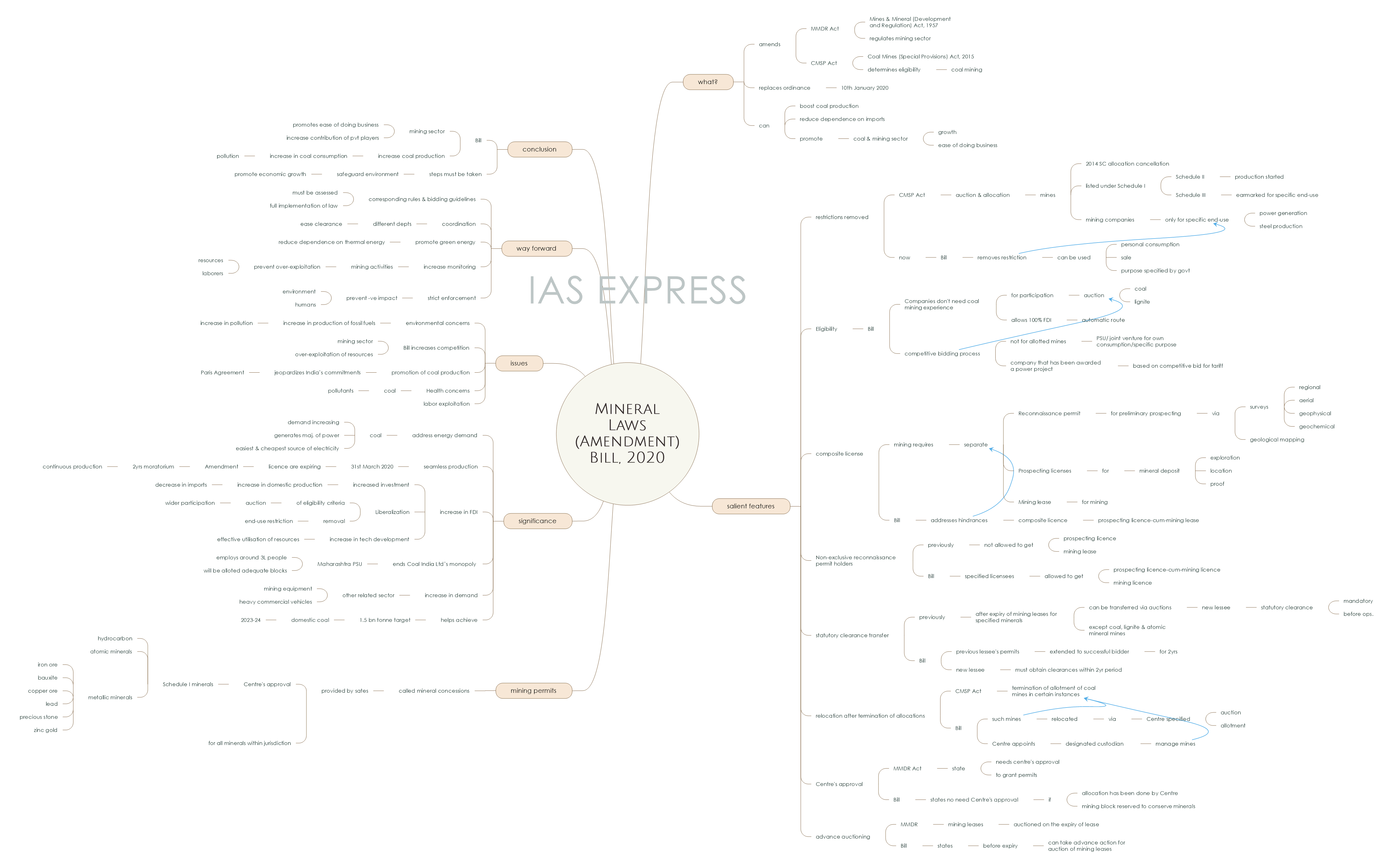

Mineral Laws (Amendment) Bill, 2020 – Features, Significance & Issues

Recently, the Parliament had passed the Mineral Laws (Amendment) Bill, 2020 to make changes in the Mines and Mineral (Development and Regulation) Act, 1957 and the Coal Mines (Special Provisions) Act, 2015. This is a significant step towards boosting the economy that is currently facing the brunt of the global recession and the pandemic. Though this Bill may improve India’s balance sheets by reducing the coal imports, it simultaneously causes a significant impact on the environment by opening the mining sector to the private players. The government must ensure that there is a strict regulation so that the people and the environment do not feel the negative impact of this move.

This topic of “Mineral Laws (Amendment) Bill, 2020 – Features, Significance & Issues” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What is Mineral Laws (Amendment) Bill, 2020?

- The Parliament had recently passed the Mineral Laws (Amendment) Bill, 2020 to amend:

- Mines & Mineral (Development and Regulation) Act, 1957 (MMDR Act)

- Coal Mines (Special Provisions) Act, 2015 (CMSP Act)

- This Bill replaces the Ordinance for amendment of both Acts, which was promulgated on 10th January 2020.

- The Mines and Minerals Act, 1957 regulates the mining sector, while the Coal Mines Act, 1973 determines the eligibility for coal mining in India.

- This Bill promotes growth and Ease of Doing Business in the Indian coal and mining sector by boosting coal production and reducing the dependence on imports.

What are the salient features of Mineral Laws (Amendment) Bill, 2020?

Removal of restriction:

- The Coal Mines (Special Provisions) Act provides for auction and allocation of mines whose allocation was cancelled by the Supreme Court in 2014. These mines are listed under Schedule I of the Act.

- Schedule II and III are sub-classes of the mines listed in the Schedule I.

- Schedule II lists out mines whose production has already started then and Schedule III mines are those that are earmarked for specific end-use.

- As per the existing Act, the companies that are acquiring Schedule II and Schedule III coal mines through auction can use the coals produced in these mines only for specific end-uses like for power generation and steel production.

- The Bill removes this restriction imposed by the Act.

- It allows companies to undertake coal mining operation for personal consumption, sale or for any other purpose as specified by the Union.

Eligibility:

- The Bill elucidated that the companies do not need to possess any coal mining experience in India to participate in the auction of coal and lignite blocks.

- This allows 100% Foreign Direct Investment in the sector via automatic route.

- Also, the competitive bidding process for auction of coal and lignite blocks will not apply to mines considered for allotment to:

- A government company or its joint venture for own consumption, sale or any other specified purpose

- A company that that has been awarded a power project based on a competitive bid for a tariff.

The merger of licences:

- Currently, three licences are required while engaging in the mining activity in India. They are:

- Reconnaissance permit

- Prospecting licences

- Mining lease

- Reconnaissance permit is granted for preliminary prospecting through regional, aerial, geophysical or geochemical surveys and geological mapping.

- A prospecting licence is granted for exploring, locating and proving mineral deposits.

- To mine the proven deposits, mining licence is mandatory.

- These licences have to be taken separately.

- This feature has been a major hindrance for investors as prospecting is an expensive business, both in technology as well as in the cost. This seemed unattractive to the investors as they rarely get mining licence after they have proven the existence of minerals within that specific area.

- To address this issue, the Bill adds a composite licence called “prospecting licence-cum-mining lease” to provide both prospecting licence and mining lease under one umbrella.

Non-exclusive reconnaissance permit holders to get other licences:

- Currently, the holders of non-exclusive reconnaissance permit for exploration of specified minerals are not permitted to obtain prospecting licence or mining lease.

- The Bill permits such holders to apply for the prospecting licence-cum-mining licence or mining licence.

- This will apply to certain licensees as prescribed in the Bill.

Transfer of statutory clearance to new bidders:

- Previously, after the expiry of mining leases for specified minerals (minerals other than coal, lignite and atomic minerals), it can be transferred to new individuals via auctions.

- This new lessee should obtain statutory clearance before starting mining operations.

- The Bill provides that the various approvals, licences and clearances that are given to the previous lessee will be extended to the successful bidder for two years.

- During this period, the new lessee will be allowed to continue mining

- However, the new lessee must obtain all the required clearances within this two-year period.

Relocation after the termination of all allocations:

- The Coal Mines (Special Provisions) Act, 2015 provides for the termination of allotment orders of coal mines in certain instances.

- The Bill adds that such mines may be relocated via auction or allotment as may be determined by the Centre.

- The Centre will appoint a designated custodian to manage these mines until they are relocated.

Approval from the Union Government:

- According to Mines & Minerals (Development and Regulation) Act, State Governments need prior approval from the Centre to grant reconnaissance permit, prospecting licence or mining lease for coal and lignite.

- The Bill states that the Central Government’s approval is not required for granting licences for coal and lignite in certain cases. These cases include:

- The allocation has been done by the Central Government,

- The mining block has been reserved to conserve a mineral.

Advance auctioning:

- According to the Mines & Minerals (Development and Regulation) Act, mining leases for specified minerals (minerals other than coal, lignite and atomic minerals) are auctioned on the expiry of the lease.

- According to the Bill, the state governments can auction a mining lease before expiry.

Who gives the permits in the mining sector?

- The state governments provide permits for mining, which are called mineral concessions, for all the minerals located within their respective jurisdictions. This comes under the provisions of the Mines & Minerals (Development and Regulation) Act, 1957 and Mineral Concession Rules, 1960.

- However, for minerals specified under the Schedule I of the Mines & Minerals (Development and Regulation) Act, 1957, the Centre’s approval is necessary before granting the mineral concession.

- Minerals specified under the Schedule I include hydrocarbon, atomic minerals and metallic minerals like iron ore, bauxite, copper ore, lead, precious stones, zinc and gold.

What is the significance of this Bill?

- Addresses energy demand: The demand for coal within the country is increasing exponentially in recent times as the government is expanding the capacity to generate power. Most of the power in India is generated by coal. The increase in the production of the easiest and cheapest source of electricity, coal, especially domestic coal, can back the government’s bid to provide electricity for all citizens. Without an increase in coal production, it would be difficult to achieve this objective.

- Seamless coal production: It was found the mining leases of 334 mines of iron ore, manganese ore and chromite are expiring on 31st March 2020 and of these around 50 mines are contributing significantly in the domestic production. Without the amendment that allows two-year moratorium to the new bidders, the mines’ production would not come to the markets as these they would close down due to the lack of permits.

- Increase in foreign investment: The Bill ensures an increase in investments and boosts in domestic coal production to reduce the dependence on imports of coal. India had imported 235 million tonnes of coal last year, of which 135 million tonnes was worth Rs.171,000 crore could have been met from domestic reserves.

- The provisions of this Bill puts an end to Coal India Ltd’s monopoly in the mining sector as it increases the scope for the private sector. Coal India Ltd (CIL) is a Maharashtra PSU that employs around 3 lakh people. To ensure that the CIL’s interests are not compromised the way BSNL has been by opening up to private players, it will be allotted adequate blocks and will be supported so that the labour interests are not compromised.

- Liberalisation: This amendment is a welcome step towards liberalisation of the mining sector and attracting the much-needed foreign investment. Two crucial aspects – liberalising the eligibility criteria for participating in the auction and removal of end-use restriction – will attract investment in the sector and foreign direct investment too.

- The removal of restrictions will allow the successful bidder or allottee to utilise mined coal for own consumption or sale for other purposes as specified by the government, thereby allowing wider participation and competition in the auction.

- The liberalised policy will allow global players to look for an investment opportunity, which in turn will allow the country to leverage their technical capabilities for effective utilisation of natural resources for the benefit of people at large.

- It also increases demand in other sectors such as mining equipment, heavy commercial vehicle industries etc.

- It helps achieve the government target of 1.5 billion tonnes of domestic coal production by 2023-24

What are the issues with this Bill?

- Environmental Concerns: While many countries are moving away from fossil fuels, especially coal, to combat climate change, India is boosting its demand in this sector, putting the environment at risk.

- This Bill provides for an increase in the competition in the mining sector, paving the way for the rise in the chances of over-exploitation of resources.

- Promoting the growth of coal sector jeopardizes India’s commitments in Paris Agreement.

- There is also the health concerns with the growth of the mining sector as coal-burning releases particulate matter, sulphur dioxide, nitrogen dioxide and mercury. This is a threat to the health of people living in the region.

- There is a huge possibility of private companies undermining labour guidelines to increase their profit and reduce input costs. This can significantly affect the health and well-being of the employees.

What can be the way ahead?

- The corresponding rules and bidding guidelines must be assessed in detail to ensure that the proposed law is implemented and given full effect.

- This includes making necessary changes to rules and regulations on mining, which include Mineral Conservation and Development Rules, 2017, Minerals (Other than Atomic and Hydrocarbons energy minerals) Concession Rules, 2016 etc.

- There must also be coordination among different government departments so that there is an ease in clearances.

- While promoting coal mining, the government must also ensure an increase in the investments in green energy so that it can reduce its dependence on thermal energy.

- There must be an increase in monitoring of the mining activities so that the private players are not tempted towards over-exploitation of resources and labourers.

- Regulations must be strictly monitored and enforced so that there is no adverse impact on either the environment or human beings because of the increase in mining activities.

Conclusion

Mineral Laws (Amendment) Bill, 2020 is a significant step towards promoting ease of doing business and increasing the contribution of private players in the mining sector. As this also promotes the growth of coal production within the country, it increases coal consumption. This, in turn, increases pollution and other adverse impacts on the environment. Thus, steps must be taken to safeguard the environment while ensuring the economic growth of the country.

Practice Question for Mains:

Mineral Laws (Amendment) Bill, 2020, while ensuring economic growth, also threatens India’s commitments in Paris Agreement. Elucidate (250 words)