RuPay Domestic Card Scheme Agreement

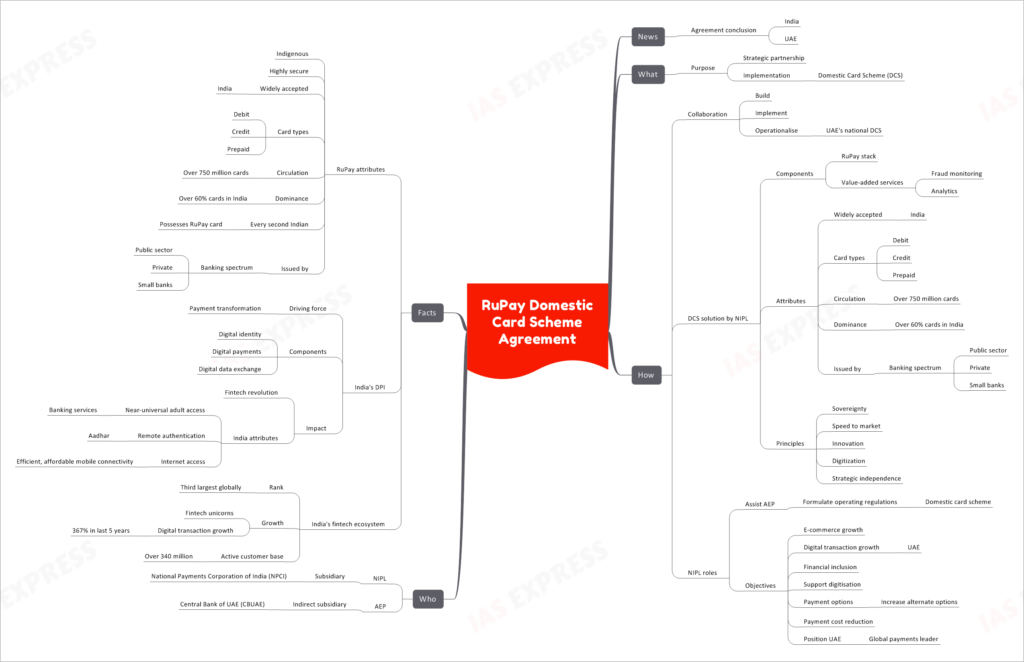

In recent news, India and the United Arab Emirates (UAE) have concluded a significant agreement to bolster their strategic partnership through the implementation of the RuPay Domestic Card Scheme (DCS).

This topic of “RuPay Domestic Card Scheme Agreement” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is the RuPay Domestic Card Scheme Agreement?

Purpose

The primary aim of this agreement is to solidify the strategic partnership between India and the UAE through the implementation of the Domestic Card Scheme (DCS). The DCS is a crucial component of this partnership.

How it Works

The collaboration involves building, implementing, and operationalizing the UAE’s national DCS. The DCS solution is developed by the National Payments Corporation of India (NPCI), a subsidiary of NIPL.

DCS Solution by NIPL

- Components

- RuPay Stack: The core technology infrastructure for the DCS.

- Value-added services: Including fraud monitoring and analytics.

- Attributes

- Widely Accepted in India: RuPay cards are widely accepted across India.

- Card Types: The scheme includes debit, credit, and prepaid card options.

- Circulation: With over 750 million cards in circulation.

- Dominance in India: Over 60% of cards in India are RuPay cards.

- Issued by Diverse Banks: RuPay cards are issued by a spectrum of banks, including public sector, private, and small banks.

- Principles

- Sovereignty: Ensuring control over domestic payment systems.

- Speed to Market: Promoting rapid implementation.

- Innovation: Encouraging technological advancements.

- Digitization: Fostering a digital payments ecosystem.

- Strategic Independence: Reducing dependency on international card networks.

NIPL Roles

NIPL plays a pivotal role in assisting the Abu Dhabi Global Market’s (ADGM) subsidiary, Abu Dhabi Exchanges Partners (AEP), which is an indirect subsidiary of the Central Bank of UAE (CBUAE).

- Objectives

- Promote E-commerce growth.

- Drive digital transaction growth in the UAE.

- Enhance financial inclusion.

- Support digitization efforts.

- Increase payment options and reduce costs.

- Position the UAE as a global payments leader.

Key Players

NIPL (National Payments Corporation of India)

- A subsidiary responsible for the development and implementation of the RuPay DCS.

AEP (Abu Dhabi Exchanges Partners)

- An indirect subsidiary of the Central Bank of UAE (CBUAE) that collaborates with NIPL and formulates operating regulations for the domestic card scheme.

Facts About RuPay and India’s Payment Landscape

RuPay Attributes

- Indigenous and highly secure payment system.

- Widely accepted across India.

- Offers debit, credit, and prepaid card options.

- Over 750 million RuPay cards in circulation.

- Holds over 60% market share of cards in India.

- Nearly every second Indian possesses a RuPay card.

- Issued by a diverse range of banks, including public sector, private, and small banks.

India’s DPI (Digital Payments Infrastructure)

- A driving force behind India’s payment transformation.

- Comprises digital identity, digital payments, and digital data exchange components.

- Has fueled the fintech revolution in India.

- Key attributes include near-universal adult access to banking services, remote authentication through Aadhar, and efficient, affordable mobile connectivity.

India’s Fintech Ecosystem

- Ranked as the third-largest globally.

- Witnessed the emergence of fintech unicorns.

- Recorded a remarkable 367% growth in digital transactions in the last five years.

- Boasts an active customer base of over 340 million users.