Direct Tax in India – Need, Challenges, Government Measures

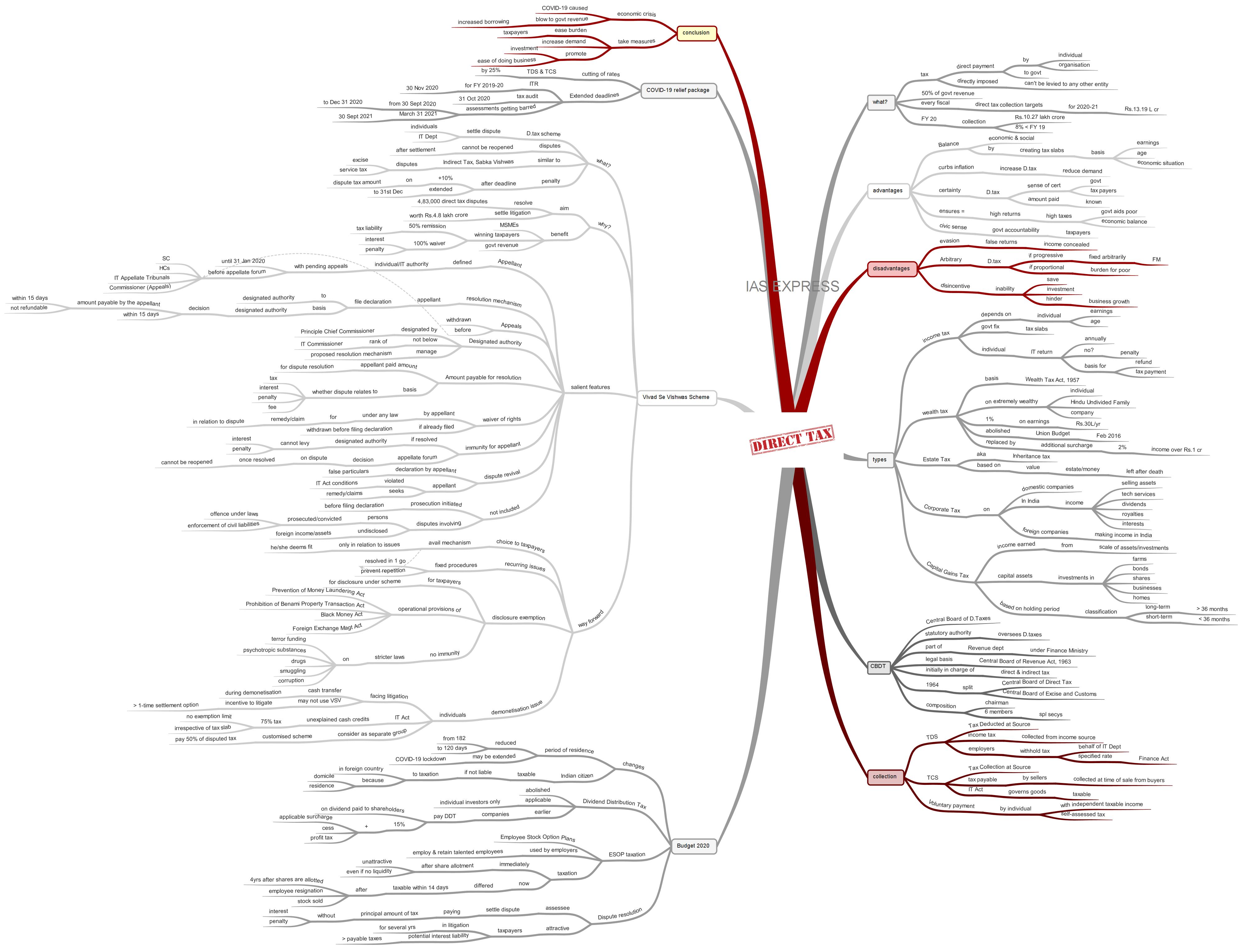

Direct tax contributes to a significant portion of the government’s revenue. However, with the growing economic crisis due to the coronavirus outbreak, the government was forced to ease tax burdens on individuals. The Income Tax department has set its budgetary direct tax collection target for 2020-21 at Rs.13.19 lakh crore, 28% higher than the actual collection in the last fiscal, which ended on May 31, with a huge reliance on Vivad se Vishwas scheme that provides for a direct tax dispute resolution mechanism. Yet, this novel scheme is also facing challenges due to the pandemic. It is necessary to ease pressure on taxpayers to increase spending and promote new businesses, while also ensuring necessary revenue sources for the government.

This topic of “Direct Tax in India – Need, Challenges, Government Measures” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is the Direct Tax?

- Direct taxes are taxes that are paid directly to the government by an individual/organisation.

- It is imposed directly and cannot be levied to any other entity for payment.

- It is one of the two major sources of government revenue. The other is the indirect tax.

- Direct taxes form around 50% of the government’s revenue share every fiscal.

- The government sets direct tax collection targets for every financial year to enhance revenue.

- The country’s direct tax collection for FY 20 stood at Rs.10.27 lakh crore, 8% lower than the previous year’s collections

What are the advantages of direct tax?

- Balance: The government achieves economic and social balance by creating tax slabs based on individuals’ earnings and age. The tax slab determined based on the country’s economic situation. Individuals are exempted so that income inequalities are balanced.

- Addresses inflation issues: Government increases taxes during inflation in order to reduce the necessity for goods and services, which leads to a decrease in inflation.

- Certainty: The direct tax creates a sense of certainty for the government and the taxpayers, as the amount of tax that must be paid and collected is known by the taxpayer and the government respectively.

- Ensures equality: Individuals and organisations with higher returns are to pay higher taxes to the government so that it can aid the poor and vulnerable within the society. This ensures economic balance.

- Civic sense: An individual is aware of paying taxes. Thus, he/she feels conscious of his/her rights and is proactive in the government’s usage of the taxes. This ensures accountability from the government’s side.

What are the disadvantages of direct taxes?

- Easily evadable: Not all are willing to pay their taxes to the government. Some are willing to submit a false return of income to evade tax. These individuals can easily conceal their incomes, with no accountability to the law of the land.

- Arbitrary: Taxes, if progressive, are fixed arbitrarily by the Finance Minister. If proportional, it creates a heavy burden on the poor.

- Disincentive: If there are high taxes, it does not allow an individual to save or invest, leading to the economic suffering of the country. It does not allow businesses/industry to grow, inflicting damage to them.

What are the types of direct tax?

Income Tax:

- Depending on the individual’s earnings and age, the income tax is imposed.

- The government fixes various tax slabs, which determine the amount of income tax that needs to be paid by the individual.

- The taxpayer should file Income Tax Returns (ITR) annually, failing which penalty is levied.

- Depending on the ITR, the individual receives a refund or might have to pay a tax.

Wealth Tax:

- According to the Wealth Tax Act, 1957, an individual, a Hindu Undivided Family or a company must pay a wealth tax of 1% on earnings of the Rs.30 lakh per annum.

- This tax is levied on the extremely wealthy individuals, companies or HUFs at the end of a particular fiscal year.

- This reduces income inequalities within the country and ensures high revenue for the government.

- It was abolished in Union Budget on February 2016 and was replaced by an additional surcharge of 2% on the superrich with a taxable income of over 1 crore annually.

Estate Tax:

- Estate Tax or Inheritance Tax is paid based on the value of the estate or the money that an individual has left after his/her death.

- Domestic companies, apart from shareholders, will have to pay corporate tax.

- Foreign companies who make income in India must also pay this tax.

- Income earned by selling assets, technical services, dividends, royalties or interest that is based in India are also taxable

Capital Gains Tax:

- It is imposed on the income that is earned from the scale of assets or investments.

- Investments in farms, bonds, shares, businesses, art and home are capital assets.

- Based on the holding period, they are classified into long-term and short-term.

- Any assets, apart from securities, that are sold within 36 months from the time of acquisition come under the short-term gains.

- The long-term assets are levied if the income is generated from the sale of assets that were held for more than 36 months.

Who oversees direct taxation in India?

- The Central Board of Direct Taxes (CBDT) is a statutory authority that oversees direct taxation in India.

- It was established after the enactment of Central Board of Revenue Act, 1963.

- Initially, it was in charge of both direct and indirect taxes. However, when the administration of the taxation became difficult, it was split into Central Board of Direct Taxes and Central Board of Excise and Customs since 1964.

- CBDT is responsible for the administration of the direct tax laws and is a part of the Department of Revenue under the Union Finance Ministry.

- The body is headed by a chairman and 6 members, who are also special secretary to the government.

How is the direct tax collected?

Tax Deducted at Source (TDS):

- Tax Deducted at Source is the collection of income tax directly from the individual’s source of income periodically or occasionally.

- All entities in India, including foreign representative offices and Indian setups like wholly-owned subsidies, should withhold tax on employees’ salaries on behalf of the IT department.

- The employer may also deduct TDS on various other payments like rent, interest, dividend and royalty.

- The Finance Act of each financial year specifies the rates in force for deduction of tax at source according to the IT Act, 1961.

Tax Collection at Source (TCS):

- TCS is the tax payable by a seller, which he collects from the buyer at the time of sale.

- IT Act governs the goods on which the seller has to collect taxes.

Voluntary payment by taxpayers:

- Every taxpayer, who earns taxable income, must pay income tax in India.

- An individual who has an independent income can deposit self-assessment tax or advance tax to the credit of government by using a tax payment form.

What were the changes made in the direct tax regime under Union Budget 2020?

Taxation of individuals:

- The government has made changes in the period of residence in India, which would make a person be regarded as a resident.

- Period of residence has been reduced from 182 to 120 days.

- Conversely, the overseas stay should be 240 days instead of 182 days.

- It should be noted that the CBDT has decided to extend this time frame in consideration to those who were forced to stay back in India due to coronavirus lockdown.

- Another change made during the budget is that an Indian citizen would be regarded as resident in India if he is not liable to pay tax in a foreign country because of his domicile, residence etc., there.

- This widens the ambit of overseas Indians who are liable to pay tax in India.

- There is no choice available to opt for a reduced tax rate regime, like in the case of companies, if one forgoes deduction, exemptions and concessions.

Dividend Distribution Tax:

- Dividend Distribution Tax (DDT) was abolished and will apply to individual investors only.

- Earlier, the companies were required to pay DDT on the dividend paid to its shareholders at the rate of 15% plus applicable surcharge and cess, which is in addition to the tax payable by the company on its profit.

- This has increased the burden for investors, especially those liable to pay tax less than the rate of DDT if the dividend is included in their income.

- This decision would make the Indian equity market more attractive and provide relief for investors.

ESOP taxation:

- Employee Stock Option Plans (ESOPs) are used by the start-ups to employ and retain highly talented employees during the times of cash crunch.

- However, the taxation on ESOPs curtails the benefits for the employee. Previously, the employee has to pay tax once the shares are allotted even if there is no liquidity.

- Given the shares of start-ups are generally unlisted, there is no available market to sell them and generate cash, creating cash flow challenges for employees as they receive a benefit in kind but need to pay tax from their pocket.

- To address these issues, the Finance Bill deferred taxation to future years. It proposed that the stock option allotted by an eligible startup is taxable within 14 days after the following events:

- Expiry of 4 years from the end of the year in which shares are allotted

- Sale of stock option by the employee

- Resignation by the employee

Dispute resolution:

- One of the interesting aspects of Finance Bill is the provision for allowing assessee who is in appeals on tax disputes to settle the dispute by paying the principal amount of tax without having to pay interest or penalty.

- This is attractive for those taxpayers who are in litigation for several years and who have run up a potential interest liability that exceeds payable taxes.

What is Vivad Se Vishwas Scheme?

- Vivad Se Vishwas Scheme is the direct tax scheme announced during Budget 2020 for settling tax disputes between individuals and the IT department.

- Any income tax disputes settled under this scheme cannot be reopened in any other proceedings by the IT Department or other designated authority.

- This scheme is similar to the ‘Indirect Tax, Sabka Vishwas’ scheme that was introduced to settle disputes related to excise and service tax

- Earlier, the scheme offered complete waiver on interest and penalty to the taxpayers with a full and final settlement on the dispute if individuals availed it by 31st March 2020. Anyone opting for settlement after 31st March should pay an additional 10% penalty on the disputed tax amount.

- Now, the payment without additional amount is extended to 31st December of this year as a part of the COVID-19 relief package.

Why was it introduced?

- The Vivad se Vishwas scheme aims to resolve 4,83,000 direct tax disputes that are pending in various appellate forums.

- It is expected to resolve a major part of direct tax litigation worth about Rs.4.8 lakh crore by way of remission and waiver of interest and penalty for all pending disputes for which an appeal is filed.

- This scheme is highly beneficial for MSMEs to settle their tax dispute instead of litigating their tax positions with their limited resources

- The scheme’s provisions also provide relief for taxpayers who win their appeal at any stage by giving 50% remission of tax liability and 100% waiver of interest and penalty.

- This mechanism also provides timely revenue for the government and helps ease business operations.

What are the salient features of Direct Tax Vivad se Vishwas Act, 2020?

- Appellant: The Act defines an appellant as the income-tax authority or the person or both, whose appeal is pending before any appellate forum as on 31st January 2020. These appellate forums include the Supreme Court, High Courts, the Income Tax Appellate Tribunals, and the Commissioner (Appeals).

- Resolution mechanism: The Act provides for a resolution mechanism under which an appellant can file a declaration to the designated authority of the initial resolution of pending direct tax disputes. Based on the declaration, the designated authority would decide the amount payable by the appellant against the dispute and provide a certificate, consisting of details of the payable amount, within 15 days of the receipt of the declaration. The appellant must pay this amount within 15 days after receiving the certificate. This amount is not refundable.

- Appeals withdrawal: Once the designated authority issues the certificate, appeals pending before IT Appellate Tribunals and the Commissioner (Appeals) will be deemed to be withdrawn. If the appeals or petitions are pending before the SC and HCs, the appellant should withdraw appeal/petition.

- Designated Authority: The Principle Chief Commissioner will designate an officer, not below the rank of a Commissioner of Income Tax as the designated authority, who manages the proposed resolution mechanism.

- The amount payable for resolution: The amount paid by the appellant for resolution of dispute is determined based on whether the dispute relates to the payment of tax or payment of interest, penalty or fee. Also, he is required to pay an additional amount if such payment is made after the deadline (31st December 2020).

- Waiver of rights: For dispute resolution, the appellant should furnish an undertaking waiving his rights to seek any remedy or claim concerning that dispute under any law, including the IT Act, 1961. All such claims already filed about the dispute should be withdrawn before filing the declaration.

- Immunity for the appellant: Once the dispute is resolved, the designated authority cannot levy interest or penalty in relation to that dispute. Furthermore, an appellate forum can decide on matters pertaining to dispute once it is resolved. Such matters cannot be reopened in any proceedings under any law.

- Revival of disputes: The declaration filed by an appellant will become invalid if its particulars were found to be false, appellant violates any of the conditions referred in the IT Act or he seeks any remedy or claim in relation to that dispute. Consequently, all proceedings and claims withdrawn based on the declaration will be revived.

- Disputes that are outside the ambit of this mechanism include:

- Those disputes where the prosecution has been initiated before the declaration is filed

- Disputes which involves persons who have been convicted or are being prosecuted for the offence under certain laws (like IPC) or enforcement of civil liabilities

- Disputes involving undisclosed foreign income or assets

What can be the way ahead?

Choice for taxpayers:

- One of the vital functions of Vivad Se Vishwas is the providing of the flexibility of choice to the taxpayers.

- Any disputes around additions made by the tax authorities for an assessment year may typically involve multiple issues before appellate authorities.

- In such cases, the taxpayer should be given an option to avail this mechanism only in relation to issues he/she deems fit.

Resolving recurring issues:

- Procedures must be provided to resolve recurring issues even for the future in relation to which assessment has not been initiated.

- This will ensure that the future recurring issues of the taxpayers will be resolved in one go and they are relieved from future litigations for the same and recurring issues.

Exemption of disclosures:

- Vivad Se Vishwas mechanism must ensure that the taxpayers do not face any adverse consequences after disclosure under the scheme.

- The scheme should allow exemption from operational provisions of the Prevention of Money Laundering Act, Prohibition of Benami Property Transaction Act, Black Money Act and Foreign Exchange Management Act.

- However, immunity should not be provided for stricter laws, like those dealing with terror funding, drugs, psychotropic substances, smuggling and corruption.

Solving the demonetisation issue:

- After demonetisation, provisions concerning cash transactions were introduced in the IT Tax.

- According to the provisions of the IT Act, unexplained cash credits are taxed at a flat rate of 75% (including cess) without providing any benefit of basic exemption limit and irrespective of tax slab.

- A major section of taxpayers are facing litigation pertaining to cash transferred made during demonetisation.

- Such taxpayers may be unwilling to use this scheme, as the incentive to litigate is higher than the one-time settlement option.

- Such cases may be considered as a separate group, which may be given a customised scheme to pay 50% of the disputed tax.

What were the direct tax measures announced by the Finance Minister as a part of COVID-19 relief package?

Cutting of TDS and TCS rates:

- Under the COVID-19 relief package, the rates of tax deduction at source (TDS) and tax collection at source (TCS) have been cut by 25% for the next year.

- This concession is applicable for 23 specified payments, like dividend, payment to insurance commission etc., where TDS is levied at a rate ranging between 20% and 1% and 11 payments where TCS is applicable.

Extension:

- The Centre has extended the deadline for income tax returns for the financial year 2019-20, with the due date, now pushed to 30th November 2020.

- The tax audit deadline has been extended to 31st October 2020, from 30th September 2020.

- The date of assessments getting barred on 30th September 2020 has now been extended to December 31, 2020.

- Those that are going to be barred on 31st March 2021 will be extended to 30th September 2021.

Conclusion:

Currently, with the coronavirus-led economic crisis, the government’s revenue is facing a huge blow, leading to an increase in its borrowings. To reduce the impact, the government must take proactive measures to ease the burden on taxpayers, so that they are able to increase demand within the economy and can invest in growth and development of the economy. This, along with Sabka Vishwas scheme for indirect taxes and Vivad Se Vishwas scheme, will enable ease of doing business and economic development of the country.

Practice questions for mains:

Critically examine how the government can make use of direct tax mechanism to increase revenue during the economic crisis. (250 words)

https://www.financialexpress.com/budget/budget-2020-a-sea-change-in-the-direct-tax-regime/1851453/

https://www.india-briefing.com/news/direct-taxes-in-india-explained-14340.html/

https://www.taxscan.in/vivad-se-vishwas-scheme-you-need-know/47561/

https://www.bankbazaar.com/tax/direct-tax.html

https://www.business-standard.com/about/what-is-direct-taxes-code