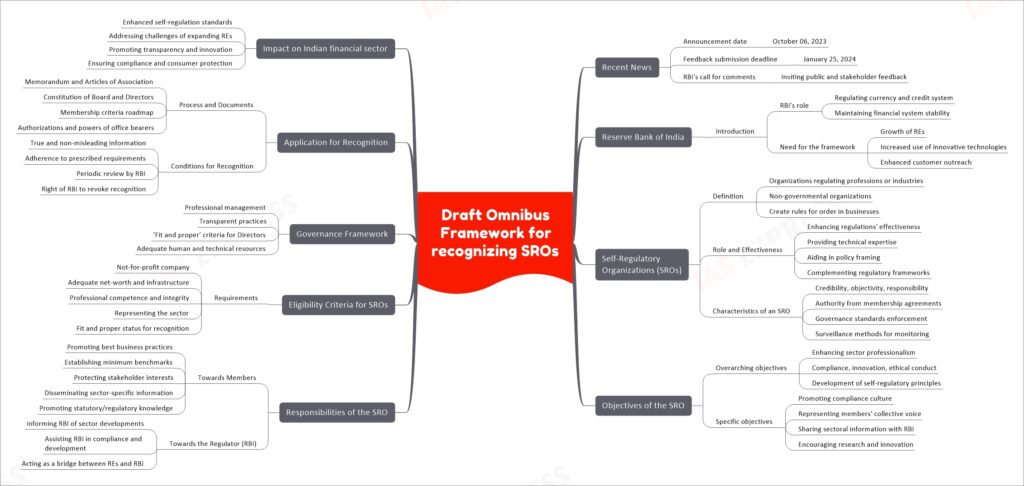

Draft Omnibus Framework for recognizing SROs

In simple terms, the Draft Omnibus Framework released by the RBI aims to establish improved standards for self-regulation in the financial sector by recognizing and regulating Self-Regulatory Organizations (SROs). These SROs are non-governmental bodies that will create rules to ensure order and ethical practices among businesses and organizations in various sectors. The framework outlines the roles, responsibilities, eligibility criteria, and governance standards for these SROs. It is part of RBI’s effort to enhance regulatory efficiency, foster innovation, and protect stakeholder interests in an increasingly complex and technologically advanced financial landscape.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.