development with emphasis on infrastructure.

- It has 2 institutions: the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA).

Objectives:

- To end extreme poverty by 2030.

- To increase the shared prosperity of the poorest 40% of the population in all countries.

Functioning:

- Most of its funds are from the world’s financial markets. In addition to this, the shareholders pay capital to it.

- Its high rating (triple-A rating since 1959) has allowed it to borrow at a low cost while providing capital at favourable terms to middle-income developing countries. This enables the sustainable progress of development projects.

- It earns its annual income from returns of its equity and from margins on lending. This is used to meet operational costs, strengthening the balance sheet, etc.

- It also offers financial solutions like loans, guarantees, risk management products, etc.

- It provides knowledge and advisory services to both national and sub-national levels, in public debt and asset management.

- It supports efforts to fortify public financial management, policies and institutions, improve investment climate and address impediments in service delivery.

AIIB

- The Asian Infrastructure Investment Bank is an international development bank that finances infrastructure projects in Asia.

- It was established based on the proposal of China and started functioning in 2016 with its headquarters in Beijing.

- Half of the bank’s voting share is with China and hence the AIIB has often been perceived as challenge to other international lending bodies like the IMF and World Bank.

- It has 103 members worldwide and includes almost every large Asian country except Japan. Despite pressure from the USA, nearly half of the NATO members have signed on.

Objectives:

- To foster, in Asia, sustainable economic development, create wealth and improve infrastructure connectivity.

- To promote regional cooperation to address challenges to development.

Functioning:

- It provides or facilitates financing of infrastructure projects in central, south east and south Asia and also in the Middle East.

- Its other priorities include private capital mobilization and encouraging partnerships that motivate private capital investments like with other governments or multilateral development banks.

- It provides both sovereign backed (to governments) as well as non-sovereign backed financing (to private enterprises or sub-sovereign entities).

- It makes direct equity investments in both public and private sector firms by subscribing to shares, converting loans into equities, etc.

ADB

- The Asian Development Bank was established in 1966 as an IFI to foster economic growth and cooperation in the Asia-Pacific.

- It currently has 68 members– both from the region and from outside. The USA and Japan are 2 of its largest stakeholders.

- It is headquartered at Manila, Philippines.

Objectives:

- During its early years, its primary focus was on rural development and improved food production.

- It envisions an Asia-Pacific that is prosperous, resilient, inclusive and sustainable.

- It seeks to eradicate poverty and promote social and economic development.

Functioning:

- The ADB raises capital through international bond market.

- In addition to this, it relies on contributions from members, earnings from lending and loan repayments.

- It provides loans, technical assistance, grants and also invests in equities.

- It facilitates policy dialogues, provides advisory services and mobilizes financial resources via co-financing operations.

NDB

- The New Development Bank was formerly known as the BRICS Development Bank.

- It was established in 2014 with the signing of the Fortaleza Declaration by the BRICS leaders.

- All UN members are eligible to become members of the NDB. The NDB itself holds an observer status with the UNGA.

- The BRICS nations’ share cannot be lesser than 55% of voting powers. India, like other BRICS nations hold 20% of the share holdings, a 20% of total voting rights.

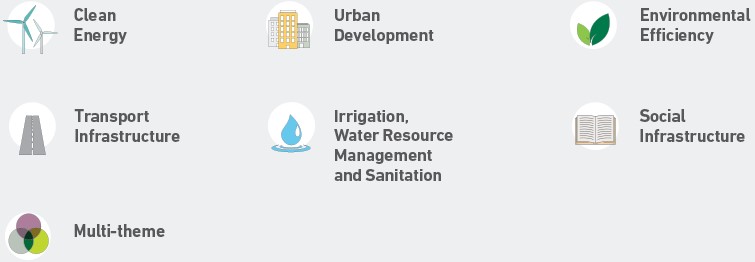

Objectives:

- To fortify cooperation among the BRICS countries.

- To supplement the efforts of other IFIs to achieve global development and sustainable growth.

- To achieve environmental and social sustainability.

Functioning:

- It provides support both public and private projects in the form of loans, guarantees, equity participation and other such financial instruments.

- It provides technical assistance for these projects.

- It enables information, cultural and personnel exchanges for aiding these projects.

- Its key operational areas are as follows:

How has the IFIs been responding to the impacts of COVID-19?

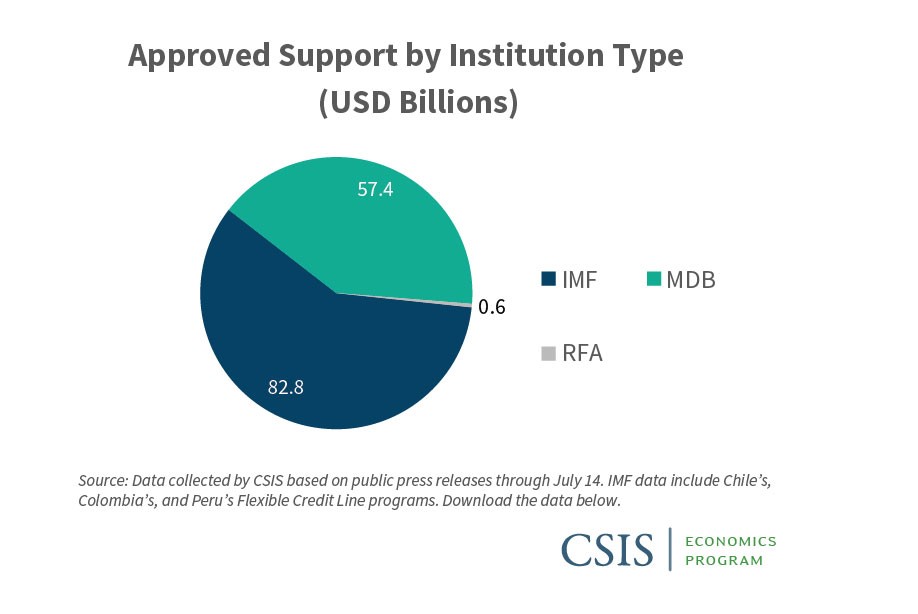

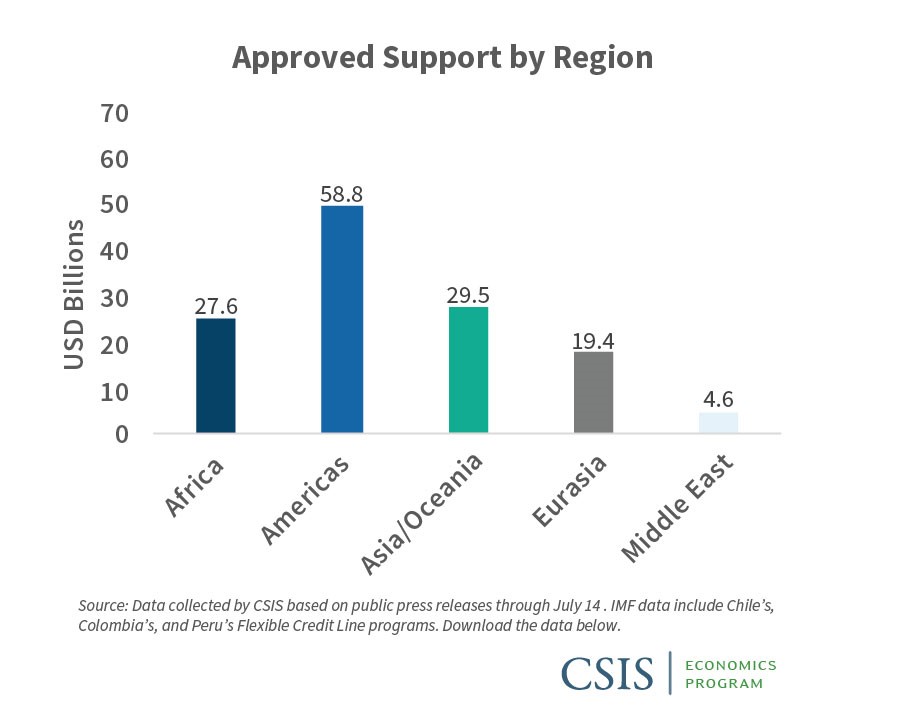

- The COVID-19 pandemic and its economic fallout has generated a massive need for financing especially among the low and middle income countries and the IFIs have approved billions of dollars for COVID-19- related support.

- In April, the IMF warned that the recession triggered by the pandemic could be the worst since the Great Depression and worse than the 2008-09 Global Financial Crisis.

- Additionally, an unprecedented amount of capital has taken flight from the emerging markets, which are estimated to contract by at least 1%.

- This has caused the governments to turn to IFIs for financial support en masse.

- The Americas have been the largest recipient of these approvals, followed by Asia and Africa.

- The World Bank and the IMF have called for debt standstill for low income countries to help them devote their scarce funds for tackling the pandemic instead of debt service payments.

- In April, the G-20 donor countries agreed to such a debt standstill till the year end.

IMF:

- The IMF is to tap its total lending capacity which is about $1 trillion. Other multilateral development banks are to mobilize $240 billion over the next 15 months.

- On average the IMF approves 18 program a year and the highest number of approvals came in 1994 when 34 programs were approved in a single year. This year, the IMF is set to break this record.

- The IMF has been using the following tactics to deal with this high demand:

- Providing rapid but one-off assistances to help in the COVID-19 response.

- Debt relief for vulnerable and economically weaker countries. This has been approved for 25 of its low income members.

- Increasing the current loans’ size.

- Approving new loans.

- The Fund has already approved several COVID-19 related assistances to countries like Congo, Nigeria, Madagascar, Pakistan, etc.

- It had revamped the Catastrophe Containment and Relief Trust to provide grants to cover debt payments for 6 months. It can now provide $500 million in grants and is funded by countries like Japan, Germany, UK and China.

- The Fund is to triple its Poverty Reduction and Growth Trust Fund (PRGT) to $17 billion.

- A short-term liquidity line has been approved for members with strong economic policies but requiring short-term financial aid to support their liquidity buffers.

World Bank:

- By April end, the World Bank had approved or was in the process of approving $9 billion worth of 94 COVID-19 related projects in 78 countries. These include projects to support containment measures, train medical personnel, provide for testing equipment, etc.

- It has committed $50 billion in net transfers to low income countries.

- It has committed $8 billion for financially supporting private firms and their employees through the International Finance Corporation (IFC), its private sector lending facility.

- It is to set up a $5 billion facility to support private sector investors and lenders to tackle the fallout from the pandemic.

- Health Emergency Preparedness and Response Multi-Donor Fund (HEPRF), a multi-donor trust fund is to be set up to help countries get ready for disease outbreaks. Japan has already pledged to be a founding donor to this fund.

- It is to issue additional ‘pandemic bonds’ to help developing countries. The concept was introduced in 2017. The investors could buy these bonds and get interest payments. In case of a serious disease outbreak, the developing country could use a part or all of the principal.

ADB:

- In April, the ADB committed $20 billion for COVID-19 response. This includes $5 billion for concessional lending and grants.

- Up to $13 billion could be used in a new COVID-19 Pandemic response option under its Counter-cyclical Support Facility.

- These funds are to be used to finance the expenditures of poor and vulnerable countries’ governments.

- Of this 20 billion USD commitment, $2 billion has been set aside for loans and guarantees to boost the private sector.

AIIB:

- AIIB announced the establishment of a Crisis Recovery Facility to provide $10 billion financing over a period of 18 months. This is to be available to both public and private sector

- The facility is to focus on health infrastructure, pandemic preparedness, liquidity support and immediate support (budgetary and fiscal).

NDB:

- The NDB approved 1 billion USD worth of emergency assistance loans to China. It also issued Yuan-denominated bonds to help finance expenditure in areas of China that were hit the worst by the virus.

- It is to set up an ‘Emergency Assistance Facility’ to provide emergency loans to the member countries. These loans are to be used to meet expenses related to COVID-19 response and in economic recovery.

How has India used the services of IFIs?

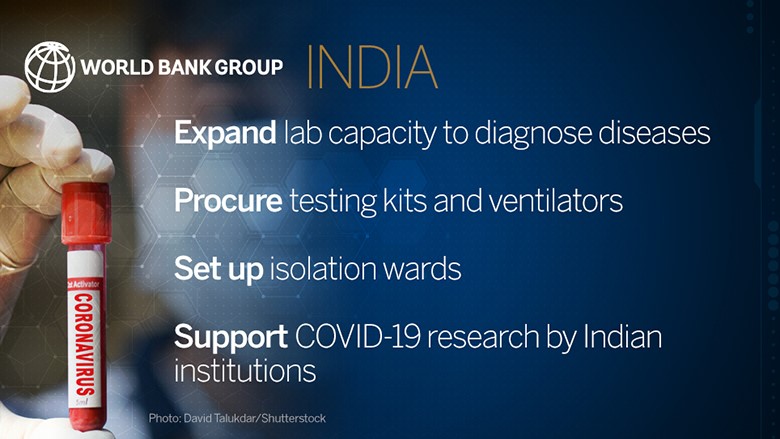

- India has got approval for $1 billion for the Indian COVID-19 Emergency Response and Health Systems Preparedness Project from the WB to support screening, contract tracing and diagnostics, procurement of PPE, setting up isolation facilities, etc.

- This is the largest health sector support from WB to India.

- The ADB approved a $5 billion loan to India under the CARES program (COVID-19 Active Response and Expenditure Support Program) which is funded through the COVID-19 pandemic response option (CPRO).

- The CARES program is to help in the COVID-19 response activities including containment, disease prevention, provision of social protection for the vulnerable categories of the population, etc.

- The NDB approved the Emergency Assistance Program in Combating COVID-19 under which a loan of 1 billion USD is to be lent to Indian government.

- This program envisages COVID-19 response activities like disease prevention and detection, funding of critical healthcare expenditures to enhance capacity and preparedness and to provide immediate economic assistance to enable economic and social recovery.

What are the challenges?

- Though the IFIs have been pulling out stops to meet the unprecedented demands for their assistance and services, experts have raised concern that the funds would still be insufficient.

- Loans from the IFIs- like from the IMF- are conditioned on economic reforms such as austerity measures and structural reforms. The current need for finances has been triggered by exogenous shocks and not by irresponsible economic policies. Hence, policy experts are questioning whether such conditionality must be applied to the assistance seeking countries.

- In addition to this, negotiating these conditionalities take time– something that cannot be wasted in fighting the impacts of the fast-spreading virus.

- Political tensions have been impacting some countries’ ability to access the IFIs’ assistance.

- In Iran’s case, the ‘maximum pressure’ campaign’ of the USA has been impeding its ability to freely access IMF’s program. This is because the USA is the largest shareholder in the Fund and has the largest voting share. It has the ability to veto major policy decisions in the IMF.

- In case of Venezuela, the IMF had declined the South American country’s request for assistance as its members were in disagreement over the legitimacy of President Maduro.

- In some countries, like Sudan, transitional governments are in place. They have only recently started improving relations with the international community and are still ridden with large arrears to their institutions. Because of this they aren’t able to access most of the IFI financing mechanisms.

- Delayed or insufficient access to such financial assistance could exacerbate pre-existing issues in many countries.

- The ability of the countries to repay the loans to these IFIs would be affected given the impact of the virus on the economies. In addition to this, the GDP growth projections have been discouraging.

- Even before the COVID-19 crisis, 40% of low income countries were already at a high risk of debt distress.

- In addition to this, private capital markets would become more risk averse because of the global downturn.

What is the way forward?

- To overcome the delay in financial disbursals, the IFIs have been working to increase their flexibility and expedite the processing of requests for emergency financing.

- The SDR of IMF could be used to overcome the roadblock being posed by the USA in case of financial assistance to countries like Iran. Iran, for instance, has $1 billion worth of SDR within the Fund. A part of it could be sold to obtain a freely usable currency which is then transferred to an account managed by Iran’s central bank but outside the country. This could then be used to meet the expenditure needs of the virus-stricken country.

- Need to gather more political support for SDR allocation. The necessary technical work for this SDR allocation must be simultaneously undertaken.

- There is a need to set aside political differences among the countries as the pandemic could potentially turn into a serious humanitarian crisis.

- The richer countries need to understand that only if the virus is eliminated across the world– even in the poorest countries and countries under sanctions- will it be able to eliminate it completely in its own territory.

- IFIs need to engage with each eligible countries to avoid attempts by creditors to curtail on coverage or reach opaque side agreements.

- The debt service relief must be quickly operationalized at least for the poorest countries.

- The lending capacity of the MDBs must be increased and a less conservative approach must be used in deploying the capital.

- Need to create new framework for debt sustainability and financing for the at-risk low-income countries.

Conclusion

The current health and economic crisis have put unprecedented pressure on the IFIs, with both developed and developing countries- let alone the economically poor countries- looking for financial assistance. The IFIs for their part are trying to mobilize finances for the countries. However, various issues ranging from pre-existing economic weaknesses and debt burden to political tensions are presenting as impediments to the countries gaining from these assistances. Prioritized action supported by mature political leadership at the IFIs is the need of the hour.

Practice question for mains

The COVID-19 crisis has given rise to an unprecedented demand for external financing. Examine the role of IFIs in this context. (250 words)

https://en.wikipedia.org/wiki/International_financial_institutions

https://www.brettonwoodsproject.org/2019/01/art-320747/

http://www.ddegjust.ac.in/studymaterial/mba/fm-305.pdf

https://www.imf.org/en/About/Factsheets/IMF-at-a-Glance

https://www.worldbank.org/en/about/history

https://www.worldbank.org/en/who-we-are/ibrd

https://www.investopedia.com/terms/a/asian-infrastructure-investment-bank-aiib.asp

https://www.aiib.org/en/about-aiib/who-we-are/financing-operations/index.html

https://www.adb.org/who-we-are/about#history

https://www.adb.org/news/adb-approves-1-5-billion-financing-support-indias-covid-19-response

https://www.ndb.int/about-us/organisation/members/

https://www.investopedia.com/terms/a/asian-development-bank.asp

https://www.ndb.int/about-us/essence/history/

https://www.ndb.int/about-us/essence/our-work/

https://www.csis.org/analysis/tracking-international-financial-institutions-covid-19-response

https://www.everycrsreport.com/reports/R46342.html

https://www.ndb.int/emergency-assistance-program-in-combating-covid-19-india/

https://www.aljazeera.com/ajimpact/imf-overcome-roadblocks-give-aid-iran-200416233604121.html

https://www.cgdev.org/blog/what-next-international-financial-response-covid-19-crisis