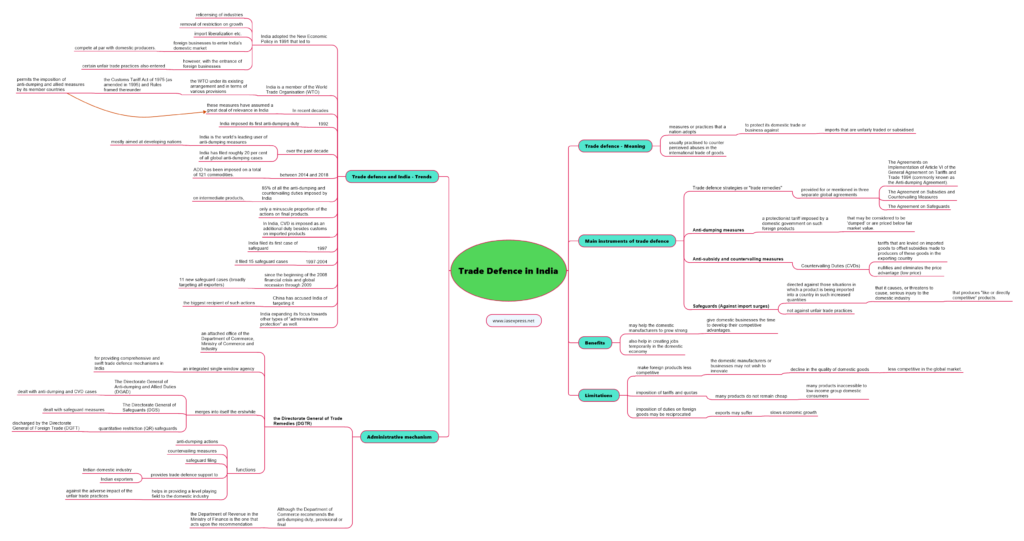

Trade Defence in India – Trends and Main Instruments

In a recent move, India has imposed anti-dumping duty on five Chinese products to protect domestic manufacturers from lower-priced imports. The step was taken following the findings and recommendations of the Directorate General of Trade Remedies (DGTR). It is not new when India has imposed anti-dumping duty on Chinese imports rather it throws light on India’s trade defence strategy that India is adopting to protect its manufacturers.

This topic of “Trade Defence in India – Trends and Main Instruments” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

Trade defence – Meaning

- It refers to those measures or practices that a nation adopts to protect its domestic trade or business against imports that are unfairly traded or subsidised and that may cause considerable harm to the domestic businesses and manufacturers.

- Trade defence is usually practised to counter perceived abuses in the international trade of goods.

Main instruments of trade defence

- Trade defence strategies or “trade remedies” are provided for or mentioned in three separate global agreements. These are:

- The Agreements on Implementation of Article VI of the General Agreement on Tariffs and Trade 1994 (commonly known as the Anti-dumping Agreement).

- The Agreement on Subsidies and Countervailing Measures.

- The Agreement on Safeguards.

- The main types of trade defence instruments include:

- Anti-dumping measures

- Dumping takes place when an exporter sells a product in a foreign market below the price of “like products” (the same type and quality of goods) charged in the exporter’s domestic market or below the cost of production.

- Dumping is considered to be an unfair trade practice and has a distortive effect on international trade as it often leads to predatory pricing.

- Anti-dumping duty (ADD) refers to a protectionist tariff imposed by a domestic government on such foreign products that may be considered to be ‘dumped’ or are priced below fair market value.

- Anti-subsidy and countervailing measures

- Subsidisation is when an exporter provides financial assistance to manufacturers or companies to produce or export goods.

- Subsidisation may have adverse effects on the domestic economy and may also limit or displace the exports of another country.

- To counter such subsidisation, countries may adopt anti-subsidy and countervailing duties.Countervailing Duties (CVDs) refer to such tariffs that are levied on imported goods to offset subsidies made to producers of these goods in the exporting country.

- It nullifies and eliminates the price advantage (low price) enjoyed by an imported product when it is given subsidies or exempted from domestic taxes in the country where they are manufactured.

- CVDs raise the price of the imported product thus helping in ensuring a level playing field to the domestic producers against those foreign producers who export products in the former’s market by receiving subsidies in their home country.

- CVDs help in offsetting the negative effects of subsidisation.

- Safeguards (Against import surges)

- Safeguards are directed against those situations in which a product is being imported into a country in such increased quantities that it causes, or threatens to cause, serious injury to the domestic industry that produces “like or directly competitive” products.

- Such measures are not against unfair trade practices rather they usually apply to the sudden surges in imports of those products which may harm the domestic industry.

- Anti-dumping measures

India and trade defence – Trends

- Globalization brought about a new era of international trade.

- India could not remain aloof of what was happening worldwide and thus it opened its market to the world adopting the New Economic Policy in 1991, also known as the LPG (Liberalization, Privatisation and Globalisation) reforms.

- The New Economic Policy led to the relicensing of industries, removal of restriction on growth import liberalization etc. These economic reforms allowed foreign businesses to enter India’s domestic market and compete at par with domestic producers.

- However, with the entrance of foreign businesses into the Indian market, certain unfair trade practices also entered such as dumping.

- India is a member of the World Trade Organisation (WTO) and the WTO under its existing arrangement and in terms of various provisions under the Customs Tariff Act of 1975 (as amended in 1995) and Rules framed thereunder permits the imposition of anti-dumping and allied measures by its member countries.

- In recent decades, these measures have assumed a great deal of relevance in India given the scenario arising out of unfair trade practices adopted by some of our trading partners.

- India imposed its first anti-dumping duty in 1992 and over the past decade, it has become the world’s leading user of anti-dumping measures.

- India has filed roughly 20 per cent of all global anti-dumping cases, quite disproportionate to its share of global imports of 2%.

- India’s anti-dumping duties are mostly aimed at developing nations. India has imposed anti-dumping duties (ADDs) on a total of 155 commodities against China across many sectors to protect the domestic industry since 2001.

- During the period between 2014 and 2018, ADD has been imposed on a total of 121 commodities.

- Nearly 85% of all the anti-dumping and countervailing duties imposed by India are on intermediate products, with only a minuscule proportion of the actions on final products.

- In India, the CVD is imposed as an additional duty besides customs on imported products when such products are given tax concession in the country of their origin.

- India filed its first case of safeguard in 1997 and over the 1997-2004 period, it filed 15 safeguard cases.

- However, since the beginning of the 2008 financial crisis and global recession through 2009 India had filed 11 new safeguard cases (broadly targeting all exporters) and 5 new China-specific safeguard cases.

- China has accused India of targeting it and is the biggest recipient of such actions.

- India has become the dominant worldwide source of antidumping enforcement and seems to be expanding its focus towards other types of “administrative protection” as well.

Administrative mechanisms in India

- In India, anti-dumping actions and countervailing measures along with safeguard filing are undertaken by the Directorate General of Trade Remedies (DGTR).

- DGTR functions as an attached office of the Department of Commerce, Ministry of Commerce and Industry.

- It is an integrated single-window agency for providing comprehensive and swift trade defence mechanisms in India.

- The DGTR is a single national entity that merges into itself the erstwhile:

- The Directorate General of Anti-dumping and Allied Duties (DGAD) that dealt with anti-dumping and CVD cases.

- The Directorate General of Safeguards (DGS) that dealt with safeguard measures.

- Quantitative restriction (QR) safeguards functions discharged by the Directorate General of Foreign Trade (DGFT) have also been merged.

- It provides trade defence support to Indian domestic industry and exporters in dealing with increasing instances of trade remedy investigations instituted against them by other countries.

- DGTR helps in providing a level playing field to the domestic industry against the adverse impact of the unfair trade practices like dumping and actionable subsidies from any exporting country, by using Trade Remedial methods under the relevant framework of WTO arrangements, Customs Tariff Act & Rules and other relevant laws and international agreements, in a transparent and time-bound manner.

- Although the Department of Commerce recommends the anti-dumping duty, provisional or final, it is the Department of Revenue in the Ministry of Finance that acts upon the recommendation within three months and imposes such duties.

Benefits

- Trade defence measures may help the domestic manufacturers to grow strong as tariffs will protect them from foreign competitors. Such measures give domestic businesses the time to develop their competitive advantages.

- These measures also help in creating jobs temporarily in the domestic economy as protection of tariffs, quotas or subsidies allow domestic businesses to hire local people.

Limitations

- As trade defence make foreign products less competitive, in long term, the domestic manufacturers or businesses may not wish to innovate. This will eventually lead to a decline in the quality of domestic goods and may make them less competitive in the global market.

- Since many imported products having lower prices in the domestic market are put under tariffs and quotas, they do not remain cheap to the consumers any longer. This makes many products inaccessible to low-income group domestic consumers.

- If a country imposes duties on foreign goods, the moves may be reciprocated and the former may also face the imposition of such measures and its exports may suffer. Thus, trade defence slows economic growth.

Way forward

Although the motivation behind the trade defence measures may be wise and well-thought, they eventually work against the economic health of the country which brings into practice such measures. In the era of globalisation where the global economies are so well integrated, trade defence may limit the abilities of domestic producers in terms of innovation (lack of competition) and market access (retaliatory measures by foreign countries). Thus, the focus should be on maintaining a balance that will eventually help the domestic and world economy grow.

Practise Question

Q. Are anti-dumping duties (ADDs) imposed by India on Chinese products helping the domestic producers and consumers effectively? Comment.

- https://www.thebalance.com/what-is-trade-protectionism-3305896

- https://www.trade-knowledge.net/knowledge/trade-remedies-why-do-we-need-them-and-how-do-they-work/

- https://www.dgtr.gov.in/about-us/about-department

- https://www.dgtr.gov.in/about-us/designated-authority2

- http://www.legalservicesindia.com/article/1055/Dumping-&-Anti-Dumping-Measures.html

- https://www.usitc.gov/publications/332/EC201010A.pdf

- http://www.eximguru.com/exim/indian-customs/anti-dumping-duty/anti-dumping-duty-introduction.aspx

- https://www.thehindu.com/news/national/india-imposes-anti-dumping-duty-on-5-chinese-goods-for-5-years/article38044225.ece

- https://www.dgtr.gov.in/trade-defence

- https://www.investopedia.com/terms/c/countervailingduties.asp

- https://www.investopedia.com/terms/a/anti-dumping-duty.asp#:~:text=Key%20Takeaways-,An%20anti%2Ddumping%20duty%20is%20a%20protectionist%20tariff%20that%20a,priced%20below%20fair%20market%20value.&text=In%20the%20long%2Dterm%2C%20anti,domestic%20companies%20producing%20similar%20goods.

- https://trade.ec.europa.eu/doclib/docs/2013/april/tradoc_151014.pdf

- https://ustr.gov/trade-agreements/wto-multilateral-affairs/wto-issues/trade-remedies

- https://en.m.wikipedia.org/wiki/Trade_defence_instrument

Great