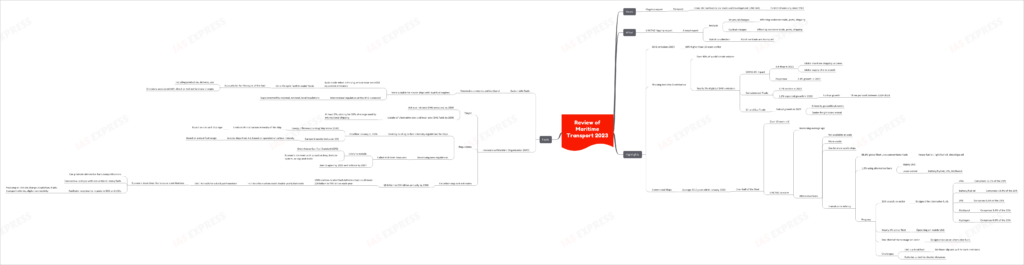

Review of Maritime Transport 2023

The “Review of Maritime Transport 2023” is the latest flagship report released by the UN Conference on Trade and Development (UNCTAD), marking its annual tradition that began in 1968. This comprehensive report delves into the structural and cyclical changes impacting seaborne trade, ports, and shipping, while also providing crucial statistics about maritime trade and transport.

This topic of “Review of Maritime Transport 2023” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Key Highlights

Greenhouse Gas Emissions (GHG)

- GHG emissions in 2023 are a staggering 20% higher than they were a decade ago, indicating a concerning trend in the shipping industry.

Contribution of Shipping Industry

- The shipping industry plays a pivotal role, contributing to over 80% of the world’s trade volume.

- It is also responsible for nearly 3% of global GHG emissions, highlighting its environmental impact.

COVID-19 Impact

- In 2022, the global maritime shipping industry experienced a 0.4% drop in shipping volumes, mainly due to supply chain disruptions caused by the COVID-19 pandemic.

Projections

- The report forecasts a 2.4% growth in the maritime shipping industry for the year 2023.

- Despite the setback in 2022, containerized trade is expected to grow by 1.2% in 2023, with further growth projected at 3% between 2024 and 2028.

- Oil and gas trade saw robust growth in 2022, driven by geopolitical events, leading to a revival in tanker freight rates.

Commercial Ships

- As of January 2023, the average age of commercial ships is 22.2 years, with over half of the fleet being more than 15 years old.

- UNCTAD expresses concerns about the increasing average age of the fleet and the challenges associated with transitioning to alternative fuels.

Transition to Alternative Fuels

- The adoption of alternative fuels remains in its infancy, with only 1.2% of the global fleet using them. The majority (98.8%) still relies on conventional fuels such as heavy fuel oil, light fuel oil, and diesel/gas oil.

- Notably, liquefied natural gas (LNG) is the primary alternative fuel, with lesser use of battery/hybrid, liquified petroleum gas (LPG), and methanol.

- Progress is evident, with 21% of vessels on order designed for alternative fuels. Among these, LNG comprises 52.1%, battery/hybrid 39.9%, LPG 5.5%, methanol 3.4%, and hydrogen 0.3%.

- Nearly 6% of the active fleet is already operating primarily on LNG.

- Challenges lie ahead, as LNG is still considered a fossil fuel with issues like methane slip and well-to-tank emissions, and batteries are better suited for shorter distances.

International Maritime Organization (IMO) Initiatives

GHG Emission Target

- The IMO has set a bold target of achieving net-zero GHG emissions from international shipping by 2050.

Uptake of Alternative Fuels

- The 2023 IMO GHG Strategy aims for at least 5% uptake of alternative zero and near-zero GHG fuels by 2030, with an aspirational goal of reaching 10% of energy used by international shipping.

Regulatory Changes

- Existing carbon intensity regulations for ships are under revision, with a deadline of January 1, 2026. These regulations include the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII), which assess operational carbon intensity based on fuel usage.

- New regulations, known as “mid-term measures,” are under development. These include the Greenhouse Gas Fuel Standard (GFS) and economic elements like carbon levies, feebate systems, or cap-and-trade. The aim is to finalize these regulations by 2025 and enforce them by 2027.

Decarbonization Challenges and Costs

- Achieving full decarbonization could require annual investments ranging from $8 billion to $28 billion by 2050.

- The infrastructure needed for 100% carbon-neutral fuels may demand annual investments between $28 billion to $90 billion.

- It’s important to note that full decarbonization might double yearly fuel costs, emphasizing the need for a just transition.

Economic Incentives

- UNCTAD advocates for economic incentives, such as levies or contributions, to promote the competitiveness of alternative fuels and bridge the cost gap with conventional heavy fuels.

- These incentives can also facilitate investments in ports, especially in Small Island Developing States (SIDS) and Least Developed Countries (LDCs), focusing on climate change adaptation, trade and transport reforms, and digital connectivity.

Sustainable Fuels

- Renewable ammonia and methanol are identified as more suitable for newer ships equipped with dual-fuel engines.

- For these fuels to be truly sustainable, they must achieve zero or near-zero carbon dioxide equivalent emissions on a life-cycle ‘well-to-wake’ basis, considering the full production, delivery, and usage process, as well as any associated land use changes.

- International regulations at the IMO need to be complemented by regional, national, and local regulations to ensure the sustainability of these fuels.