Loanable Funds Theory

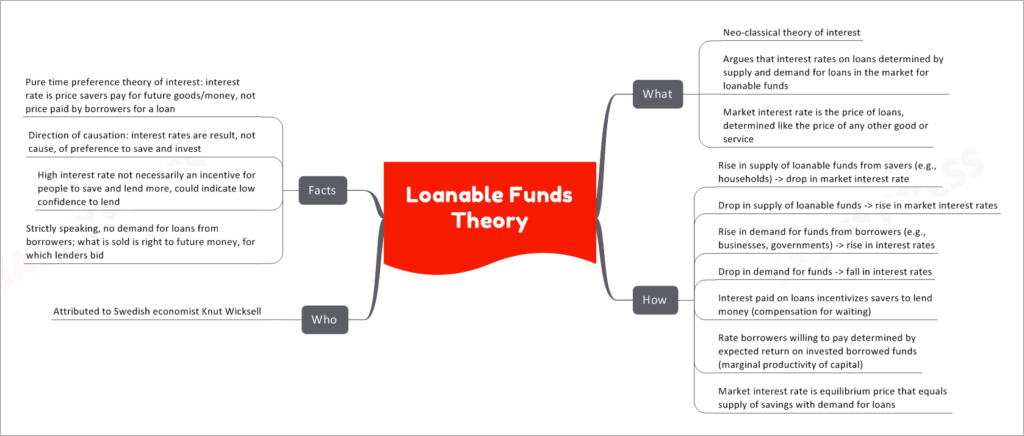

The Loanable Funds Theory is a fundamental concept in economics, specifically in the realm of interest rates. This theory delves into the relationship between supply and demand for loans, ultimately shaping the interest rates in a market economy.

This topic of “Loanable Funds Theory” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Unveiling the Loanable Funds Theory

Neo-Classical Interest Theory

The Loanable Funds Theory is rooted in neoclassical economics and focuses on explaining how interest rates are determined in the market. It proposes that the interest rates on loans are set by the interaction of supply and demand within the market for loanable funds.

Price of Loans

This theory contends that the interest rate functions as the price of loans. Similar to the pricing mechanism for any commodity, the interest rate is influenced by the forces of supply and demand within the market.

Mechanisms at Play

Supply and Demand Dynamics

The Loanable Funds Theory operates through a series of supply and demand dynamics:

- Supply Increase: When there is a rise in the supply of loanable funds (from sources like households or savers), the market interest rate drops.

- Supply Decrease: Conversely, a decrease in the supply of loanable funds leads to a rise in the market interest rate.

- Demand Increase: An increase in the demand for loanable funds from borrowers (such as businesses or governments) results in a rise in interest rates.

- Demand Decrease: A decrease in the demand for funds leads to a fall in interest rates.

Incentives and Borrower Decisions

The payment of interest on loans serves as an incentive for savers to lend their money. This compensation reflects the opportunity cost of waiting rather than spending the money immediately. On the other side, borrowers determine the interest rate they are willing to pay based on their expected returns from investing borrowed funds, considering the marginal productivity of capital.

Equilibrium

The market interest rate emerges as an equilibrium price, where the supply of savings aligns with the demand for loans.

Origin and Attributes

Attributed to Knut Wicksell

The Loanable Funds Theory is attributed to the Swedish economist Knut Wicksell, who played a pivotal role in shaping economic thought.

Pure Time Preference Theory

Wicksell also introduced the concept of the “pure time preference theory of interest,” positing that interest rates reflect the price that savers pay for future goods or money, rather than the price borrowers pay for loans.

Direction of Causation

It’s important to note that interest rates are considered a result, not a cause, of the preference to save and invest. A high interest rate doesn’t necessarily lead to increased savings; it could indicate low confidence in lending.

Clarifying Borrower Dynamics

Strictly speaking, the theory argues that borrowers don’t demand loans; instead, they bid for the right to future money, which lenders offer.