Bima Sugam

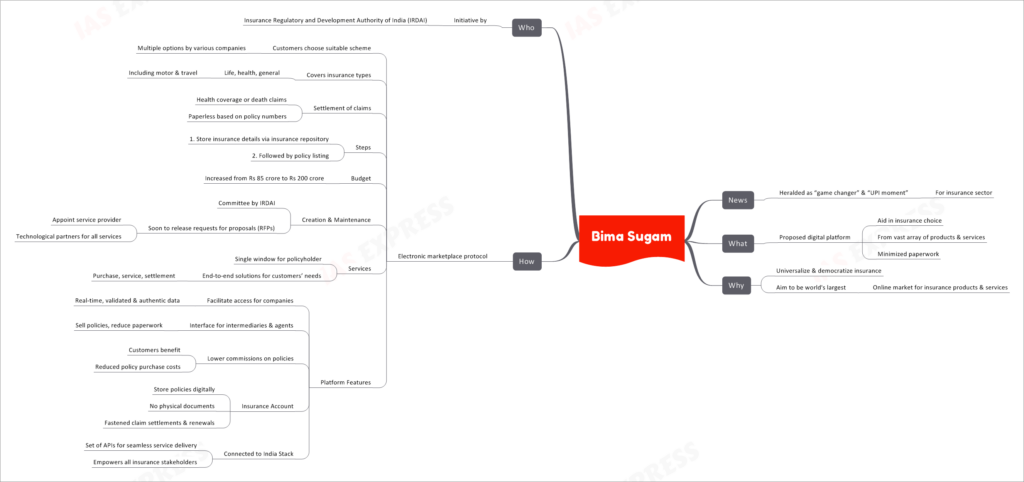

The insurance sector is on the brink of a transformative revolution, with the introduction of a proposed digital platform that has been hailed as a “game changer” and likened to the “UPI moment” for the industry.

This topic of “Bima Sugam” is important from the perspective of the UPSC IAS Examination, which falls under General Studies Portion.

What

Proposed Digital Platform

- The proposed digital platform aims to simplify the insurance landscape by providing a user-friendly interface that helps individuals make informed choices from a vast array of insurance products and services.

- One of the key goals is to minimize the cumbersome paperwork traditionally associated with insurance transactions.

Why

Universalize and Democratize Insurance

- The overarching objective is to universalize and democratize access to insurance, making it more accessible and understandable to the masses.

- The aspiration is to become the world’s largest online market for insurance products and services, thereby expanding insurance coverage across the nation.

How

Electronic Marketplace Protocol

- The digital platform will operate on an electronic marketplace protocol, enabling customers to select suitable insurance schemes from multiple options offered by various insurance companies.

- It covers a wide spectrum of insurance types, including life, health, and general insurance, encompassing categories such as motor and travel insurance.

- The settlement of claims, whether related to health coverage or death claims, will be facilitated in a paperless manner based on policy numbers.

Key Steps

- Insurance Repository: Customers will begin by storing their insurance details in an insurance repository.

- Policy Listing: This will be followed by policy listing on the digital platform.

Budget

- The project’s budget has been increased from Rs 85 crore to Rs 200 crore, underlining the commitment to its success.

Creation and Maintenance

- A dedicated committee by the Insurance Regulatory and Development Authority of India (IRDAI) is responsible for overseeing the creation and maintenance of the digital platform.

- Requests for proposals (RFPs) will soon be released to appoint service providers and technological partners for all services.

Services

- The digital platform will serve as a single window for policyholders, offering end-to-end solutions to meet their insurance needs, including purchase, servicing, and claim settlement.

Platform Features

- The platform will facilitate access for insurance companies to real-time, validated, and authentic data.

- It will also offer an interface for intermediaries and agents to sell policies, reducing paperwork and streamlining the insurance purchase process.

- Lower commissions on policies will benefit customers by reducing policy purchase costs.

- An innovative feature includes the creation of an “Insurance Account” where policies can be stored digitally, eliminating the need for physical documents and expediting claim settlements and renewals.

- The platform will be seamlessly connected to India Stack, a set of APIs that empower all insurance stakeholders for efficient service delivery.

Who

Initiative by IRDAI

- This groundbreaking initiative is spearheaded by the Insurance Regulatory and Development Authority of India (IRDAI), demonstrating their commitment to modernizing the insurance sector and making it more accessible and efficient for all.