IL&FS/NBFC Crisis – The Need for Financial Sector Reforms

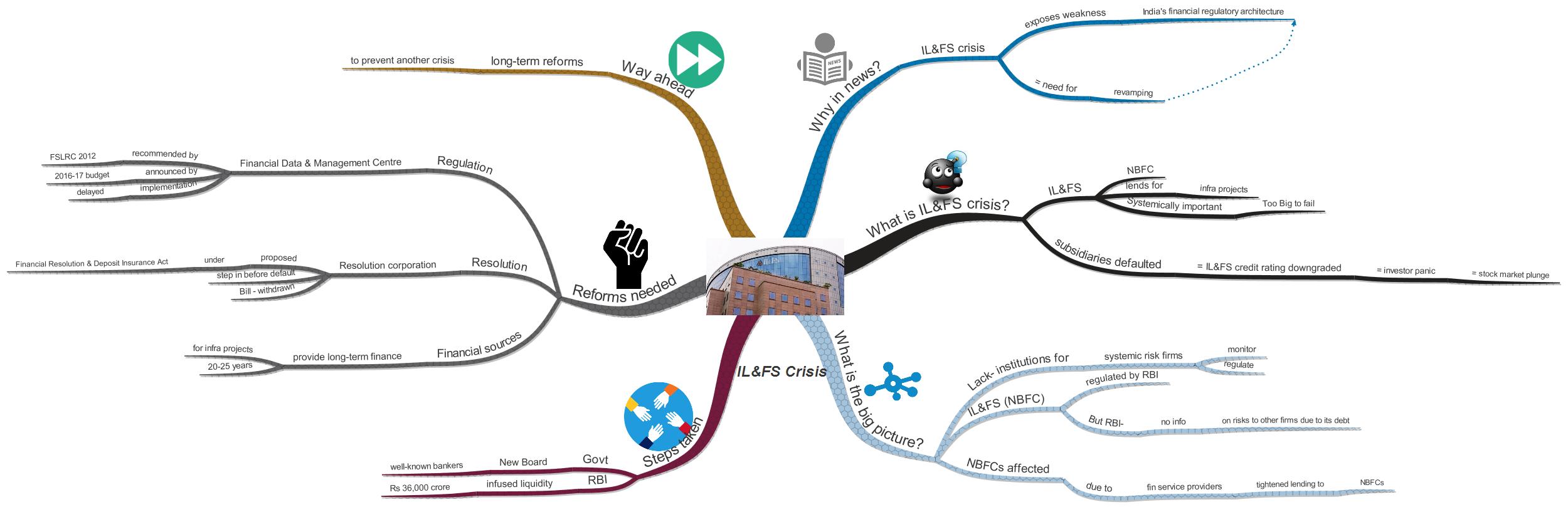

The Infrastructure Leasing and Financial Services (IL&FS) crisis exposes the weakness in India’s financial regulatory architecture. It highlights the need for suitable reforms in regulatory mechanisms since the consequences are widespread.

What is the IL&FS crisis?

- Infrastructure Leasing and Financial Services (IL&FS) is a Non-Banking Finance Company (NBFC) that lends for infrastructure projects (learn about NBFCs at the end).

- Some of its subsidiaries defaulted on their loan = Credit rating of IL&FS as a whole was sharply degraded.

- Due to this, Investors sold their stocks in housing finance firms leading to stock market plunge.

- IL&FS Company is listed as “systemically important” by the RBI and hence it is “too big to fail”. The inter-linkages between IL&FS and other financial entities like banks, mutual funds, and infrastructure players are too strong and the company would have taken down all of them with it if it were allowed to fail.

- If tax-payer money is utilized to save IL&FS, it would be another drain on the Union Budget. Notably, the centre’s finance is already burdened by mismanagement and regulatory failures in the banking sector.

What is the big picture?

- There were shortfalls in ensuring institutions in place to monitor and regulate systemic risks.

- IL&FS is a non-banking finance company (NBFC) regulated by RBI. However, RBI does not have all the information needed to understand risks to other financial firms arising from its debt. Notably, Pension funds, provident funds, mutual funds, and insurance companies hold the debt of IL&FS subsidiaries. But RBI does not regulate these and hence will not have the full picture.

- The RBI may know only about bank loans to the conglomerate. But the ripple effects of financial shocks can be felt across sectors and not just financial markets.

- The IL&FS default forced banks, mutual funds, and other fund providers to tighten lending to NBFCs by rising borrowing costs. This has created a liquidity crisis (lack of money flow) and is severely impacting the smaller NBFCs too. As the cost of borrowing is rising for NBFCs, their stock prices also plunged.

What are the steps taken to solve the crisis?

- The central government took steps to take control of the company and arrest the spread of the contagion to the financial markets. A new board was constituted replacing the earlier which has failed to discharge its duties. New board includes some well-known bankers including Uday Kotak from Kotak Mahindra Bank.

- As there is a need to infuse liquidity in the market, RBI infused up to Rs 36,000 crore via open market operations (purchase and sale of government securities by the RBI).

What does it call for?

- The failure of one company can cause a risk to the whole financial system. Such systemic risk requires constant monitoring because if the firm is large, it is considered “too big to fail”. Even if it is not too big but deeply integrated with the business of other firms, it may be “too networked to fail”. In either scenario, such firms and their networks need to be monitored at all times to get a full picture of their assets and liabilities.

- For better response, the regulator must know who will get hit if such firms fail, by how much and what will be the consequences.

- To ensure financial stability, this supervisory task has to be given to an agency with powers to monitor risks across sectors.

What are the reforms needed?

Regulation

- In 2012, the Financial Sector Legislative Reforms Commission suggested legislative and architectural reforms for financial regulation.

- This included a body that would monitor systemic risk.

- The Financial Data and Management Centre would have the legal powers to collect all regulatory data along with sectoral regulators.

- The 2016-17 Budget proposed the establishment of such data centre and subsequently, a draft bill was proposed.

- However, concerned raised by financial regulators are delaying the implementation process.

Resolution

- Financial firms, both bank, and non-bank require an orderly mechanism for crisis resolution.

- The Resolution Corporation was proposed to be established under the Financial Resolution and Deposit Insurance Act.

- This would have monitored the company (IL&FS) and decided whether it is systemically important and would have stepped in before the firm defaulted.

- However, the opposition to the legislation led to the withdrawal of the Bill.

Financial sources

- The major reason for the IL&FS failure is the asset-liability mismatch caused by funding projects of 20-25 years payback period with relatively short-term funds of only 8-10 years.

- Thus there is a need for a source that provides long-term finance for infrastructural projects (high gestation period).

- The LIC and some insurance companies are the only domestic sources but they too do not lend beyond 10 to 12 years.

- Therefore, the centre and the RBI should come up with ways to deepen the debt markets where infrastructural players can borrow long-term.

Way ahead

The lack of a quick strategy by the regulator as well as the government could result in a solvency issue resulting in a domestic debt crisis inflicting wounds on banks and mutual funds. The need of the hour is for the government to take long-term reforms in order to prevent another crisis like this from happening again.

About NBFCs

- Non-Banking Finance Companies are those companies which provide banking services without satisfying the legal definition of a bank and thus do not have a banking license.

- They are incorporated under the Companies Act, 1956 and desirous of commencing the business of non-banking financial institution as defined under the RBI Act, 1934.

- NBFCs are not allowed to take deposits from the public, which keeps them outside the scope of traditional oversight under banking regulations.

- NBFCs can provide banking services like loans and credit facilities, retirement planning, money markets, underwriting, and merger activities.

- Currently, NBFCs are regulated by various regulators like RBI, SEBI, IRDA, National Housing Bank and Department of Company Affairs depending on the type of services they offer.

- RBI regulates companies that deals in lending, financial leasing, hire purchase and acquisition of shares or stocks etc.

- SEBI regulates companies that deals in stock broking, merchant banking etc.

- IRDA regulates NBFCs that provides insurance services.

- National Housing Bank regulates Housing finance companies.

- Department of Company Affairs regulates Nidhi and Chitfund companies.

Practice Question

Evaluate various issues that are highlighted by the recent IL&FS Crisis and suggest suitable reforms to prevent such financial crisis from happening again.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.