UPI Tap and Pay

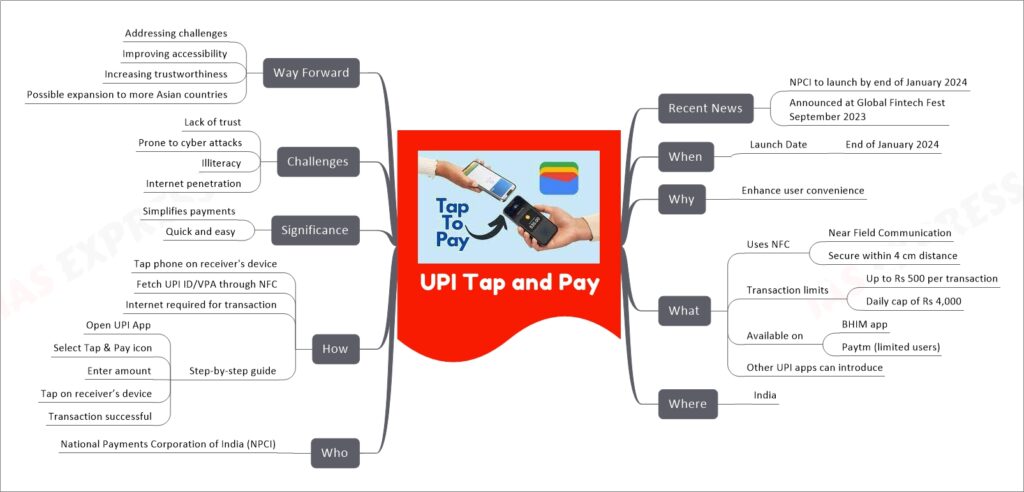

UPI Tap and Pay is a forthcoming feature introduced by the National Payments Corporation of India (NPCI), set to launch by the end of January 2024. This innovative payment method utilizes NFC (Near Field Communication) technology, allowing users to make transactions by tapping their smartphones against a receiver’s device. It is designed for transactions up to Rs 500, with a daily cap of Rs 4,000. Currently, this feature is available on BHIM and Paytm (for limited users), with other UPI apps also having the option to introduce it. While it aims to enhance user convenience and quicken the payment process, challenges like lack of trust, vulnerability to cyber-attacks, illiteracy, and limited internet penetration remain. Future prospects include more widespread adoption and possible expansion to other Asian countries.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.